The drive manufacturer’s profitability also improved significantly, with an increase in the EBIT margin before exceptional items from 4.6% to 6.1%. In view of this positive business performance, the Company confirms that its full-year results for 2023 are likely to be at the upper end of the forecast ranges published in March.

“Our results for the first six months of this year show that we are now operating much more profitably. This is hugely important to us because it is helping us to forge ahead with our Dual+ strategy and thus achieve our overarching strategic objectives,” says Deutz CEO Sebastian Schulte. “Underpinned by the improving performance of our Classic business in combination with the ongoing expansion of our service business and the shift toward alternative drives that is now under way, we are excellently positioned to continue on our long-term growth trajectory.”

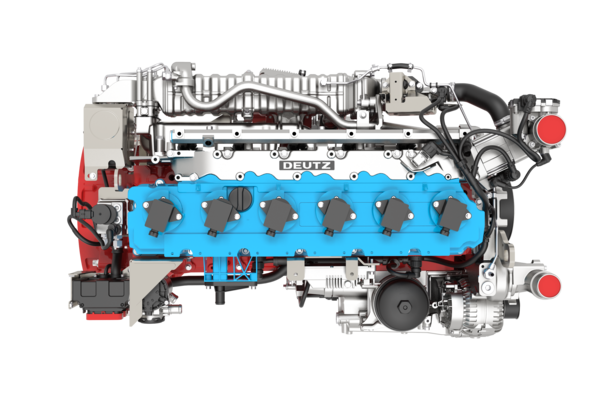

Zero-emission products

The company's Dual+ strategy started 2022 and encompasses both the optimisation of its existing core business in internal combustion engines and the development of new zero-emission products.

In its Green business segment, Deutz signed a letter of intent for a small-scale production run of hydrogen-powered gensets in the second quarter. Then in mid-July, the company says it took a big step toward volume production of hydrogen engines when it chose automotive supplier Mahle to supply hydrogen engine components. Deutz says it intends to start full production of hydrogen engines for stationary applications in 2024.

While Deutz registered sharp rises in revenue and earnings in the first half of 2023, new orders were down by 8.0% compared with the very high level recorded in the prior-year period. The latter was predominantly attributable to the Asia-Pacific region, where signs of saturation in the Chinese market and, in particular, high inventory levels at construction equipment manufacturers in China led to declining demand.

Commenting on the group’s financial position, CFO Timo Krutoff said: “Cash flow from operating activities more than tripled compared with the first half of 2022, and our free cash flow improved by €33m to €8.3m.”

Orders

New orders received by the Deutz Group in the first six months of 2023 amounted to €991.7m, which was down by 8.0% compared with the prior-year period. From a regional perspective, this was due to the sharp fall in orders in the Asia-Pacific region. By contrast, new orders declined in the EMEA region only slightly and the Americas region recorded a significant increase. At application segment level, new orders went up year on year in the service business and the Miscellaneous application segment but went down in the other application segments.

Orders on hand stood at €739.8m as at June 30, 2023 (June 30, 2022: €768.9m), which should provide stability for the business in the months ahead. Within the total figure, the orders on hand attributable to the service business amounted to €47.9m (June 30, 2022: €36.6m).

Unit sales of Deutz engines stood at 91,451 in the first half of 2023, a year-on-year rise of 1.1%. By contrast, the group’s total unit sales decreased by 1.3% to 107,345 units compared with the first six months of 2022 owing to the sharp fall at Deutz subsidiary Torqeedo, which makes electric drives for boats.

At regional level, unit sales edged up in the EMEA and Asia-Pacific regions but declined year on year in the Americas, mainly owing to the aforementioned reduction in unit sales of electric boat drives. From an application segment perspective, the decrease in unit sales was attributable to the Miscellaneous, Agricultural Machinery, and Construction Equipment application segments.

Deutz generated revenue of €1,023.5m in the reporting period, an increase of 10.0% that was driven by all regions and application segments. The much faster rise in revenue than in unit sales was primarily due to market-oriented pricing in the Classic segment and positive product mix effects.

EBIT before exceptional items (adjusted EBIT) improved markedly in the first half of 2023, advancing from €42.6m in the prior-year period to €62.5m. This increase was due to the higher volume of business combined with economies of scale and, in particular, positive price and product mix effects in the engine and service business. However, the group’s adjusted EBIT was once again squeezed by the loss reported by Torqeedo, which has not yet managed to break even.

The improvement in adjusted EBIT meant that the company’s net income came to €44.3m, compared with €28.0m in the prior-year period. As a result, earnings per share rose from €0.23 to €0.36.

Guidance

In April, Deutz refined the guidance that it had published in mid-March. It expects its full-year results for 2023 to be at the upper end of the original forecast ranges. In view of its positive business performance in the second quarter, Deutz has confirmed its refined guidance.

The company therefore continues to anticipate unit sales of around 195,000 engines in 2023, an accompanying rise in revenue to around €2.1bn, and an adjusted EBIT margin of approximately 5.0%. Free cash flow before mergers and acquisitions is still predicted to be in the mid-double-digit millions of euros.