Company orders were down 7% on a reported basis and 8% organically. Reported operating margin in the quarter was 6%, up 520 basis points versus the prior year.

Xylem generated $275 million of operating cash flow and $234 million of free cash flow in the quarter, representing a conversion of 215%, driven by discipline on capital spending and working capital, as well as favourable timing of interest and tax payments. The company’s liquidity remains strong, at approximately $2.4 billion, including cash and committed credit facilities.

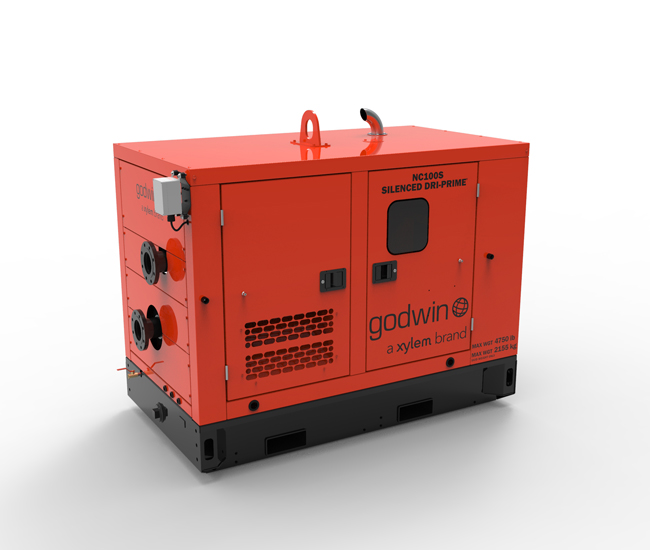

A better than forecast trading period for Xylem, whose portfolio includes quarrying-suited Godwin and Flygt dewatering pumps, is said to have been primarily driven by the resilience of the wastewater utility business and healthy residential demand.

“Our team delivered operational performance exceeding expectations on both the top line and bottom line,” said Patrick Decker, Xylem’s president and CEO. “Our supply chain continues to be robust, we’re maintaining discipline on cost and capital, and cash generation is healthy. Overall, we’re executing with focus and purpose to make sure our customers can continue delivering essential services to their communities.”

“Despite continuing macro uncertainty, we are serving end-markets that showed signs of increasing stability through the quarter,” continued Decker. “China returned to pre-pandemic growth, Europe grew modestly, and the US, while still lagging other regions, improved sequentially in the quarter. We continue to set strong commercial pace as utilities accelerate interest in transformational technologies that increase operational and financial resilience. Physical distancing is delaying some project revenues dependent on fieldwork in the short term, and we continue to closely monitor COVID-19 developments. We are well-positioned irrespective of how the pandemic plays out and set to emerge in an even stronger position.”

Xylem expects fourth-quarter organic revenue declines in the range of 6-8% and adjusted operating margin in the range of 13% to 13.5%. Full-year free cash flow conversion is anticipated to be greater than 100%.