Some suffer, and some gain from rising fossil fuel prices, with the MENA region, firmly residing in the latter camp. Additional funds generated by oil producers across the region due to the sustained fossil fuel price hike are largely being spent on various forms of construction, which, in turn, have pushed up demand for aggregates, such as gravel, concrete, sand, and crushed stones. The GCC (Gulf Cooperation Council) countries have taken the lead in the past year, announcing building projects worth billions of dollars.

MENA’s construction sector growth, particularly in the oil/refinery, petrochemical/industrial, and commercial construction, is fuelled by US$90 to $125 per barrel of crude oil. As of 8 March 2023, the price of Brent crude oil stood at $80 but is expected to rise in the coming months.

More importantly, the huge spending by various governments in the region in executing various infrastructure projects is expected to create thousands of direct and indirect jobs leading to more economic activity throughout the region.

For instance, Morocco has approved 26 investment projects under a total budget of $2.8 billion, and these projects will create over 3,735 direct jobs and 23,182 indirect jobs, the country’s investment commission, chaired by Morocco’s Prime Minister Aziz Akhannouch, said on 23 January 2023.

A few days later, Akhannouch told delegates at the annual Davos summit in Switzerland that his country has become a leader in sustainable development and is targeting 50% reliance on renewable energy by 2030, saying: “Renewable energies now account for 38% of our energy mix, and our ambition is to reach 50% or 52% by 2030.”

Even in Egypt, which is recovering from the post-COVID-19 effect, the award of construction projects is set to grow by 18% to $23.5 billion in 2023 from $19.9 billion in 2022. While the building sector walked away with a lion’s share of USD9.7 billion in 2022, it was followed by the industrial USD5 billion and infrastructure USD$2.7 billion sectors, respectively.

Coming to the GCC, two major events – the 2022 FIFA World Cup in Qatar and Expo 2020 in Dubai (the event was deferred by one year due to the COVID-19 pandemic) – gave a fillip to the construction activity in the region.

Encouraged by the success of World Expo 2020 in the UAE, Saudi Arabia wants to hold the World Expo in 2030 as the Kingdom has already initiated infrastructure projects worth more than $750bn, including NEOM city, which alone is estimated to cost around $500bn.

Fitch Solutions, which offers credit risk and strategy decisions with reliable data, has forecast the region's construction industry to exhibit overall real growth of 5.0% y-o-y in 2023, ahead of the global industry's 2.3% y-o-y expansion, as activity in the region continues to benefit from elevated energy prices, impending disinflation in the price of materials and burgeoning project pipelines.

“Countries such as Libya, Egypt, and Iran will see the fastest individual real growth rates among markets in the region in 2023, while Qatar will feature one of the region's slowest growth rates as FIFA World Cup-related construction activity dissipates,” it said.

Fitch Solutions said it would remain bullish on the growth prospects for the MENA as a whole and the GCC countries, as these countries are generally characterised by young populations and robust economic diversification initiatives and will be able to allocate more resources into their respective infrastructure sectors as oil prices rise.

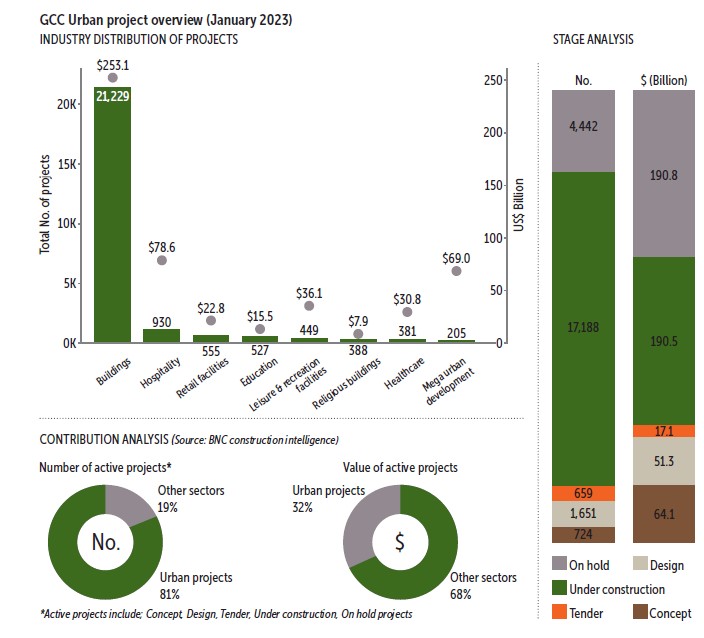

According to the UAE-based BNC Construction Intelligence, there are 24,664 active urban construction projects in the GCC, estimated at USD513.9 billion. The GCC's urban construction sector constitutes 81% of the number of all active projects in the region.

“In dollar terms, urban construction projects account for 32% of the total estimated value of all sectors in the region,” BNC said (see info graph). Active projects include concept, design, tender, under construction and on-hold projects.

Grant Earnshaw, manager for Holcim, MENA Region, said that the region has seen a reasonable recovery in the post-COVID-19 era with governments returning to spending in construction. Infrastructure development remains an area with significant growth potential across the region, given its key role in improving the efficiency of trade flows, living standards and job creation, he said.

“Many economies in the region are hydrocarbon-based, so governments are seeing rising revenues that allow for increased spending through state budgets. We currently see a softening of volumes in the private residential sector, which is largely impacted by inflation,” Earnshaw said.

In its latest report on the MENA construction equipment (CE) market - Growth, Trends, Covid-19 Impact and Forecasts between 2023-2028, Mordor Intelligence, a global market intelligence and advisory firm, said that various ongoing and future projects, which the local governments have initiated in the region to improve the infrastructure, were creating a demand for construction equipment.

The report said that the CE market in these countries is valued at $4.26 billion and is expected to reach $6.4 billion by 2028, registering a CAGR of 4% over the next five years.

Saudi Arabia represents the second-largest market for the construction sector in the GCC region after the UAE, which occupies more than 34% of the revenue generated. Saudi Arabia holds a revenue share of 29%, followed by Qatar and Oman with 12% and 10%, respectively. The construction of high-rise buildings like the Jeddah Tower in Saudi Arabia is anticipated to increase the demand for construction equipment in Saudi Arabia, the report said.

The COVID-19 pandemic severely affected the construction industry and associated equipment demand due to disruptions in the supply chain, reduced investment in new equipment procurement, the halting and postponement of construction projects, and unstable economic growth in many countries.

“However, since last year, the construction industry across the region has been experiencing significant growth in investment and economic development, witnessing major orders for CE from GCC countries in the region which is likely to drive the market in focus during the forecast period,” the report noted.

In August last year, Doosan Infracore Co., a subsidiary of Hyundai Construction Equipment, won an order to supply 62 units of construction equipment to major customers in Saudi Arabia and Bahrain, the report said.

One of the major factors driving the growth of the CE market is the growing construction industry, especially in developing countries, owing to numerous growth opportunities in infrastructure, residential, and non-residential sectors.

The rise in the construction of multi-family houses (with the growing trend for nuclear families), and increasing investments in the construction of roads, highways, smart cities, metros, bridges, and expressways are due to the growing population and urbanization. The growing trend toward automation is expected to drive the growth of the market, the report said.

Each country in the Middle East region has grown in the construction sector in its unique way over the years, adhering to its own pace, norms, and ambitions.

The UAE is responsible for significant projects, owing to the fact that Dubai has more robust development and investment than the rest of the Middle East. High economic growth, a growing elite population, increased foreign investment, and other factors have contributed to this.

In fact, Saudi Arabia, the UAE, Oman, and Egypt are launching several infrastructure projects, including new megacities, railway projects, harbours, airports, housing projects, and so on, all of which are expected to boost construction demand.

“The city's infrastructure development also contributes to the need for construction equipment. The building of major rail networks like Etihad Rail in the UAE is also projected to propel the market for construction equipment in the Emirates,” the Mordor Intelligence report added.

According to Earnshaw, sustainability and efficiency are the two trends marking the construction equipment market in the region. Customers are looking for improved sustainability performance as well as energy efficiency, which can help to lower operations costs, he said.

“Thanks to ECOPlanet, the construction of the Alamein Downtown Towers has saved 2,900 tons of CO2 (compared to reference OPC) for an emissions reduction of 45%, demonstrating that green construction at scale is possible,” Earnshaw said.

With construction activity gaining momentum, the demand for construction equipment has gone up in the last few months. Holcim is involved in major projects across all countries in the region - from the new Central Bank of Iraq to the Alamein Downtown Towers project in Egypt, he added.

The region’s aggregates market is facing some challenges, such as the scarcity of skilled manpower and the high cost of construction materials. These factors are likely to restrain market growth in certain countries.

There is significant opportunity within the sector. Egypt hopes for more favourable macroeconomic factors in 2023 as material prices are increasing, and imports are becoming more expensive amid currency devaluation, inflation, and supply chain shocks emanating from the Russia-Ukraine war.

Even Kuwait is not immune as its construction sector has been grappling with contractual disagreements, increasing the possibility of a wave of contract terminations, a report by Arabic daily AlRai said.

The report went on to say that some contractors refused to implement contracts that they had signed at the start of 2022 and did not commence the projects due to reasons such as the issuance of licences or considerations related to either party.

“The contractors justified this with compelling reasons related to an unprecedented increase in the prices of construction goods. This led to high inflation rates that have strained the contractors’ ability to continue with the implementation,” AlRai added.

Another major factor that is expected to push up the demand for construction aggregates is the tragedy that struck two Middle East countries - Turkiye and Syria - in the form of a massive earthquake on 6 February 2023.

A fortnight after the disaster, Murat Kurum, Turkey’s Minister for the Environment and Urbanisation, said: “At least 164,000 buildings containing 520,000 apartments have either collapsed or are so damaged that they need to be demolished. Most of the destroyed buildings were built before 1999, and no inspection was carried out in these buildings during the construction stage.”

The Turkish government’s initial plan is to build 200,000 apartments and 70,000 village houses at a cost of at least $15bn. The reconstruction of infrastructure projects like buildings and roads and some airports is likely to take at least three to five years.

While Turkey is expected to recover fast from the ill effects of the disaster as it has abundant mines and natural reserves, it will take some time for war-torn Syria as some of the affected areas are still held by anti-government rebels.

Even 6Wresearch, a global market research and consulting firm, said the Middle East construction aggregates market is projected to grow from 2022 to 2028, mainly due to the increasing demand for infrastructure projects in the region, particularly in Saudi Arabia and the UAE.

The main drivers for the growth of the market are increasing infrastructure development and construction activities in the region, as well as rising demand for construction aggregates from the residential, commercial, and industrial segments.

Additionally, the major regions that are expected to account for most of the market are Saudi Arabia, the UAE, Egypt, and Iran, 6Wresearch said.

These countries are witnessing high growth rates owing to their large population bases and growing economies. Additionally, these countries have embarked on several industrialization projects over the past few years, which have led to an increase in demand for construction aggregates, the report added.

Laura Morgan, Market Intelligence Lead MEA, Project & Development Services, at Jones Lang LaSalle (JLL), said that the GCC and wider MENA region have performed well considering periods of economic volatility, based on the Vision Programmes throughout the region with committed efforts to economic diversification. The value of the projects pipeline, correlated with elevated oil prices, all point to a strong construction sector in 2023.

She said that the region, like the rest of the world, has witnessed elevated construction prices attributed to global economic and geopolitical events. Issues relating to the availability of materials or disruptions to the supply chain can impact prices, as seen over the last two years, she explained.

On the possibility of a spurt in demand for construction aggregates, she said the region always relied on imports from both within the region and outside, and the Arab world is advantageously placed to access construction materials from varying locations but is not immune to rising prices, like the rest of the world.

Generally, MENA is performing well in comparison with other regions, both at a macroeconomic level and a strong construction sector. Including an ambitious pipeline of unawarded contracts, she said.

“This is a force for new construction trends such as modern methods of construction, along with construction technologies and a greater sustainability influence. We are seeing an increasing interest to source materials locally, which in the long run supports a growing manufacturing sector to meet such trends,” Morgan added.