South Korean quarry operators and contractors are increasingly investing in premium crushing and screening plant to give them an edge when competing to supply construction firms involved in the country’s impressive long-term infrastructure development. Metso is among top global quarrying plant solution companies with a strong order book in South Korea. Guy Woodford spoke to two of the country’s leading quarry operators who have invested in the Finnish OEM’s plant and visited Seoul-based HAEIN Corporation, Metso’s South Korea distributor, to get the inside track on the East Asian nation’s quarrying scene.

Daewoon in the city of Gunsan in south-west South Korea is the first quarrying company in the country to purchase

Furthermore, the HRC plant makes the perfectly cubical shape required in manufactured sand, and can accept all feed, even with high moisture content. It can make 0-10mm-sized products. A total of 35 HRC units have been sold to date globally.

Daewoon’s purchase of the HRC-8 is an example of how the nation’s quarry sector firms are keen to continue investing in the productivity and efficiency gains offered by the latest premium crushing and screening equipment, such as Metso’s.

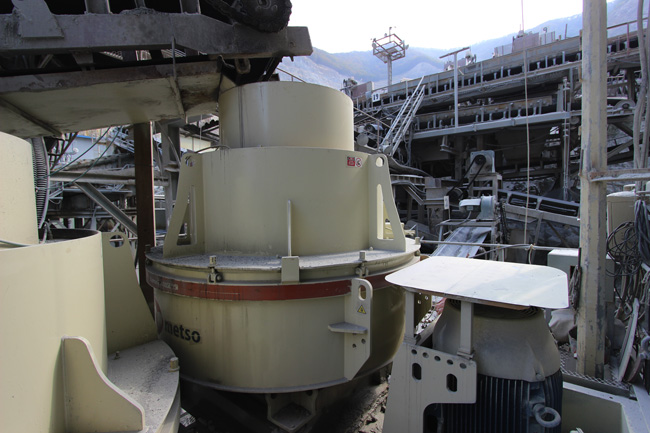

Another such company is Tae-Hyung Enterprise Co. (Tae-Hyung), whose quarrying business headquarters is a 90-minute drive south of South Korea’s capital, Seoul. The firm recently placed an order for two Metso HP400 cone crushers and one B9100SE vertical shaft impactor (VSI). The company’s first Metso plant purchases were two used Barmac B9100SE VSIs bought in 2008. This was followed by two Metso HP300 cone crushers in 2013 and two Metso HP400 cone crushers and four additional Barmac B9100SE VSIs in the years 2013-2017. A used Nordberg C145 jaw crusher was also purchased from a Korean mining company in 2016.

Investing in Barmac VSI crushers and Metso- and Nordberg-branded cone crushers over the last five years has enabled Tae-Hyung to make a tidy profit from its manufactured sand, which sells at 40% above the average market price due to its consistent high quality.

“The Metso plant allows us to produce quality manufactured sand with less flakiness,” emphasises Ho-Joong Yoon, the 62-year-old president of Tae-Hyung’s quarrying business and Tae-Hyung Enterprise Co., which also specialises in ready-mixed concrete and asphalt supply.

Tae-Hyung’s Metso plant fleet works across the company’s two quarries - Gimcheon and Pocheon. By investing in its Metso plant, Gimcheon Quarry’s production output has gone from 700m³/day ten years ago to 2,000m³/day in 2018, with Pocheon Quarry’s output rising from 6,000-7,000m³/day to 12,000m³/day. Pocheon Quarry’s significantly greater output is due to its softer initial aggregate material.

“Ten years ago, demand for minus 25-millimetre aggregate was strong in South Korea. Around that time the government made it illegal to take sand from rivers. Building materials companies then started extracting more sand from coastal areas, but last year that was also made illegal.

“The law changes have generated huge demand for manufactured sand, but not every quarry is equipped to produce it. It takes a long time and a lot of investment to build up production capabilities as we have done. This gives Tae-Hyung a competitive advantage,” explains Yoon, adding that the price of manufactured sand in South Korea is currently US$11.5-$12 per cubic metre, up from around $7 last year. He continues: “Our manufactured sand is used to make concrete for infrastructure projects in cities and towns, such as new residential accommodation and roads.”

Yoon says that the South Korean government is looking at a new labour law which would restrict the working week to no more than 52 hours. This, he says, could lead to Tae-Hyung and other quarrying and building materials companies investing more in plant automation to keep production volume up.

A senior figure in the Korean Aggregates Association, Yoon, who is married and has two daughters, has worked in the building materials industry for 30 years – the past 28 years with Tae-Hyung and two years prior to that working for Halla Cement.

Commenting on his day-to-day working life, Yoon, he says: “Unfortunately I have very little family time. I am up at 5am and have so many jobs to do, so many different work facilities and job sites to visit. I still get a great sense of achievement when I get projects done. Over the years I have also been able to overcome some colleagues’ concern about investing in premium plant.”

HAEIN Corporation (HAEIN) has been Metso’s aggregates and minerals processing plant dealer for South Korea since 2012.

Crucially, what has been a highly successful partnership to date still has a lot of room to grow, given the presence of more than 500 quarries in South Korea and a national annual aggregates demand of around 225 million tonnes. The nation’s population has doubled since 1960 and now stands at 51 million people, over 81% of whom are living in an urban area. With the many major infrastructure projects, like high-speed trains, subways, bridges, residential buildings, airport and harbour expansions, the high demand for aggregates looks set to remain for many years. Furthermore, the ban on using river and sea sand has rapidly increased the demand for high-quality manufactured sand. With Metso renowned globally for its premium manufactured sand production, it offers HAEIN a further strong sales channel.

Headquartered in Seoul and with 14 branches strategically placed near customer jobsites, HAEIN is also the dealer for, among others, U.S. global quarrying, mining and construction equipment giant

“We have around 3,000 customers with around 25% of our sales to quarrying, mining and construction customers,” explains Kyung-Hie Won, HAEIN’s long-standing chairman and CEO.

HAEIN managing director, Sung Wook Choi, says high-capacity stationary crushing and screening plant is most in demand among South Korea’s 500 to 600 aggregates-producing companies.

“Customers strive for maximum efficiency alongside optimum productivity. It is all about lowering the cost per tonne. We have 100 big customers who produce at least 100,000 cubic metre tonnes of aggregate products a month, but few have invested in a complete plant solution. That’s a potential growth area for us, as is mobile crushers and screeners.

“We continue to invest in the replacement parts and servicing side of our business. We are also continuing our staff training programme to boost Metso product and plant engineering knowledge.”

Won believes the possibility of a unified Korea has been enhanced by the historic high-profile talks between U.S. president Donald Trump and North Korean president Kim Jong-un in Singapore on 12 June 2018.

North Korea is thought to have huge reserves of untapped mineral resources and a great need for new infrastructure. New cross-border road connections are being planned between North and South Korea. The two governments have set up a joint study group to discuss new road links across the border as well as upgrades and improvements to key roads in North Korea. One road link being prioritised for improvement works is the Musan to Kaesong route. Upgrading this route would boost transport between South Korea and China, as well as between South Korea’s capital Seoul and the North Korean capital, Pyongyang.

It is also interesting to note reports of a large increase in house prices near the North and South Korea border in the immediate aftermath of the Trump-Jong-un talks.

All this adds up to potentially huge opportunities for Korean aggregates producers, and global market quarry plant original equipment manufacturers (OEMs), including Metso.

“Residential construction was down and the South Korean aggregates market somewhat depressed due to the government restricting house building in a bid to stop landlords buying up lots of properties, rather than first-time buyers. This year, that policy is being relaxed,” says Won.

Choi continues: “South Korea has stringent regulations for the quality of aggregates, both for asphalt and concrete. Hence, most quarry owners and aggregates producers are concerned about the shape of the aggregates. This increases the demand for the best available technology and equipment.”

Given rising South Korean demand for manufactured sand, HAEIN staged a big event on manufactured sand production in June 2017.

“It was a big success,” says Choi. “We had over 35 of our big customers at the event and showcased our entire manufactured sand production range. We demonstrated how Metso plant, like the HP cone crushers and the new HRC-8, can improve production efficiency and the shaping of the final product. Currently, less than 5% of all aggregates producers in South Korea are producing manufactured sand. There is huge room for growth in this area of the market.”

So how does Choi see the future of the quarrying plant sector? “I expect to see more consolidation. The demand for high-quality products will continue to increase. Efficiency requirements will continue to increase, and therefore the demand for bigger and more efficient crushers will remain high. The role of automation will definitely grow.”

Sambo Mining has invested heavily in Metso plant to meet rising demand not only for the US$23 million-a-year turnover business’s -30mm-sized dolomite, but also for its subsidiary, Kwang Jin, a 400,000tonnes/year limestone quarrying company.

Sambo Mining is the biggest South Korean supplier of dolomite, producing more than 700,000tonnes/year of -30mm product out of raw dolomite material extracted from its own mine. Last year, Sambo Mining produced 800,000tonnes of -30mm dolomite – a new annual output record for the business.

“We have to produce dolomite every day of the year to meet demand, so our production plant must not go down,” says Chang Hee Han, president of Sambo Mining. “We started investing in Metso plant in 2014, with the first model being an ES303 screen to work with another OEM crusher at our dolomite mine. We saw that too much oversized material from the crusher was not being recirculated by our existing screen. We spoke to Metso who recommended the three-deck ES303 screen. The ES303’s performance has been outstanding. It is also very reliable.”

Due to the successful deployment of the Metso ES303 screen, in 2016 Han decided to introduce more Metso plant to Sambo Mining and Kwang Jin’s dolomite mining and limestone quarrying sites, located four kilometres apart in Danyang, central South Korea. He purchased a Metso NW106 mobile jaw crusher, a Lokotrack LT106 mobile jaw crusher, a Lokotrack LT1100 mobile jaw crusher, a Metso NW220GP mobile cone crusher and a Barmac B6150SE vertical shaft impactor.

“The mobile jaw crushers have been fantastic. The tight-nip angle of the Metso crushers means that the material is crushing better in the chamber than it was in previous models.

“I now have four full Metso plants for Sambo Mining and Kwang Jin. I decide which ones to use at any given time by demand, site conditions and the nature of the raw material,” explains Han.

Sambo Mining’s president says he has been impressed with the aftermarket support he receives from HAEIN.

“Their people are often here at our Seoul headquarters discussing how our Metso plant is doing. I remember when I thought that a bracket support for the Metso ES303 screen was weak and told HAEIN about it. It was taken away, inspected, reinforced and returned within four months. The screen was able to keep working throughout this time. We were not charged for the alteration and I was very impressed with this service.”

Han, who has a degree in mechanical engineering, has worked for Sambo Mining for 22 years. Prior to that he worked as an excavator and wheeled loader designer for

“When I started at Sambo Mining in 1996 there was just one company. Now I’m president of Sambo Mining and three subsidiaries, two of them I bought after they went bankrupt,” says Han. “It gives me pleasure to know that I managed to save many jobs by buying those companies.”

Han says he is always looking to the future business marketplace. “Limestone and dolomite can be raw materials for concrete and I see a lot of growth in the aggregates sector. The mining business requires a lot of capital investment. That makes it challenging and hard to plan for the long term.

“In the next year or two I will be looking to invest in a new mobile plant for our limestone quarrying business, so I will see what Metso has to offer.”