The Doosan Infracore Europe outdoor stand at bauma 2022 is packed and a hive of activity as I arrive for my interview with Chris Jeong and Gilles Bendaoud on the third day of the week-long construction, quarrying, mining and recycling equipment industry showcase. It is always like this on Doosan stands at the world's major off-highway machine exhibitions, a visual illustration of the company's global pull and, in this latest context, an indication of its growing presence in the key European sales market.

Among many new machines and linked solutions from Doosan at the showpiece event were the DX225LC-7X – the manufacturer's first 'Smart' crawler excavator designed to help operators work faster and more efficiently, the quarrying-suited DA45-7 4x4, the company's debut 4x4 articulated hauler, the giant 100t DX1000LC-7 crawler excavator, for large quarry and mining customers, and an industry-first Transparent Bucket for loaders.

Another important feature of the Doosan stand was the dedicated Innovation Center, where the company unveiled its new generation XiteCloud' All-in-One Platform' for Smart Construction under Doosan's Powered by Innovation banner.

In 2019 in South Korea, Doosan introduced Concept-X, the world's first unmanned automated and integrated control solution for construction, quarrying and mining sites. XiteCloud is the first stage in commercialising Concept-X.

Doosan is committed to producing innovative products and services for its customers and delivering added value through innovation. Visitors to bauma 2022 could see the latest developments in the XiteCloud system as the company further expands its business portfolio into the field of construction site management to complement its existing operations in manufacturing and sales of construction equipment.

With XiteCloud, a customer can manage multiple tasks such as surveys, terrain analysis, machine purchases, equipment operation and construction management on a single platform, thereby reducing construction costs and saving time while increasing work accuracy, which raises productivity. XiteCloud also allows customers to manage multiple projects on a single platform, accumulating and managing data that can be utilised for future decision-making/business. The range of new solutions within the XiteCloud system demonstrated at bauma included XiteCore, XiteFleet, XiteAnalyst, XiteSIM, XiteSafety, and XiteAuto.

As suggested by its name, XiteCore is a Cloud-based open, integrated dashboard that connects all the XiteCloud solutions, providing the information needed to execute a construction job well with easy project management and control.

This system provides opportunities for collaboration and communication among project participants with an open platform that adopts an applied card-type interface that allows the user to set the dashboard flexibly according to the characteristics of the project (card type, location, size, etc.) It also incorporates real-time monitoring of weather, manpower, equipment, instruments, CCTV, and other aspects, together with connection to the other solutions within XiteCloud, such as XiteFleet and XiteAnalyst.

Name checking some of the new equipment models and technology on show, I ask Jeong to sum up in a word Doosan's bauma 2022 line-up. "Groundbreaking," he replies, adding, "Our quarrying and construction customers are very keen on XiteCloud and the big fleet management capability it gives them, and we are keen to give them the best machines to support it.

"Automation and unmanned equipment solutions are going to be a paradigm changer in the marketplace. The COVID-19 pandemic increased labour cost and restricted the availability of machine operators, and increased demand for automation-based solutions. At this exhibition we are demonstrating where we are on this and will be refining our technology for its commercialisation. We are looking at putting on further demonstrations of XiteCloud at CONEXPO/CON-AGG 2023."

Jeong says it is crucial for Doosan to keep pushing its innovation programme to enable the company to standout in a competitive marketplace. "We are working at speed to narrow the gap between us and other major players. Innovation and technology can be a key differentiator for us."

So, where does Jeong see Doosan Infracore Europe positioned against its top original equipment manufacturer (OEM) peers? "The last three years have seen us improve our market position across the heavy equipment lines, including medium-to-large excavators where we are now at a 9% market share. We think we can grow further in this area.

"We are also investing more in developing our wheeled loader and compact machine business, having initially focused on our heavier machines. We plan to launch a full range [1-10t] of mini excavators within the next year. This will significantly enhance the products and services we can offer our compact market customers."

"We already cover 70% of the mini-excavator market with our completely renewed models," says Bendaoud. "The rest is sourced from a third party. We also already have a full range of medium- to large-wheeled loaders and crawler excavators."

Commenting on which parts of Europe offer the best growth potential for Doosan, Jeong says: "We are investing even more of our resources into the German market. It has the biggest potential, but it is a very competitive market. We are establishing a specific branch in the country to emphasise our commitment to German customers.

"We are also doing a lot around our sustainability, minimising any potential risks from external market changes, such as inflation and geopolitical issues, like the events taking place in Ukraine. While Doosan has its mother equipment manufacturing plant in South Korea, we do have a sub-assembly facility in Belgium that helps us to meet European customers' diverse demand. We are also always looking at OEM partnerships, such as the one we have with Netherlands-based Tobroco-Giant for compact wheeled loaders."

I ask Jeong about how Doosan Infracore Europe is coping with major challenges impacting the European off-highway equipment market, including longstanding supply chain issues linked to the COVID-19 pandemic, and an inflation and cost of living crisis partly attributable to Russia's ongoing war in Ukraine. "I think a recession has started already. This year we think the European market will be down about 5% compared to last year. To manage the market sentiment changes, we are looking at our costs and are looking at our logistical supply chain from South Korea."

A graduate of Carnegie Mellon University in the US and in Material Science & Engineering from Korea University in Seoul, South Korea, Jeong has been with Doosan since 2006. He became CEO of Doosan Infracore Europe in July 2021, replacing Charlie Park, who had held the position since 2017 and now has a new role with Doosan in South Korea. Before taking up his current Prague, Czech Republic-based CEO brief, Jeong worked in varied senior sales, strategy, product management and marketing roles covering Doosan's trading in Asia, Oceania, Africa, the Middle East, Russia, and India.

How does Jeong see European construction and quarrying equipment customers' expectations differing from what he saw in his extensive experience working in emerging markets? "Customers in Europe are very diverse and very specific in their requirements. We always look to be well prepared when we launch new products so that we can meet what customers in Germany require, for example, and the differing requirements of, say, those in the UK and so on."

Turning his attention to Doosan's research and development work and its evidence in the company's new product range for European customers, Jeong says: "Electrification is a major theme for everybody involved in the European off-highway equipment market. This year we launched a two-tonne electric excavator and are showing here a prototype of a 14-tonne battery-electric excavator. While we started with electrification of our compact machines, we have plans to extend this to our medium- to heavy crawler excavators and wheeled loaders."

On hydrogen-powered machines, Jeong says that is something Doosan is working on with its parent company, the Hyundai Genuine (HG) group, which also contains Hyundai Construction Equipment (HCE), created after Hyundai Heavy Industries Holdings (HHIH) acquisition of Doosan in 2021. "This is core R&D for us, along with product electrification," Jeong stresses.

"I think we are looking at a couple of years before you will see Doosan hydrogen-powered machines," says Bendaoud. "We are working on some wheeled loaders powered by hydrogen fuel cells. The difficulty is in how you store the hydrogen and how the infrastructure around its distribution may vary from country to country. Electric machine development can be very costly. Some of our partners have developed fully electric compact models, and we are starting to sell them in countries such as Norway and the Netherlands, but these purchases tend to only be possible through government subsidies."

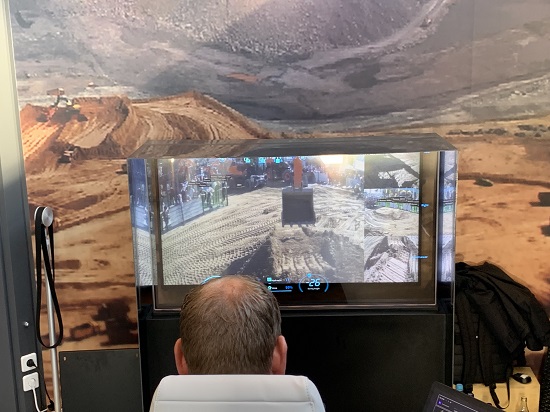

At bauma 2022, Doosan demonstrated TeleOperation of the company's new DX225LC-7X' Smart' crawler excavator working in the demo area of its stand.

Doosan defines TeleOperation as the operation of construction equipment from a remote station. At the last bauma in 2019, Doosan created one of the show's highlights when the company first demonstrated 5G technology for worldwide TeleOperation of construction machines. This entailed operating a Doosan DX380LC-5 40-tonne crawler excavator over 8,500km away in South Korea from an operator's booth on the bauma 2019 stand in Munich.

One of the reasons for the huge distance between the machine and operator at bauma 2019 was the lack of availability of 5G technology at the time in Europe. Three years on, 5G is now fully implemented in Europe, so at this year's show, visitors could see all parts of the operation live on the stand, with the DX225LC-7X being teleoperated by an operator in a booth in the Innovation Center.

Commenting on Doosan's commitment to more environmentally friendly production and final product operation, Bendaoud says: "We are very conscious of our products' carbon emissions and are working hard not only on the electrification of machines but on reducing fuel consumption. Our -7-machine technology is very fuel efficient."

"Some of our -7-machine range represents a double-digit drop in fuel consumption compared to our previous generation products," emphasises Jeong.

Jeong says that Doosan Infracore Europe continues to "fine tune" and "improve" its equipment maintenance contracts with customers. "Our TCO [total cost of ownership] and product quality is among the best. The quality of service and capability of our dealers has also improved a lot. That is saving customers money and has led to an improved equipment commissioning process. We now have around 90 dealers across Europe and cover almost 100% of the continent."

Jeong says less than 5% of Doosan Infracore Europe's sales are direct. He also notes that the subsidiary has seen a rise in its e-commerce trading, a sales route that has become very popular in other markets, including China.

"I think with machines utilising more complex technologies, it's harder to do more e-commerce business as compared to more commoditised machines like our compact equipment," says Bendaoud.

I finish our conversation by asking Jeong how he sees the construction and quarrying equipment industry a decade from now. "I read an article some time ago which said that the construction industry is one of the most conservative industries in the world, but the COVID-19 pandemic really brought forward the desire for autonomous machines and technology. Also, to make the [construction or quarry] job site more efficient, connectivity will be key. No single job site has one branded equipment fleet, and customers want full visibility of their job site and its running costs. As not just a manufacturer but also a solution provider, this is something we are very keen on giving to our customers now and in the technology we are working on for the future."