It has long been reported that the aggregates industry in Italy is one of fragmentation and of small family businesses unwilling or unable to form bonds strong enough to consolidate and create a cohesive force. And while that situation continues, as it appears to be doing, the industry will not make a name for itself as a major contributor to the Italian economy as a whole.

Italy is not a member of the UEPG (European Aggregates Association), although figures from that organisation put it at number six in its table of 35 aggregates producers in Europe, behind Germany, Russia, France, Turkey and Poland.

The national industry body, the Associazione Nazionale Estrattori Produttori Lapidei Affini (

A simple comparison of figures over the last five years shows the increased predominance of sand and gravel, but an overall reduction in total aggregates production.

In 2008, 2,500 quarries run by 1,900 operators produced 368 million tonnes of materials, of which 135 million tonnes were sand and gravel and 85 million tonnes were crushed.

Figures from 2010 show that 2,460 quarries run by 1,550 operators produced 350 million tonnes of which 210 million tonnes were sand and gravel and 140 million tonnes were crushed rock.

Latest available figures from 2012 show only 2,000 quarries run by 1,300 operators, producing just 240 million tonnes, of which sand and gravel accounted for 144 million tonnes and crushed rock for 96 million tonnes.

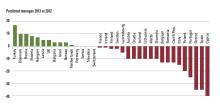

The National Institute for Statistics (Istat) is the main supplier of official statistical information in Italy. What this body had to say about production in the construction sector shows negatives in every figure.

“In November 2013 the seasonally adjusted index decreased by 2.6% compared with the previous month. The percentage change of the average of the quarter September-November decreased by 3.2%, with respect to the previous quarter. The calendar adjusted index of production in the construction sector in November 2013 decreased by 10.8% compared with November 2012 (calendar working days were 20 versus 21 in November 2012): in the period January-November 2013 the index decreased by 11.1% compared with the same period of 2012. The unadjusted index of production in the construction sector decreased by 14% compared with November 2012. Comparing the average of the first eleven months of 2013 with the same period of 2012 the index decreased by 11.4%.”

A dry statement followed by another with no more optimism. “The construction costs index for residential building approximates the monthly evolution of costs of the residential construction sector. Since January 2013 the indices are calculated with reference to the base year 2010.

“In December 2013 the index decreased by 0.1% compared with the previous month. The index rose by 0.3% compared with December 2012. The index for 2013 increased by 0.7% over the previous year.”

With such a large number of small companies running the extraction sites throughout the country (each company operates an average of 1.5 quarries) it is impossible to get a clear picture of exactly what those individual companies are expecting or forecasting for the years ahead. It is left to the very few internationally recognised names to paint a picture of what might happen. Given their relative financial might, and their greater experience in corporate and public relations, it is no surprise that what the world hears from them is a clear message of optimism.

The Italian cement and construction materials group

Cementir is planning new acquisitions, especially in Africa, Asia and North America, and it intends to increase its market quota of white cement, which already covers 15% of the global demand, and develop its business in the waste management sector. In particular, the company expects for the latter to contribute to its EBITDA by over €10 million by 2016.

Savings mean harsh decisions, and reports are that Cementir has told the unions that it planned to close down the hot production area in its Taranto plant. This is largely due to the drop in demand from the construction sector as well as a drop in supply of slag to Ilva, the local steelmaker. The facility’s nominal production, which stands at around 1.5 million tonnes/year was reaching just 500,000tonnes.

The production structure of Holcim (Italy) consists of three cement production units, including one complete cycle (with oven) at Ternate, Province of Varese and two grinding stations in Merone, Province of Como, and Ravenna; eight quarrying of aggregates (sand and gravel); 14 concrete plants, and five cement import terminals through a joint venture in which it holds 60%.

Another area of success for Italy is in its stone and marble sector, which achieved a rise of 3.2% in volumes and 7.2% in value to €1.40 billion in exports in the same period. Marble exports to the US rose by 24% in volume and by 30% in value in the first nine months of 2013. Growth exceeded 10% both for marble blocks and slabs, and for processed marble.

When there’s general decline in a sector, it stands to reason that associated markets have a fight on their hands too. So it has been with the construction equipment industry in Italy.

UNACEA, the Italian trade association for the industry, has said that 2013 was “another bad year”, and what’s needed for an upturn are new public works and access to government incentives.

In fact 2013 marked the sixth consecutive year of decline. During those 12 months 6,192 vehicles were placed on the market with a drop of 18% relative to 2012. Sales figures included 5,990 earthmoving machines (-17%); 104 road machines (-32%) and 98 units of concrete equipment (-53%) However, comparing both the fourth quarters of 2013 and 2012 the contraction was just 0.8%.

“I would like to say nowhere to go but up, but it is probably too early to trust it,” says Enrico Prandini, vice-president of UNACEA.

“The recovery will also depend on the government actions on the relaunch of public works as well as counter measures for hydrogeological instability.”

Davide Cipolla, also from UNACEA, added: “The building market and public works are substantially stuck, and this gravely affects the production level of concrete equipment companies. Concrete production is the same as 40 years ago and in term of units sold we are in line with those times. The Italian decision-makers have to get a sense of an entire industry that is suffering.”

But the organisers of the

Samoter is co-hosting for the first time the Asphaltica exhibition for road paving, safety and infrastructures. Trade delegations are expected from more than 40 countries.

It is key that while the machine market in Italy is currently sluggish export sales are strong: they hit €1.8 billion in the first nine months of 2013. New markets, together with the economic and environmental sustainability of the construction industry, are the focus for the coming Samoter.

Samoter is the main Italian event dedicated to the construction sector and the machinery it uses with Italy being one of the main European markets for quarrying and construction machines.