This investment will enable CEC to industrialise production of its sustainable cement at CELSA UK’s EAF facility in Cardiff, deliver a real-world construction demonstrator, and advance offtake agreements with partners and customers.

Concrete is a critical material in our built environment; we use half a tonne of concrete every year for every person alive on the planet. But it’s responsible for 7.5% of total carbon emissions[1] – triple that of aviation[2]. Decarbonising cement (the energy and CO2-intensive component of concrete) is a massive challenge; CEC offers a solution.

CEC was founded in 2022 to commercialise low carbon cement research by academic co-founders Professor Julian Allwood, Doctor Cyrille Dunant, and Doctor Pippa Horton. CEC’s breakthrough process co-recycles steel and cement to produce a low carbon, circular cement product that offers a very low emissions[3], circular, and scalable alternative to existing cement production.

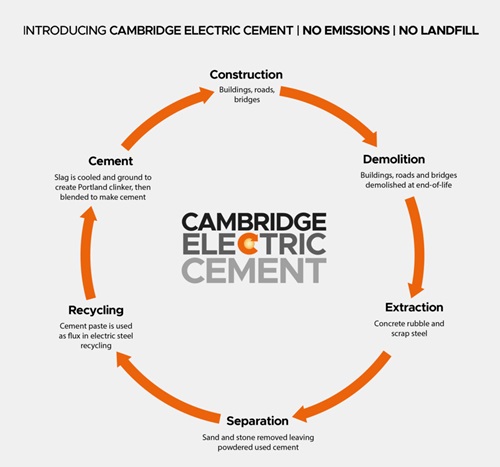

The key innovation is the substitution of recovered cement paste (RCP) for the lime used in the steel recycling process. Critically, CEC has proven that electric arc furnaces (EAFs) provide the right conditions to reactivate RCP extracted from old concrete waste, without interfering with the steelmaking. This co-production process avoids both the kiln-related energy and calcination process emissions from conventional cement production, and leverages existing steelmaking infrastructure. The team’s scientific research continues not only at the University of Cambridge, but also with research teams at the University of Warwick and Imperial College lead by Zushu Li and Rupert Myers, leveraging £2m funding from the Engineering and Physical Sciences Research Council (EPSRC).

CEC’s cement product targets a direct replacement for current Portland Cement (i.e. CEM I), delivering equivalent performance without the negative environmental impact.

By combining transformational sustainability impact[3] with its scalable, low capex model, CEC’s proposition offers a unique advantage over current technologies. Sustainable cement competitors typically offer partial emissions reduction with lower capex requirements, or transformational impact with high capex requirements. CEC’s high-impact, low-capex model is unique. Furthermore, by producing a CEM I equivalent cement, many would-be competitor technologies (e.g. calcined clay) are complementary to CEC’s approach, allowing for even greater impact.

Development to date builds upon the ‘Cement 2 Zero’ industrial demonstrator project, a consortium involving CEC and its valued industry partners: AtkinsRéalis, Balfour Beatty, CELSA UK, Day Group, Materials Processing Institute, and Tarmac. This £6.5 million initiative is funded by a Transforming Foundation Industries grant from InnovateUK. CEC’s partners continue to contribute critical experience, knowledge, equipment access, and advocacy. Following the successful completion of pilot scale trials at the Materials Processing Institute’s 7t EAF, industrial-scale trials started in May 2024, utilising CELSA UK’s 150t EAF. Phil Cartlidge, CELSA Projects Manager, who has championed the trials to date, stated that he is “very optimistic about the forthcoming industrial scale trials at CELSA UK’s 1.2Mt melt shop, which will find the way to re-engineer arc furnace slag using recycled materials and building on CELSA’s commitment to circularity and sustainability”.

Pippa Gawley, Co-founder and General Partner at Zero Carbon Capital, comments: “We are thrilled to support CEC as they embark on this exciting journey. Their innovative decarbonisation technology paired with the use of existing infrastructure addresses a significant gap and has huge abatement and commercial potential. We believe in the team’s vision and their ability to execute, and we look forward to working together.”

John Bromley, Managing Director of Clean Energy & Climate Strategy, Asset Management (Private Markets), Legal & General, says: “As an experienced energy transition investor and leading asset manager across private infrastructure, real estate, and credit, we see both the investment opportunity and operational imperative to reduce carbon emissions embedded throughout these sectors. We are proud to have supported the establishment of CEC and its preparation for this successful seed investment raise. The built environment requires substantial change to reduce emissions and reach net zero, and this challenge is a huge opportunity for institutional investors like Legal & General. We can invest early and take a long-term view to help innovative businesses develop and deliver effective decarbonisation solutions.”

Chris Gibbs, Investment Director at Cambridge Enterprise, adds: “CEC’s co-production process for sustainable cement is an elegant and revolutionary innovation. Cambridge Enterprise Ventures is delighted to invest and support the team as they commercialise this transformative technology which has the potential to make a significant impact on carbon emissions.”

Bill Yost, CEO of CEC, concludes: “We are excited to start our commercial journey to deploying our co-production process at scale with our great set of early investors and industry partners, and are hugely motivated by the potential decarbonisation and wider sustainability impact we could deliver together.”

Click here for a video on CEC: https://www.youtube.com/watch?v=MqWXXLOCeNg

About CEC

Cambridge Electric Cement is a UK-based start-up, founded in 2022 to commercialise a sustainable cement concept from the University of Cambridge. The team has developed the world’s first process for making low carbon, recycled cement, by processing it through the same electric arc furnaces (EAFs) as those used in steel recycling.

About Zero Carbon Capital

Zero Carbon Capital (ZCC) specialises in pre-seed and seed-stage investments in companies developing hard-science solutions to the critical challenge of decarbonisation. Operating across Europe, ZCC backs teams with the ambition and potential to significantly reduce carbon emissions, leveraging a deep commitment to scientific rigour and environmental stewardship. ZCC started investing with a proof-of-concept fund in 2020, which backed seven early-stage UK-based decarbonisation companies.