Sales in its North American home market increased by 74% while international revenues increased 42% driven by strong demand across all global markets compared to the same quarter in 2020, which was impacted significantly by the pandemic. Currency positively impacted sales by 3% primarily due to a weaker US dollar.

“Strong demand across many of our key markets drove continued sales growth in the second quarter, particularly in North America, and resulted in solid profitability,” said chairman and CEO Tom Linebarger. “The strength of the order board reflects robust underlying demand in many of our markets which is remarkable considering the challenges and uncertainty we faced during this same period last year."

He added that the off-road engines sector continues to experience "significant supply chain constraints”.

Earnings before interest, taxes, depreciation and amortisation (EBITDA) in Q2 were US$974m (15.9% of sales), compared to US$549m (14.3% of sales) a year ago.

Net income attributable to Cummins in Q2 was US$600m (US$4.10 per diluted share) compared to US$276m (US$1.86 per diluted share) in 2020. The tax rate in the second quarter was 21.4% including US$7m, or US$0.05 per share, of unfavourable discrete items.

Cummins has also announced its exploration of strategic alternatives for its Filtration business unit. Potential alternatives to be explored include the separation of the business into a stand-alone company.

Cummins Filtration, founded by Cummins in 1958, is a leader in the filtration space, with a strong technological base of expertise and patents. Cummins says the Filtration unit has grown consistently, and as an independent company, would have the opportunity to accelerate growth as it further diversifies into new products and end markets.

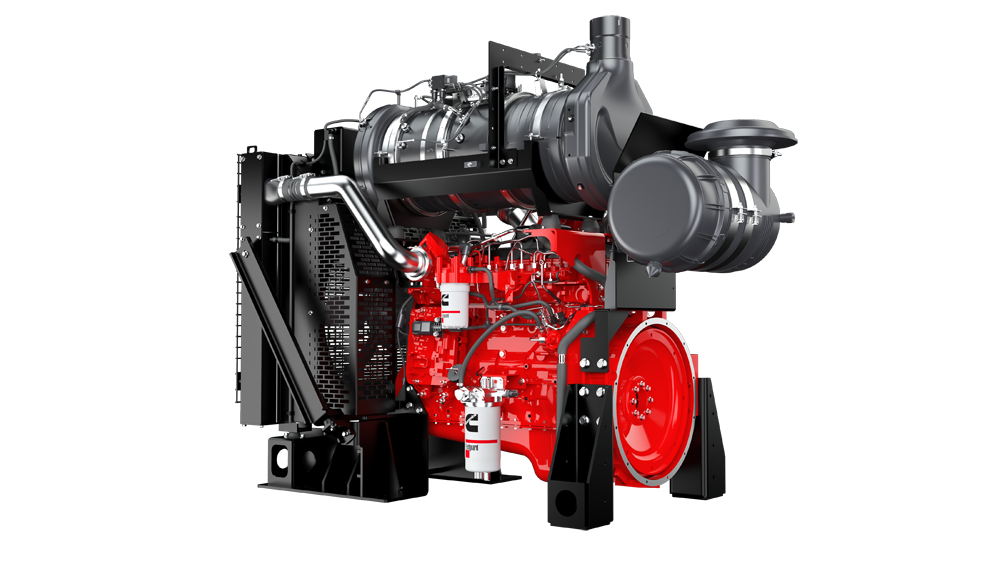

Cummins Filtration has a broad portfolio of products for use in on-highway, heavy, medium, and light-duty trucks, off -highway industrial equipment, and power generation systems.

Linebarger commented: “Cummins Filtration is a technology leader with global presence and significant runway for continued growth. We expect that the strategic alternatives we are considering will result in enhanced value for our stakeholders, and position Cummins Filtration to take advantage of enhanced opportunities to invest in organic and inorganic growth.”

Cummins says the execution of this exploration process is dependent upon business and market conditions, along with a number of other factors and considerations.

In terms of its 2021 outlook, Cummins has maintained its full-year 2021 revenue guidance of up 20 to 24% versus last year. EBITDA is expected to be in the range of 15.5 to 16.0% and the company expects to return 75% of operating cash flow to shareholders in 2021 in the form of dividends and share repurchases.

The company says that any expenses outside of the normal course of business associated with the evaluation of strategic alternatives for the Filtration business have been excluded from the outlook provided.