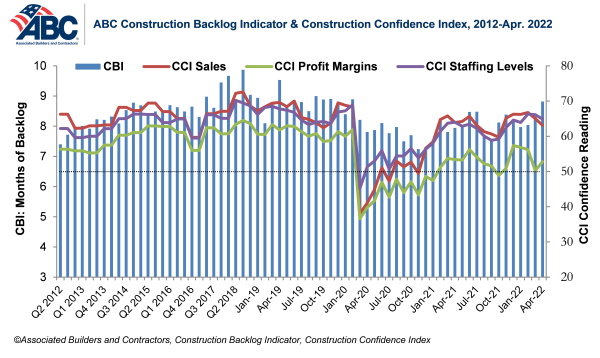

ABC's Construction Confidence Index readings for sales and staffing levels declined in April, while the reading for profit margins moved higher. All three indices remain above the threshold of 50, indicating expectations of growth over the next six months.

"The U.S. economy is facing many headwinds, but for now, the nation's nonresidential construction segment is handling them," said ABC Chief Economist Anirban Basu. "One might think that skilled worker shortages, sky-high materials prices, rising interest rates and financial market volatility would have affected industry momentum. Instead, backlog continues to rise, and contractors continue to expect sales, employment and profit margins to expand over the next six months. Demand for construction services remains strong.

"Nonresidential construction is generally a sector that lags behind the broader economy, meaning emerging economic weakness will not show up in nonresidential construction data for months to come," said Basu. "It is conceivable that the risk of recession is overstated and that contractors will thrive during the years ahead because of significant infrastructure spending. Conversely, it is possible that the combination of higher interest rates, stubborn inflation, depressed confidence, geopolitical conflict and an economy-wide downturn will have fundamentally altered the industry's outlook a year from now. Only time will tell."

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12, 2020, to better reflect the survey period. CBI quantifies the previous month's work under contract based on the latest financials available, while CCI measures contractors' outlook for the next six months.