In Q1, 2024, sales across all regions decreased or remained flat, in line with the expected market downturn. Compared to the strong sales of the same period last year, market demand is softening across the globe, with lower deliveries and order intake in Europe and North America compensated slightly by a stronger performance in Asia.

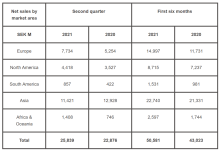

For the first quarter this year, net sales have dipped by 9% to SEK 22,877 million from SEK 25,109 million in 2023. Adjusted for currency movements, net sales of machines have decreased by 9% and service sales by 3%. Compared with Q1, 2023, a negative brand and market mix was partly offset by price realisation and lower material costs.

Meanwhile, deliveries in Q1 were on par with last year, with a lower performance in Europe and North America offset by China. During the same period, net order intake increased by 4%, largely driven by the China market and the SDLG brand which is rising after the low order intake in the previous year’s first quarter. Overall, order intake for the Volvo brand decreased in line with market development in Europe and North America. Orders in South America increased from a low level in 2023, driven by signs of a recovery in Brazil.

However, the tougher climate has not stopped Volvo CE from furthering its commitment to sustainable transformation by taking action in several important areas. Firstly, by introducing its first commercial grid-connected excavator, the EWR240 Electric material handler, to select customers earlier in the year. This was followed by a forward-thinking partnership with Sweden’s largest ski company, SkiStar, to help develop a roadmap towards fossil-free ski resorts. Later in the quarter, Volvo CE announced the trial of an innovative electric shuttle delivery solution for transporting its machines from Belley, France, together with Volvo Trucks and logistics firm Capelle Transports.

Melker Jernberg, Head of Volvo CE, said: “Maintaining profitability remains a high priority, and we have taken great steps to ensure as strong a performance as possible during these tougher times. While the industry feels the effects of this market downturn, we are maintaining our momentum to come out stronger – ensuring that we remain flexible in our systems while continuing to deliver on our transformation ambitions.”

The total machine market was flat or negative for the first quarter across most regions. While in Asia outside China, it was on par with the previous year, and South America saw a modest increase, it declined in Europe, North America and China. Europe’s 22% drop was driven largely by customer caution in the face of a weakening economic climate. In North America, a fall of 6% was likely due to a continued deferral of rental fleet replacement as interest rates and inflation remain high. Market demand in China meanwhile declined by 22% due to low investment levels and an overall slow economic activity.

The better results in South America, an increase of 4%, were bolstered by signs of recovery in various industry segments, while Asian markets outside China overall remained flat.