The cement industry is among the most difficult, if not the most difficult, to abate in terms of achieving decarbonisation.

Twenty years ago, the cement sector recognised the need to go beyond legal requirements to reduce emissions, and ten of the largest international cement suppliers made commitments to do so.

Since then, the three key levers that have been pulled to achieve industry decarbonisation have been energy efficiency, fuel switching and reducing the clinker factor. These have led to reductions of about 25% in carbon emissions since 1990.

WCA chief executive Ian Riley says these levers have the potential for about another 25% reduction. “But beyond that we must find new ways to reduce CO2 emissions including CCUS [carbon capture utilisation and storage] and zero-carbon fuels such as hydrogen,” added Riley, who was speaking at the WCA’s Annual Conference 2021 held virtually on October 20-21.

Riley says that one thing that’s becoming very clear is the potential for cross-industry collaboration towards achieving decarbonisation in areas such as learning, holistic problem solving, building scale and direct materials supply.

In addition to the moral obligation to reduce carbon emissions, the WCA was warning as far back as October 2018 that, if it didn’t take action, the cement sector could soon be facing aggressive moves on the climate-change issue from investors, regulators and other stakeholders.

Following his comments at the WCA conference, Riley delivered an address at the Sustainable Innovation Forum (SIF), part of November’s COP26 UN climate-change conference in Glasgow, where he outlined key actions governments around the world can immediately take to cut global CO2 emissions from the cement and concrete sector.

For an industry that contributes around 7% to global carbon emissions, Riley says the need to decarbonise quickly is critical if worldwide efforts to reduce and reverse global heating are to succeed.

Riley told delegates at COP26 that not only is a net-zero cement industry achievable, new technologies for carbon-negative concrete are emerging that can remove CO2 that is already in the atmosphere.

But for this to happen, he said governments around the world need to take action in three key areas to encourage faster adoption of low-carbon technologies:

- Promote a market for low-carbon concrete by encouraging its use in publicly-funded building projects

- Review and update product standards to allow low-carbon concrete to be used in a wider range of applications

- Create the right market incentives for developing and using low-carbon cement and concrete technologies, via carbon pricing, subsidies or other economic mechanisms

If governments around the world respond to the WCA’s call and take action now, Riley claims that annual emissions of CO2 from cement and concrete could be reduced by 30%, or 900 million tons per year by 2030.

“The pathways to net zero will be different for every cement plant. However, there are a few key measures which governments can adopt that will have a rapid and lasting impact on the pace of global uptake of all these measures,” Riley said.

“These measures can be implemented at low cost and will stimulate innovation and rapid scaling of new technologies. For governments looking for effective measures they can take today that will help deliver major and lasting emissions reductions in the next decade, the cement and concrete industry is a great place to start.”

Lord Adair Turner, chair of the Energy Transitions Commission (ETC), said at the WCA conference that the world is moving in the right direction on emissions reduction but nowhere near fast enough and that there is at least another 30% that has got to be done.

The ETC is a global coalition of major power and industrial companies, investors, environmental NGOs (non-governmental organisations) and experts working out achievable pathways to limit global warming to well below 2˚C by 2040 while stimulating economic development and social progress.

Turner added: “Even on what have been called the ‘hard to abate’ sectors – steel, cement, chemicals, long-distance aviation and shipping – we now have clear visions of how to get to net zero by 2050.”

Turner admitted that there may be a net cost to decarbonise for such hard-to-abate sectors, unlike in road transport where in ten years people will be spending less on owning and running their cars than they do today.

“Cement is one sector where we really don’t know how to get to zero carbon except by adding carbon capture and storage to the existing processes…. because of those emissions resulting from the very chemical process of turning calcium carbonate into calcium oxide,” said Turner. “So, in the cement sector we know that there will be an additional cost and we know that it will take time.”

Turner made a clear appeal to the cement industry, saying that it needs to squeeze out as many emissions reductions as it can in areas such as increasing energy efficiency in kiln operation and by beginning to employ CCUS. He said the industry must take action and that it needs to do it now, setting out a clear and believable path.

The ETC calculates that it may be possible to have a 0.3 gigatonne (10-15%) reduction in cement industry emissions by 2030, compared with a one gigatonne reduction (up to 35%) in the steel sector.

Turner said the crucial thing for the cement sector is to measure the progress made during the 2020s, not only by the beginning of an actual material reduction, but by having clear pathways, strategies, investment plans, technological developments and commitments to working out how and when carbon capture and storage is going to be done.

He added that the sector “needs to be on a path which is beginning to get the reductions we need in the 2020s, but is on a clear and believable path to that net zero by 2050 which we need to achieve.”

Guloren Turan of the Global CCS Institute, an international think tank for accelerating the deployment of carbon capture and storage (CCS), says that the global CCS facility has continued to grow in 2021 for the fourth consecutive year, increasing by almost a third year-on-year.

“In the first nine months of 2021 we added 70 new commercial facilities to our database, bringing the total number to 135,” she adds.

Turan says that seven of these facilities are in operation, four are under construction, and the remainder are in various stages of development. She adds that the key driver for CCS deployment has been the adoption of more ambitious climate targets and increased climate action, both from governments and the private sector, seeing the strengthening business case for CCS.

Turan says that seven of these facilities are in operation, four are under construction, and the remainder are in various stages of development. She adds that the key driver for CCS deployment has been the adoption of more ambitious climate targets and increased climate action, both from governments and the private sector, seeing the strengthening business case for CCS.

More than 100 countries and over 1,000 companies now have net-zero targets. “This has created a virtuous circle in the sense that governments are putting in place more supportive policies for CCS and the private sector, seeing the strength for CCS is advancing new projects and developing new business models to reduce cost and risk,” says Turan. “With this I particularly mean CCS networks and clusters.”

The WCA is developing a decision-making tool to help companies in the cement sector achieve the industry’s net-zero targets by turning them into actions.

Matthias Mersmann (chief technology officer at cement sector process engineering company KHD International) is on the WCA’s technology & sustainability steering committee, which works to develop its net-zero roadmap and the decision-making tool.

Mersmann says that all the cement sector roadmaps that have been published by companies and industry associations stress that the decade leading up to 2030 is decisive in taking action to deliver on the net zero ambitions.

The WCA technology & sustainability steering committee has set out the various technology options that are available to the cement sector on the path to net-zero. These include the application of lower energy consumption technologies in the cement and raw material grinding process, in addition to pre-processing and recycling of spent concrete.

Mersmann says there are a number of ways available to phase out CO2 along the cement production process, such as using low-carbon carbide slag as raw material in the production of the cement clinker used in Portland cement. CO2 produced during the cement manufacturing process can also be recycled and utilised for concrete curing, which assists in the strength development of concrete and improves its durability potential.

Maria Mendiluce, CEO of the We Mean Business coalition which works with businesses to address climate change, says it is encouraging that 15 cement companies have so far joined the UN-backed Science-Based Targets Initiative that enables companies in the private sector to set science-based emissions reduction targets.

“The cement industry is waking up to the fact that many of the players in it are going quite fast,” she adds. “We have seen that some are watching, while others are doing. As they see that some of the leading players like Dalmia Cement in India are going faster, they then think that they can also go faster. I think the rest of the industry should be worried because if they don’t pick up this train then there’s going to be quite a distance with the leading companies.

“The industry is quite conscious that they have to go faster. There is pressure from investors, and we are also going to see an increased demand for low-carbon products from the sector.”

She adds that putting incentives in executive pay and extending these further down the chain at companies can help achieve decarbonisation targets. “There are plenty of very talented engineers who can find solutions to reduce the amount of emissions in their activities,” says Mendiluce. “It’s just about putting the right incentives and targets in place.”

Dalmia Cement’s CEO Mahendra Singhi says that, despite the emissions challenges that the cement sector faces, it is possible to abate. In 2018 the company announced its commitment to be carbon negative by 2040 and Singhi says it has one of the lowest carbon footprints in the global cement sector, as well as being one of the industry’s most profitable companies.

He adds that the industry is making further strong efforts towards decarbonisation, citing the announcement on October 14 by members of the Global Cement and Concrete Association (GCCA) of their roadmap to make concrete a net-zero product by 2050.

Fuel giant BP works closely with the cement sector at both ends of the value chain, providing energy for its production processes and also purchasing cement products. Nikki Grady-Smith, BP’s senior VP city & corporate integrated solutions, says inter-sector partnerships and collaborations will be critical in accelerating decarbonisation. “We are working with large companies like CEMEX and collaborating together on solutions to move the agenda forward,” Grady-Smith adds.

She said there should be both some self-regulation by the cement industry and government policies to help the sector further reduce its carbon footprint. She cited the steel sector’s ResponsibleSteel initiative which has established some standards and certification protocols for environmentally-friendly and ethically produced steel. “That gives customers confidence in those circumstances to purchase,” she adds. “In addition, government and policy makers can encourage production methods to change, and customers to demand new low-carbon solutions moving forward as well.”

Global cement sector recovers in 2021

2021 has been a year of recovery for the global cement sector following the COVID lockdowns in 2020, according to building materials industry analyst On Field Investment Research (OFIR).

Yassine Touahri - a founding partner at the London, UK-based research company – says that estimated global cement demand in 2021 will be 8.6% higher than 2020 year-on-year (excluding China) and 5.8% higher including China.

Compared with the pre-COVID year of 2019, Touahri predicts that global 2021 cement demand will be up by 5-6%, driven by post-lockdown recovery in new housing (and to a lesser extent in public works), and solid trends in DIY cement use. “Trends for office building are still under pressure,” he added.

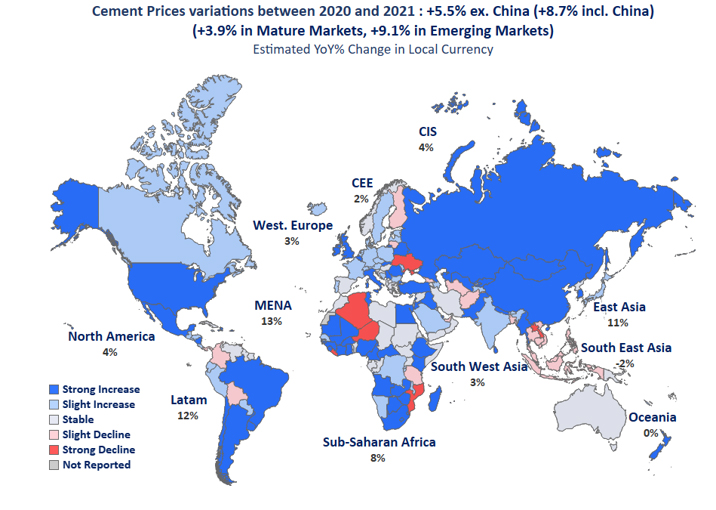

Touahri predicts that global cement prices will increase by 5.5% excluding China, and 9% including China. “Since September we have seen a massive increase in Chinese cement prices of nearly 50%, which was much above our expectations,” he says. “This reflects an environment where coal and power prices are increasing very quickly, power cuts are visible, and the cost of importing clinker has increased quite a lot.”

OFIR predicts global cement prices in US dollars including China will increase by 12% this year (3.7% excluding China).

In terms of the outlook for 2022, OFIR founding partner Arnaud Pinatel says that – while visibility for the year is limited – cement demand for the year is predicted to increase by 4.5% excluding China (and to decrease by 0.3% when China is included).

He adds that the 2021 trend of moderate increases across most global markets will be continued into 2022. “Order books are remaining solid, even if there are tensions in the supply chain,” says Pinatel. “These tensions are impacting the ability of contractors to deliver their projects on time. The risk is more on the supply than the demand side. Demand is still relatively solid when we look at the order books.”

Pinatel says the main question for 2022 is how long the current supply-side shortage (in labour, raw materials and logistics) will last.