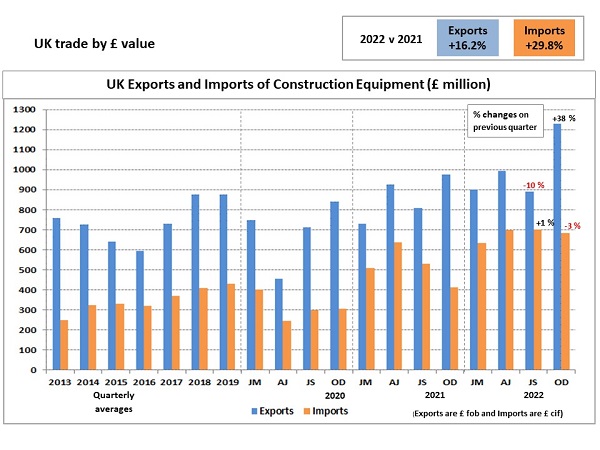

For 2022 overall, exports were close to the high levels seen in 2018 and 2019, which were the highest in the last ten years.

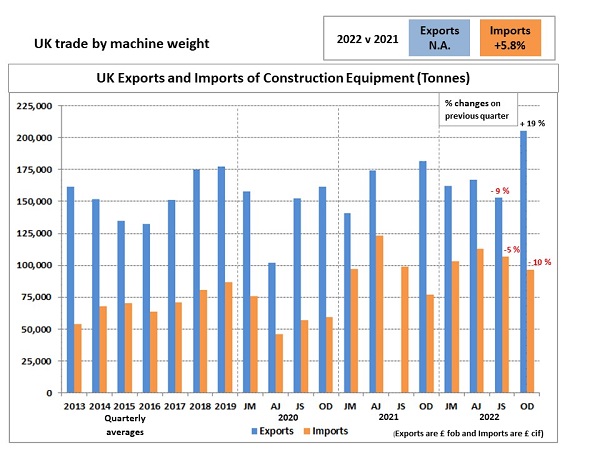

Imports of construction and earthmoving equipment in Q4 were slightly below the very high levels seen in Q3, in both £ value and tonnage shipped terms. However, for 2022 overall, equipment imports were at the highest levels recorded since 2013.

Equipment exports in Q4 were £1,228 million, representing a 38% increase on Q3 levels, and were the highest quarterly level since at least 2013. For 2022, exports reached £4,012 million, an increase of 16.5% on 2021 levels. As highlighted in earlier reports, these high levels of trade in £ value terms can be partly attributable to the higher prices being seen for equipment during the last year due to increases in the price of steel and some other products used in machine manufacture. The value of the £ also fell in 2022 against some key currencies, which will have also contributed to higher prices. However, the latest tonnage shipped data illustrates that the underlying level of export trade was very robust last year. In Q4, exports were 205 k tonnes, an increase of 19% on Q3 levels.

For 2022, exports reached 687,000 tonnes, which was close to the high levels seen in 2018 and 2019, as highlighted above. Unfortunately, a comparison can still not be made with shipments in 2021 because the problems with customs data from the Netherlands and the Irish Republic still need to be corrected. The share of total UK exports to EU markets indicates the continuation of a downward trend. The EU share fell further to 44% in 2022, after peaking at 50% in 2020 and can be partly attributed to a post-Brexit effect.

Equipment imports in Q4 were £683 million, only 3% below Q3 levels. This took total imports in 2022 to £2,715 million, which was a 30% increase on 2021 levels, and is the highest annual level since monitoring of trade began in 2013. Imports of tonnage shipped in Q4 were 97,000 tonnes, 10% down on Q3 levels. However, total imports in 2022 reached 419,000 tonnes, which was 6% above 2021 levels and the highest since 2013. This is consistent with equipment sales in the UK remaining at very high levels compared with earlier years. The EU share of total imports is shown in the table below, and similar to exports, remained on a downward trend last year. This was at 57%, the lowest since at least 2018.

The UK remained a net exporter of construction and earthmoving equipment during 2022, with exports (£4,012 million) 47% higher than imports (£2,715 million). However, this was a smaller margin than in 2021 overall, when exports were 64% higher than imports.