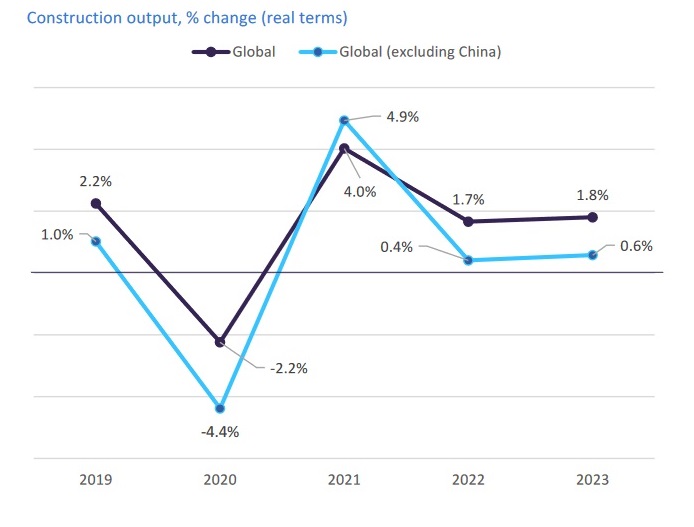

Global construction industry output will grow by just 1.8% in 2023, having posted estimated growth of 1.7% (or just 0.4% excluding China) in 2022, according to data and analytics company GlobalData.

This level of building activity has obvious implications for demand levels in the construction materials and quarrying industries which supply the sector.

GlobalData says that the construction industry is expected to regain some growth momentum from 2024 assuming an improvement in global economic stability.

The forecast for continued slow growth this year takes into account a gloomy economic backdrop, and additional challenges specific to the global construction industry, notably high construction material costs and labour shortages. The economic issues have been exacerbated by the fallout from Russia’s invasion of Ukraine and the subsequent surge in inflation and, with that, an unprecedented hiking of interest rates across the world.

Growth in the global economy is set to continue to slow in 2023, reflecting high inflation and tightening financial conditions that will constrain investment growth. The IMF predicts that global economic growth will slow to 2.7% in 2023, decelerating from 3.2% in 2022 and 6.0% in 2021. Although the recent easing of China’s zero COVID policy suggests that demand in China’s economy might be stronger than had been anticipated, economic growth in the US and Western Europe is predicted to stagnate.

Danny Richards, lead economist on construction at GlobalData, says the global construction industry is generally still in a very weak position heading into 2023.

“It is confronted by some major short-term challenges,” he adds. “Interest rates are high and could still rise further in the first half of the year before central banks bring to an end this current tightening cycle, assuming inflation starts falling from the current high levels.”

Richards says that, although they have dropped from recent peaks, construction material prices are staying relatively high. Current price levels are making the situation difficult for contractors and developers, as well as investors whose plans may no longer be viable.

Geo-political risks

“On the geo-political front there are still lots of risks related to energy prices and supply chains coming from the conflict in Ukraine, for which there is still no clear end in sight,” says Richards.

From a country and regional perspective, he adds that the opening of China’s economy with its zero-COVID policy has brought about a degree of optimism that this would provide a boost to global demand, as well as some easing of curbs on property development in China. However, on the flip side, there could then be renewed upward pressure on construction material commodity prices, giving a further risk of inflation.

Richards says that anecdotal evidence points to continued troubles in China’s construction industry, although the latest official statistics show that the industry expanded by 7.8% year-on-year in Q3 2022.

There are diverging trends among regions, and GlobalData expects declines in output in Western Europe and Australasia, and continued weakness in the US, with residential in particular being hit hard having boomed in recent past.

The Russia-Ukraine conflict has markedly impacted the construction industry in Eastern Europe. Confidence among investors has generally weakened amid the uncertainty surrounding the conflict and mounting economic headwinds stemming from the conflict’s inflationary pressure on energy prices.

India is driving up growth in South Asia, with investment in infrastructure and energy projects as well as demand from a rapidly emerging middle-class.

China’s residential sector slump and the continued weakness in the South Korean construction industry are major downside risks to north east Asia. However, the significant rise in public infrastructure investment in China will support growth.

Oil producing markets in the Middle East and North Africa (MENA) have been buoyed by relatively high oil prices which have boosted government revenues, and diversification efforts will support investment.

Sub-Saharan Africa and Latin America are just getting back to pre-COVID levels, but in South-East Asia some key markets are still struggling to recover, including Thailand, Philippines and Singapore.

US trends

Richards says that the marked contraction in the US has had a major global impact on construction growth in 2022, especially when China is excluded from the growth rate.

Investment in infrastructure will continue to be a driving force for US growth, according to GlobalData. The Infrastructure Investment and Jobs Act (IIJA) in the US is gathering momentum, and China is set to spend heavily.

Energy and utilities will also provide a boost to overall construction activity, with renewable energy projects remaining a key investment focus.

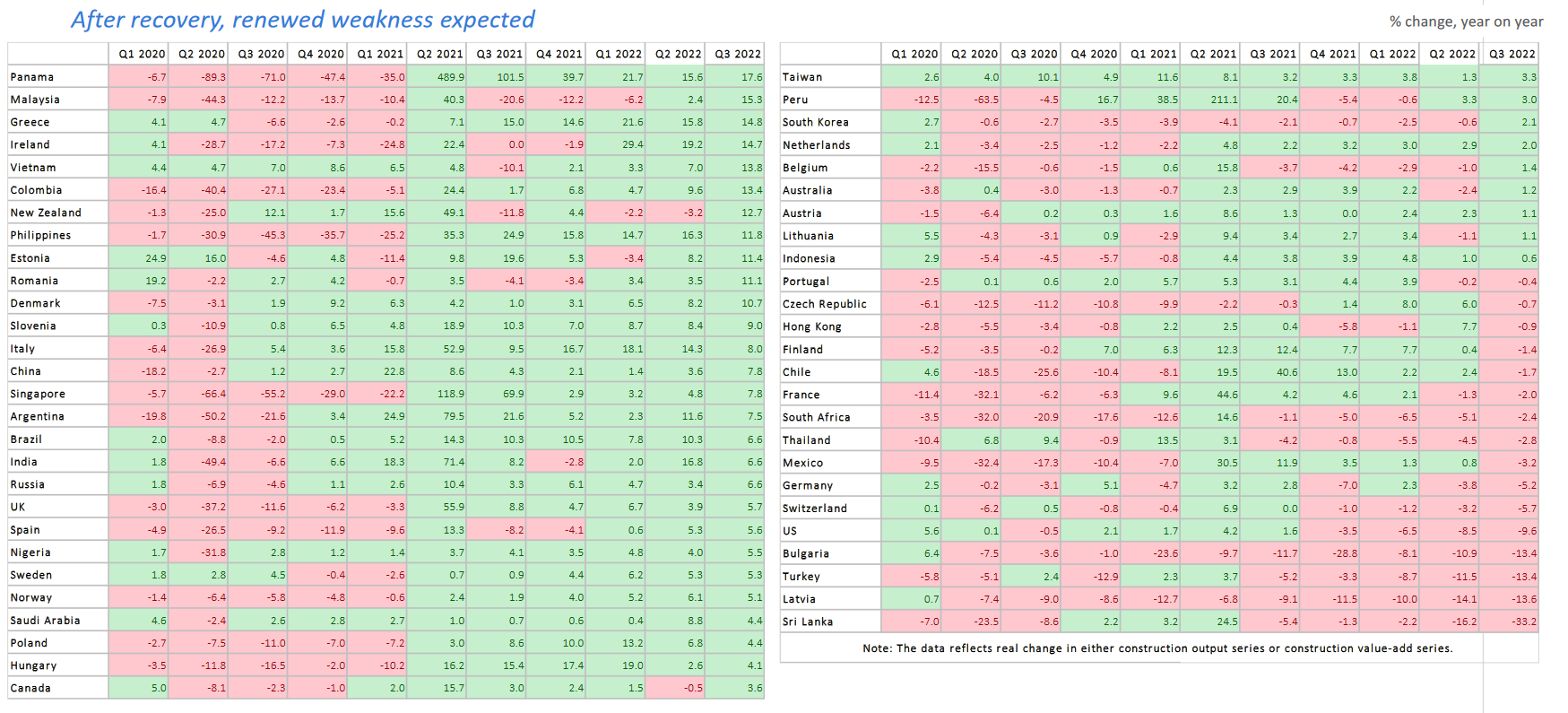

GlobalData’s construction output figures for Q3 2022 show a varied picture across different national markets. Panama and Malaysia are the two countries with the highest year-on-year growth rates of 17.6% and 15.3% respectively, but Richards says these rates are somewhat deceptive as both countries suffered major construction output falls in 2020 and are still well below the 2019 levels they were operating at.

The best performing countries in Europe have generally been those that have pushed ahead with investment, backed by the European Union’s recovery programme. Greece and Italy have both been growing rapidly, particularly through residential construction investment.

There were downturns in some major markets with the US contracting by 9.6% year-on-year in Q3 2022, and France (-2.0%) and Germany (-5.2%) also in decline. Some key emerging markets also struggled to get back to growth in Q3 such as South Africa (-2.4%), Thailand (-2.8%) and Turkey (-13.4%). After five consecutive quarters of construction growth, Mexico’s performance also dropped into the red in Q3 (-3.2%).

Trends in materials and commodity prices

Most material and commodity prices - crude oil, natural gas (Europe), copper, steel, cement and concrete, and lumber - have recorded sharp upturns on 2019 and 2020 levels in the wake of COVID, but have generally fallen from these peaks in the second half of 2022. “It is good news for the construction industry that prices are falling for these key commodities,” says Richards. “But at the same time, prices are still relatively elevated compared to the pre-COVID levels.”

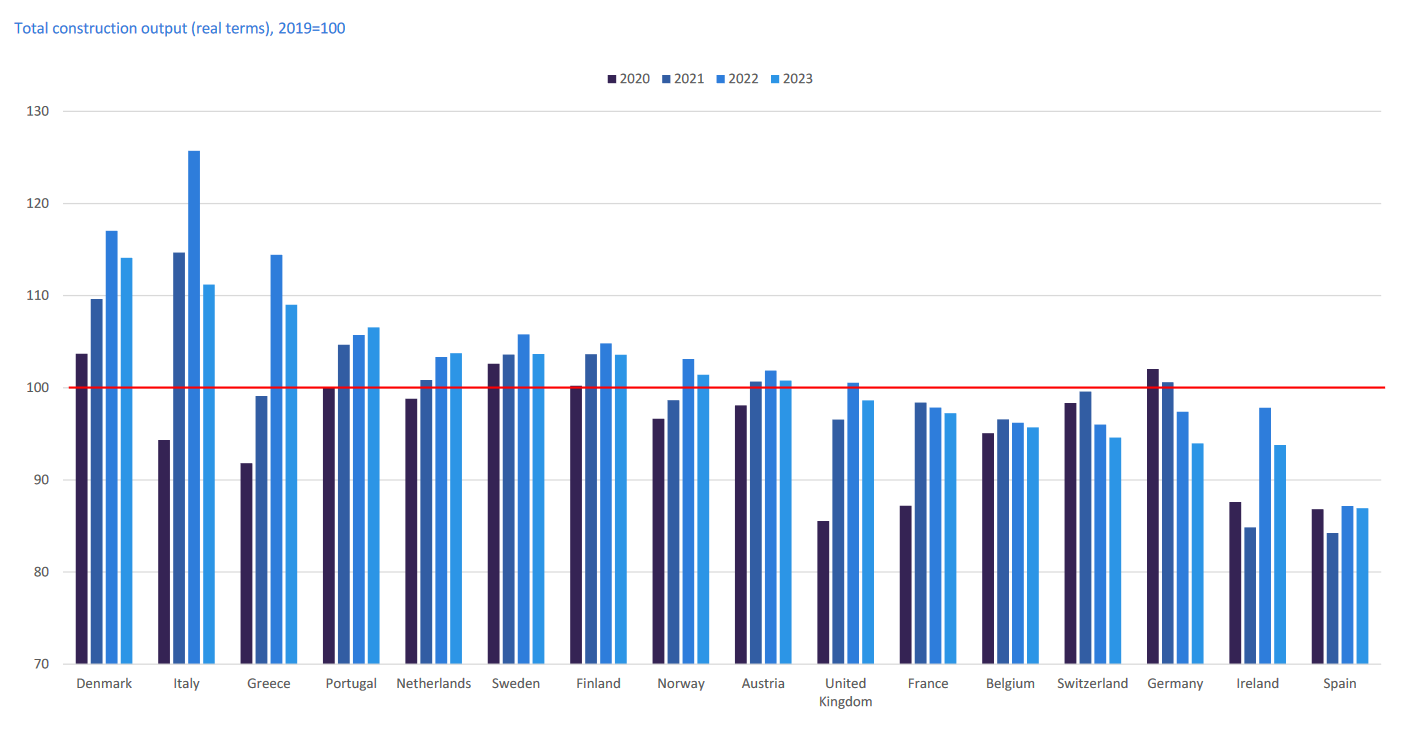

In Western Europe, Richards says that the big story on the sector side is that residential construction is the major drag on output growth in 2023. Having recovered well to show 4.9% output growth in 2022 compared with 2019 levels, the residential sector is forecast to decline by 6.2% this year in comparison with 2022. The infrastructure sector will continue to expand, increasing by 1.0% this year, but the pace of growth will slow sharply from 8.5% (2022 versus 2019), given higher project costs both in terms of delivery and financing.

Italy was a standout performer in 2022 with a booming residential sector, driven by fiscal incentives that were supported by EU funding. “Although these support schemes will continue, they are to be less generous and so the growth will subside,” says Richards. “Nevertheless, output levels [in Italy] will still remain relatively high.”

Denmark has also been one of the best performers since 2020 with construction growth driven by strong housing demand and rising levels of urbanisation. This has led to a need for more housing and constriction investment. Output in Denmark is expected to weaken in 2023 as the housing market shows signs of cooling amid rising interest rates and construction costs.

France and Spain are among a few markets that will continue to struggle, with wider economic challenges including weakened investor confidence, elevated construction costs and rising interest rates. Richards says their construction markets will not recover to 2019 levels by next year.

The UK saw a massive construction activity downturn during the height of COVID in Q2 2020, but Richards says output has recovered strongly since then and held up relatively well, outperforming most expectations in the past few quarters. He adds, however, that the 2023 outlook is not so positive: “The UK economy is cooling and the downturn is being exacerbated by monetary tightening as well as some fiscal tightening by government.”

He says that residential and commercial construction in the UK is expected to weaken as interest hikes and a cost of living squeeze impact on demand. Infrastructure will provide some support, with the government recently reaffirming its support and commitment to deliver on major infrastructure projects. The main UK construction sector trend is for a slowdown in output in the next few quarters.

GlobalData’s research indicates that the German construction sector has struggled in recent quarters. Activity levels in Q3 2022 were at a multi-year low, down by 4.2% on Q2 2022 and by 5.2% year-on-year. New orders have also dropped, impacted by high prices and interest rates, economic uncertainty an the energy crisis that is facing the wider economy.

“Some of the leading indicators that we are getting out of Germany suggest it’s going to be a fairly flat year in 2023,” Richards says. “Building permits were down 10.7% in the first three quarters of last year in both residential and non-residential.”

Regional outlook – Western Europe

Global Data states that growth projections are largely unchanged in Western Europe, with high energy costs and building materials price pressures remaining a major concern. Total construction market growth in the region decelerated to 2.2% last year, compared with growth of 6.6% in 2021, and is forecast to record negative growth of -2.8% in 2023 with most major markets suffering a decline in activity. “The cost of building materials has been a major concern and this has held back progress,” Richards says. “The hike in interest rates with potentially further rounds to come has dampened investment growth prospects.”

Investor confidence has been weak, with the Eurozone purchasing managers index in construction dropping sharply in December, with new orders falling at a quicker pace than previous months.

Construction output (value-add) fell across the EU in Q3 2022, but reflecting levels of ongoing works, is still just above the Q4 2019 level.

Infrastructure/energy projects are being promoted, backed by EU funding under the Recovery and Resilience Facility (RRF), but not all benefiting to the same degree.

"Output will be severely hampered by weak investment growth, and high prices for key construction materials and energy costs, a trend that has been exacerbated by the impact of the Ukraine war given the importance of commodity supplies from Russia and Ukraine,” adds Richards.

Regional outlook – Eastern Europe

The Eastern European construction sector as a whole “continues to look quite gloomy for this year” according to Joel Hanna, who heads GlobalData’s research team focused on the region.

He adds that the region’s construction sector is expected to contract by 2.3% this year, on the back of a relatively weak year in 2022, although the declines for both years are in fact an improvement on GlobalData’s previous forecasts of a 2.5% fall for 2022 and a 2.7% decline in 2023. “This is in large part due to slightly stronger than expected data from Q3 and Q4 in 2022 for many markets in the region,” says Hanna. “However this doesn’t mean that we are particularly more optimistic about the medium-term outlook. We expect growth to be significantly weaker in 2024, and the recovery to pre-pandemic levels is now expected to be delayed until in 2026.”

Hanna says the main reason for this is that the conflict in Ukraine is expected to be protracted, and the fallout will continue to be felt over time. Investor confidence is likely to remain weak, plus interest rate hikes will have a negative impact on housing demand. Rising construction costs will feed into higher house prices in the coming quarters and years. This is expected to hit further growth in the residential sector which has been one of the driving forces behind rising construction activity in many Eastern Europe markets in recent years, apart from 2022.

Residential is expected to be the second weakest construction sector in Eastern Europe this year after commercial (down by -4.1%), declining by 3.5% year-on-year. Commercial and industrial are also expected to weaken further this year owing to slowing economic growth which will impact on demand.

Although the energy & utilities sector is expected to contract during 2023, output levels remain fairly high, in large part due to increasing investments in energy infrastructure.

The best performing sector this year is expected to be infrastructure, which is already 3.2% above pre-pandemic levels and is expected to post further marginal growth in 2023, primarily due to support from the RRF fund in EU countries. However downsides remain in non-EU Eastern Europe countries , which face greater levels of debt distress and pressure on public finances.

Weakening public revenues owing to Western sanctions, weak external demand, and declining crude oil prices are expected to impact on the level of new investment in the Eastern Europe region’s construction sector.

Protraction of the Ukraine conflict exposes Russia to intensifying economic risk. On the upside, Hanna says that emerging export markets in Asia offer an alternative source of revenue that could offset the shortfall in revenue from Europe.

Construction output in all major Eastern Europe markets is expected to decline this year, even in the better performing markets such as Estonia, Croatia and Slovenia. The Czech Republic and Poland recovered to pre-pandemic levels in 2022, but GlobalData predicts they will dip back below that level this year. Hungary faces the largest decline in output levels in 2023 after strong growth in the previous two years, with an expected contraction of 7.6% due to decreased government spending, persistently high materials costs and ongoing labour shortages.

Developments in Turkey

Output levels in Turkey have been trending downwards since 2018, coinciding largely with the depreciation of the lira. The construction sector has also been impacted by the government’s interest rate policy and the conflict in Ukraine which have both contributed to rapid inflation and an erosion in investor confidence.

Output contracted sharply in 2022 and is expected to do so again this year. The housing market, which accounts for two-thirds of construction in Turkey, has cooled in recent months due to high inflation and rising materials costs.

On the positive side, inflation in Turkey has begun to slow and the construction confidence index has shown a steady upward trend in late 2022 through to early 2023. Hanna says this could signal a recovery in construction over the medium-term. Government spending is also likely to increase ahead of the national election in June.

In Russia, construction output levels were quite strong in the first half of 2022, despite the impact of western sanctions. This was primarily due to higher energy prices and continued trade with non-western countries, which partially offset the decline in export volume to Europe. This enabled in investment in infrastructure and energy projects to remain strong with those sectors posting annual growth of 9.7% and 4.2% respectively last year.

GlobalData still expects the western sanctions to bite over the coming quarters, however, particularly with the hit to private investment and multi-national construction companies ending their operations in Russia. The analyst predicts a decline in construction output both this year and next year. The prospect of further sanctions clouds the outlook in Russia, but an upside factor is the increasing demand for oil and gas in Asian countries such as India and China which could plug the gap in revenue from Europe.

“This could allow Russia to maintain its infrastructure investment and also could provide a direct boost to construction if Russia decides to build more eastern-facing export facilities, such as port terminals and gas pipelines,” says Hanna.

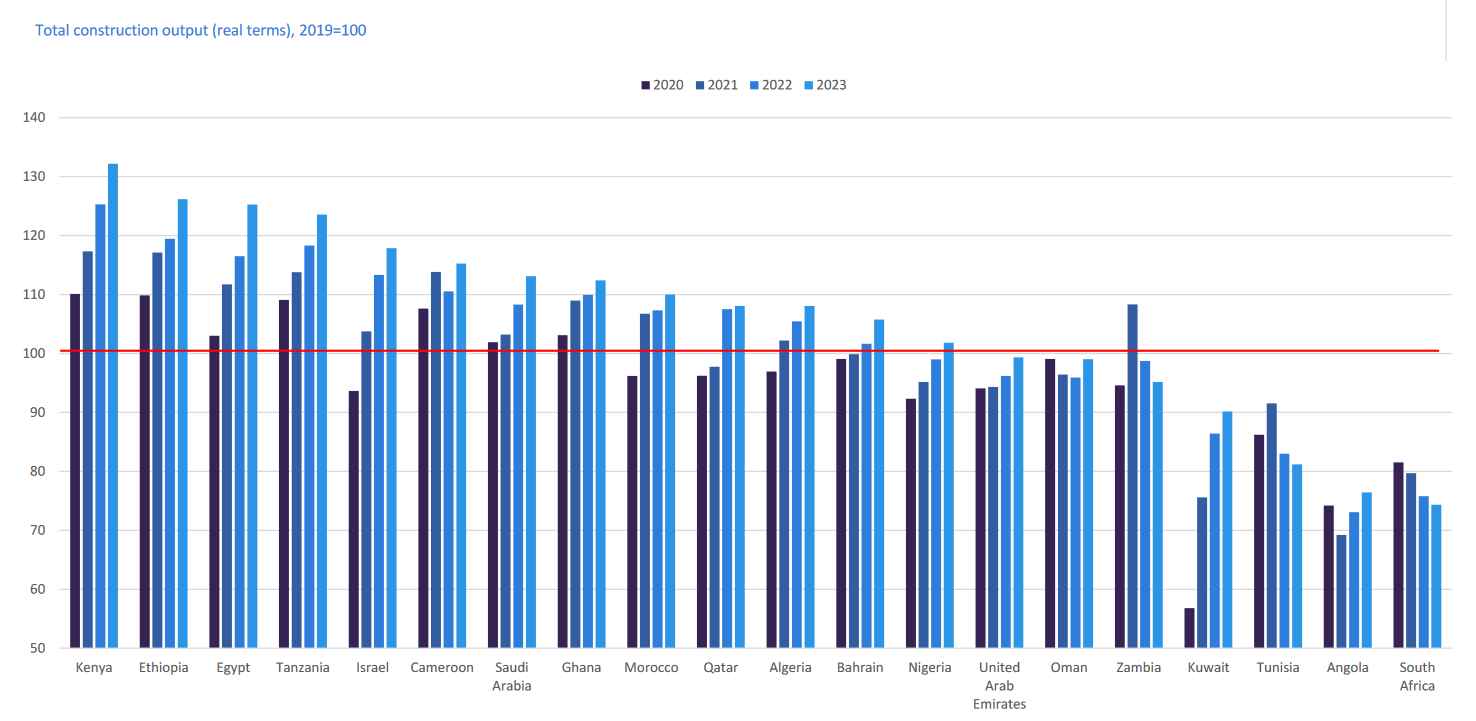

Regional outlook - Middle East & North Africa

The construction industry in the Middle East & North Africa (MENA) region posted solid growth in 2022 (4.7%), marginally behind South Asia (4.8%), with high oil and gas prices supporting fiscal surpluses and spending programmes. GlobalData predicts that growth will continue in 2023, driven by a revival in stalled projects as well as diversification efforts.

There are downside factors for the short-term outlook. High interest rates, inflation and issues with availability of construction materials are resulting in an increase in project finance costs and thereby further denting growth in private construction.

Saudi Arabia’s sovereign wealth fund – the Public Investment Fund (PIF) - has designated the Diriyah project as its fifth giga-project after the Neom, Red Sea, Qiddiya and Roshn developments. GlobalData says these projects will be a key factor driving growth in the coming years. The Saudi Arabian construction market saw growth of 4.9% in 2022.

The UAE market is among those in the region that has struggled to recover after lockdowns, but GlobalData predicts that the situation will improve during 2023.

Regional outlook - Sub-Saharan Africa

Sub-Saharan Africa’s post-pandemic economic recovery momentum has slowed since the second half of 2022, with the IMF forecasting GDP growth to remain stable at 3.7% in 2023 following a deceleration to 3.6% in 2022 from 4.7% in 2021.

The near-term outlook is uncertain owing to rising debt levels. Both public and private sector projects will face hurdles, with government revenue directed at efforts to deal with immediate socioeconomic crises while high construction material prices will make projects unviable for private sector.

The energy and utilities sector will outperform other sectors, with short term growth driven by increased activity in oil and gas projects as a result of the continued higher prices, while longer-term investments will be driven by the shift towards green energy.

Hanna says that investment in infrastructure in the region will be driven by the continued realisation of the inadequacies of the current transport and utility systems and education and healthcare facilities.

He adds that Kenya is the standout performer in the region, but GlobalData has slightly revised down its growth forecasts for the country owing to challenges caused by rising debt and inflation. New Kenyan president William Ruto has been looking to reduce investment plans to cut the country’s debt levels.

“Some of the other fast-growing markets are doing well in spite of some major challenges,” Hanna adds. “Despite Ethiopia’s conflict and security concerns, foreign direct investment flows jumped by 79% in the last fiscal year, and despite Egypt’s macroeconomic instability we haven’t seen any real dent in its investment in major urban development projects.”

One of the region’s biggest markets Nigeria is expected to just about edge above its 2019 levels in 2023, with construction spending supported by investment under the country’s five-year national development plan that runs from 2021 to 2025.

GlobalData expects South Africa’s construction industry to remain weak in 2023, declining by 1.9% in real terms following a decline of 4.9% in 2022, owing in part to soaring energy prices and disruptions in the supply of key construction materials amid the Russia-Ukraine conflict.

The latest figures from Statistics South Africa (Stats SA) showed that the construction industry’s value add declined by 4.7% and the country’s gross fixed capital formation in construction work fell by 7.6% YoY in the first nine months of 2022.