Solid demand in most regions has resulted in a good performance for Volvo Construction Equipment (Volvo CE) in this third quarter of 2022 – while the industry transformation is supported by a continued rollout of electric machines in Asian markets.

Every market outside Europe and China is demonstrating high activity and strong growth for Q3 2022, thanks to continued development in the commodity and infrastructure segments, resulting in a 23% increase in net sales compared to 2021, a greater increase than the last quarter. This is despite an overall decline in net order intake (32%) and deliveries (7%) – a smaller decrease than the last quarter, indicating a stable growth trend for Volvo CE.

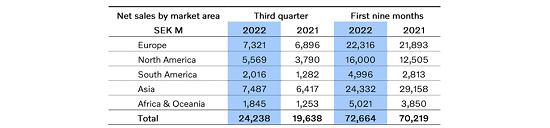

With net sales increasing by 23% to SEK 24,238mn (Є2.213bn), up from SEK 19,638mn (Є1.793bn) in the same quarter last year, profitability remains strong. When adjusted for currency movements, net sales increased by 9%, of which net sales of machines were up by 10% and service sales by 3% - reflecting Volvo CE’s continued focus on service solutions for customers. Adjusted operating income amounted to SEK 3,773mn (SEK 2,635mn in 2021), with a positive impact from price realisation and mix effects, which were partially offset by increased material and freight costs.

While profitability has been the focus for this third quarter, sustainability has still remained high on the agenda with the continued global rollout of Volvo CE’s electric machines – including the ECR25 Electric excavator in South Korea. In China, a series of customer events were held across the country to introduce customers to the company’s electric offering and charging solutions. Elsewhere, Volvo CE launched a trial test pilot for a product configurator, an online tool that allows customers to ‘build and price’ their electric compact excavators and wheeled loaders.

Melker Jernberg, President of Volvo CE, says: “In this quarter, we took still more steps on our transformation journey, ensuring that our electric machines and charging solutions are built to fit the needs of our customers in any application and region of the world. Together with our customers, we can lead the transition to a decarbonised construction industry while still continuing our efforts to build upon our strong financial position.”

Profitability has been ensured thanks to a robust North American and South American market and good progress in most Asian countries, except China, supported by government stimulus programs and high commodity prices.

After years of growth in China, the largest construction equipment market in the world, the Chinese market continued to be challenging with pricing pressure and weak demand due to lower economic activity combined with restrictions and lockdowns related to Covid-19.

In Europe, construction activity still remained high while a mild slowdown continued with increased uncertainty about the economic development making customers somewhat cautious. While overall global deliveries were down this quarter, deliveries were actually higher in Europe than the previous year, when excluding Russia. The lower global order intake is also an effect of halted sales in Russia and a high order intake in Q3 2021.