The remaining life of consented UK aggregates reserves has fallen by 20% in the last five years, according to the latest edition of the Estimated Reserves of Pits & Quarries in Great Britain report published by BDS Market Intelligence (BDS).

The report stresses that this is an alarming situation considering the industry's concerns over replenishing essential materials through the planning process.

More than 5.5 billion tonnes of reserves of sand & gravel and crushed rock (hardstone, limestone and sandstone) have been identified in 925 separate active and inactive sites operated by almost 300 individual UK companies as of the end of 2021. The report provides details of the reserves and estimated years of life at every site, summarised at county, region and national level and by company, including market shares.

Over 30% of the currently operating sites have consented reserves that are expected to be exhausted before the end of 2026 based on BDS estimates of recent outputs, while 20 counties will be exhausted of sand and gravel reserves within ten years. Four complete British regions will have no remaining sand and gravel reserves at the end of the same period.

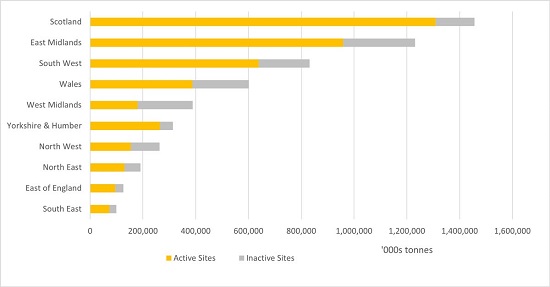

The overall life of reserves used for aggregate purposes is estimated to be 31 years, split by 12 years for sand & gravel and 39 years for crushed rock. There is significant regional disparity in where the reserves are located concerning actual needs. For example, Scotland holds 27% of the total reserves for Great Britain yet accounted for less than 8% of construction new orders in 2021. In contrast, the South East has less than 2% of national reserves but accounted for 33% of new orders for the same period.

The report also shows that 75% of the reserves are concentrated in just four regions – South West, East Midlands, Wales and Scotland. The top five aggregates producers – Aggregate Industries, Breedon, CEMEX, Hanson and Tarmac – hold a combined market share of 78% of the total reserves in Great Britain.

The report provides essential intelligence for operating companies, potential new entrants to the market, planning authorities and other industry observers. For further details or to purchase a copy of the report, contact BDS by email at [email protected] or call 01761 433035.