Net income attributable to Cummins in the fourth quarter was $631 million, or $4.43/diluted share. The tax rate in the fourth quarter was 17.2%, including $52 million, or $0.36/diluted share, of favourable discrete tax items. Excluding the Meritor business and related integration costs, net income for the quarter was $644 million, or $4.52/diluted share, compared to $394 million, or $2.73/diluted share, in 2021. Fourth quarter results also include $0.11/diluted share of costs related to the separation of the Filtration business.

In the fourth quarter, earnings before interest, taxes, depreciation and amortisation (EBITDA) was $1.1 billion, or 14.2% of sales. Excluding the Meritor business and related integration costs, as well as $19 million of costs related to the separation of the Filtration business, EBITDA was 16.1% of sales, compared to 12.1% of sales a year ago.

Fourth quarter results for the company included a full three months of Meritor. Meritor results within the quarter include $1.2 billion in revenue and EBITDA of $60 million. Fourth quarter results also include $27 million of integration-related costs. EBITDA for Meritor operations, excluding the integration costs, was $87 million in the quarter, or 7.5% of sales.

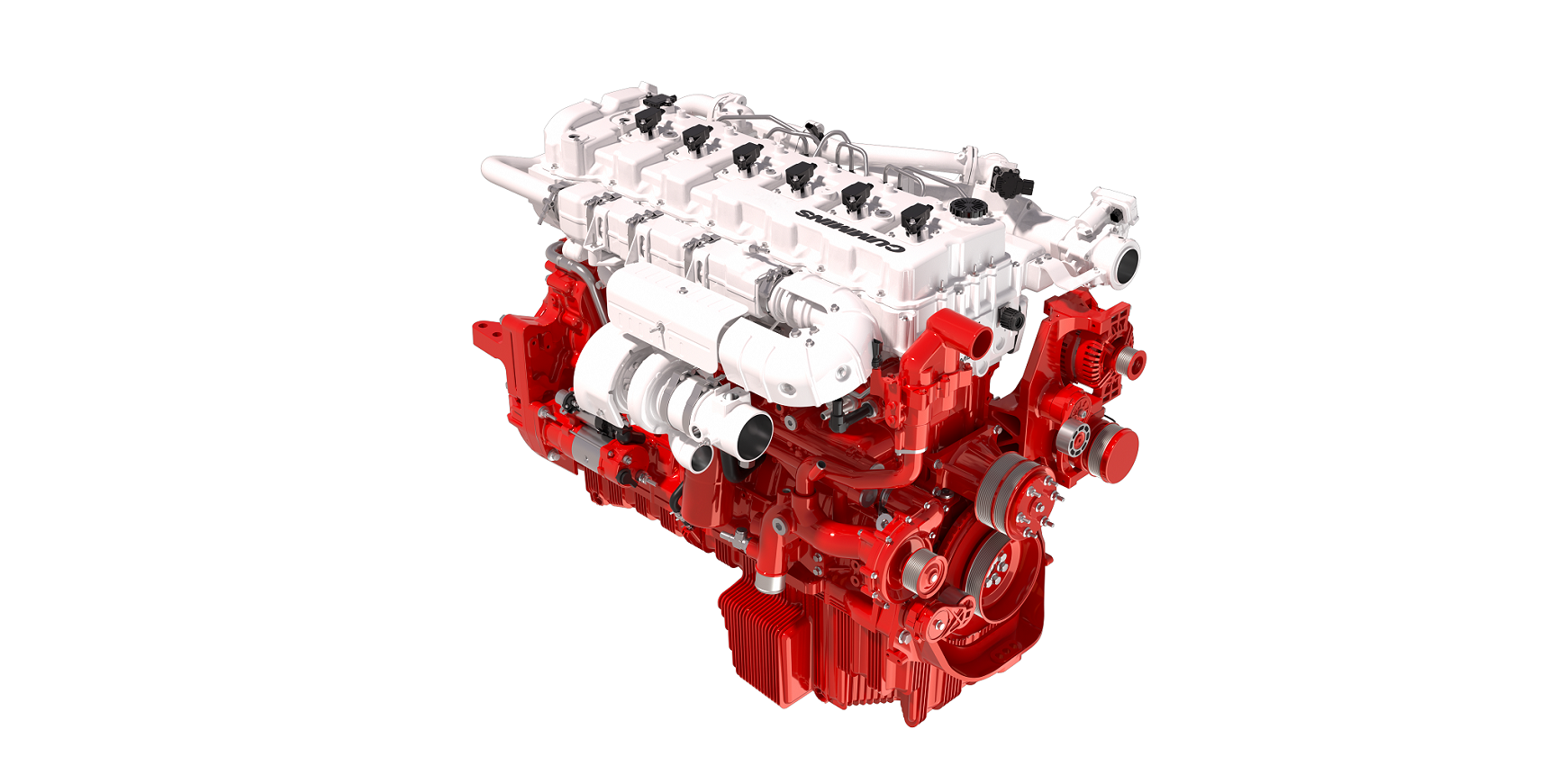

"In 2022, Cummins continued to advance its Destination Zero growth strategy through the acquisitions of Jacobs Vehicles Systems, Meritor and the Siemens Commercial Vehicles business. The innovative talent, technology and capabilities these acquisitions bring will position Cummins for success as the industry decarbonises," said president and CEO Jennifer Rumsey. "We delivered strong profitability in the fourth quarter and achieved record full-year revenues, EBITDA and EPS last year."

Revenues for the full year were $28.1 billion. Excluding Meritor, revenues were $26.2 billion, 9% higher than in 2021. Sales in North America increased by 18%, and international revenues decreased by 2% compared to 2021, as strong demand across all global markets was partially offset by the market slowdown in China and Russia.

Net income attributable to Cummins for the full year was $2.2 billion, or $15.12/diluted share. The tax rate in 2022 was 22.6%, with a net zero impact from discrete tax items. Excluding the Meritor business and related acquisition costs, integration costs, and purchase accounting impacts, net income for 2022 was $15.67/diluted share, compared to $14.61/diluted share in 2021. Full-year results also include $0.72/diluted share of costs related to the indefinite suspension of operations in Russia and $0.45/diluted share for separating the Filtration business.

EBITDA in 2022 was $3.8 billion, or 13.5% of sales. Excluding the Meritor business and related acquisition costs, integration costs, and purchase accounting impacts, as well as $111 million of costs related to the Russia suspension of operations and $81 million of costs for the separation of the Filtration business, EBITDA was $4 billion, or 15.1% of sales, compared to $3.5 billion, or 14.7% of sales, a year ago.

Full-year results for the company included five months of operations following the acquisition of Meritor. Meritor results within 2022 include $1.9 billion in revenue and EBITDA of $26 million. Results of Meritor include an inventory valuation adjustment as required by purchase accounting, which resulted in a negative impact of $32 million. Last year's results also have $83 million of acquisition and integration-related costs, including consulting and banker fees and employee separation and retention payments. The annual EBITDA for Meritor operations, excluding the purchase accounting and acquisition and integration costs, was $141 million, or 7.4% of sales.

Based on its current forecast, Cummins projects full-year 2023 revenues to be up 12-17% and EBITDA in the range of 14.5-15.2% of sales. This outlook includes the projected results of the Meritor business for 2023 but excludes any costs or benefits associated with the planned separation of the Filtration business. Within the Components Segment, Cummins expects revenues of the Meritor business for 2023 to be between $4.5 billion to $4.7 billion and EBITDA to be in the range of 10.3-11% of sales. The electric powertrain portion of the Meritor business has been integrated within the New Power portfolio with projected EBITDA losses of $55 million included in the overall guidance for that segment.

The company plans to continue to generate strong operating cash flow and returns for shareholders and is committed to our long-term strategic goal of returning 50% of operating cash flow back to shareholders. In the near term, the firm will focus on dividends and reducing the debt related to the Meritor acquisition while continuing to deliver profitable growth to our shareholders.

"In 2023, we anticipate that demand will remain strong in most of our key regions and markets, especially in the first half of the year. We will continue monitoring global economic indicators closely and ensure we are prepared should economic momentum slow further," said Rumsey. "We expect revenue growth and margin expansion in our core business and strong growth in our New Power segment in 2023."

Key corporate highlights for the firm in 2022 include the acquisition of Jacobs Vehicle Systems (JVS), a supplier of engine braking, cylinder deactivation, start and stop and thermal management technologies. They also include the acquisition of Meritor, a leading global supplier of drivetrain, mobility, braking, aftermarket and electric powertrain solutions for commercial vehicle and industrial markets. In addition, Cummins acquired the Siemens Commercial Vehicles business, a leading global supplier of high-performance electric drive systems for commercial vehicles. And another innovation for 2022 is the industry's first unified, fuel-agnostic internal combustion powertrain platforms.