César Luaces Frades is very much ‘the man in the know’ when it comes to the Spanish aggregate industry. The longstanding and highly respected general director of FdA and ANEFA, the latter one of Spain’s oldest and most reputable associations of the extractive industries and construction products, says its current trading, like other national aggregate industries across Europe, has been affected by the continuing energy crisis and disruption to supply chains.

“This complicated situation is accentuated by the Russian invasion of Ukraine and its consequent increase in the costs of electricity, fuels, explosives, steel, and many other materials and components,” he notes. “In our sector, it is very complicated to include these cost increases that we are exposed to on our customers because the public sector legislation, one of our most important clients, prohibits price revisions. The consequence of this aspect, combined with the long duration of many civil works contracts, results in companies that had to deliver estimates way before this complicated scenario unfolded, bringing skyrocketing costs.”

Luaces Frades says that all data seen by the FdA and ANEFA shows that the Spanish government is managing to keep the level of inflation below that of the rest of Europe. “But at the same time, we cannot lose sight of the fact that the year closed with an increase of about 8%,” he stresses. “On the other hand, the country's public debt is growing vertiginously, over 120% of GDP, which, soon, could force a sudden stop on public investment if interest rates get out of control.”

Luaces Frades points out that 2023 will be an election year on three different levels: the national Spanish government, regional governments (comunidades autónomas), and town councils. Traditionally, he says this has traditionally slowed down investment in public works.

Moreover, he cites that the backdrop of rising costs and rising interest rates are also affecting the construction and building sectors, both for housing and industrial developments. Therefore, while the public works component is progressing, the private investment element is slowing down, forming a scenario of “stagnating” demand.

He continues: “This very scenario, in the case of Spain, is particularly complex, as our aggregates industry is still far from having recovered a level of activity analogous to that of most similar European countries: in Spain, the consumption of aggregates per inhabitant per year barely reaches three tonnes, while in Europe this consumption is in the range of five to six tonnes per inhabitant per year, according to UEPG data.

“These circumstances, along with the supervening situation, add greatly to the complexity of the scenario for our companies and our industry, eroding their margins and their competitiveness.”

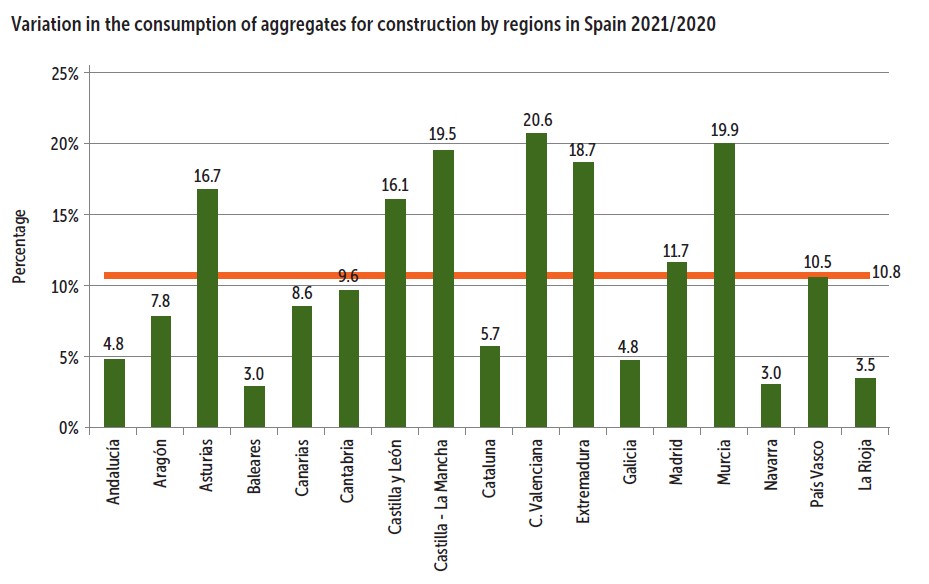

Luaces Frades highlights that in terms of consumption data, the year 2021 closed with a total growth of 10.8% - with the total consumption of natural aggregates for the Spanish construction sector being 136.9mn tonnes. “This data indicates a small recovery slightly surpassing the values registered during the year before the pandemic,” he notes. “Even so, significant territorial variations remain visible. To this figure, we must add some 3.5 million tonnes of recycled aggregates and around 1.7 million tonnes of artificial aggregates. The total consumption of aggregates in the construction sector reached 142.1 million tonnes, 76.7% of the total of the aggregates market.”

Luaces Frades says the statistics that FdA and ANEFA are beginning to gather for 2022 are starting to reveal the signs of stagnation described above, with zero or slightly negative growth.

Going back to 2021, Luaces Frades says that you can see the growth of aggregate consumption in the construction sector that year shows a positive territorial evolution in every region. Navarre, the Balearic Islands (+3.0%) and La Rioja (+3.5%) were the regions with the weakest growth.

On the other hand, Luaces Frades highlights that Valencia (+20.6%), Murcia (+19.9%), Castilla-La Mancha (+19.5%), Extremadura (+18.7%), Asturias (+16.7%) and Castilla y León (+16.1%) have shown the best performance, with a percentage growth of 15% or more.

“Since 2006, a year that registered the historical maximum, the overall average variation in consumption is -71.8%. From the all-time lowest point of consumption in 2014, the increase has been +32.3%,” Luaces explains.

“Currently, Spain - which was the second EU producer in 2006 - ranks eighth in Europe in relation to the production of aggregates, behind Russia, Germany, France, Poland, Turkey, the United Kingdom, and Italy.

“If we use the EU average per inhabitant (5.5 tonnes/year) as a reference, Spain should be consuming around 260 million tonnes of aggregates destined for the construction sector, which is slightly less than double of the value recorded in 2021.”

Since 2006, the year in which the aggregate consumption per inhabitant in Spain was one of the highest in Europe, at around 12 tonnes/inhabitant/year, this figure has fallen considerably, says Luaces Frades.

Despite the increase seen in 2021 to 2.9 tonnes/inhabitant/year, the total sum is, he notes, still well below the European average (5.5 tonnes/inhabitant/year). “In fact, these values are closer to those registered in underdeveloped countries than to those of a developed western economy integrated into the EU,” says Luaces Frades. He adds: “Of the 42 European countries for which UEPG compiles statistics, Spain ranks 38th, ahead only of Italy, Moldova, Ukraine, and the Republic of North Macedonia.”

Luaces Frades says that in 2023, it is expected that, provided that the evolution of the Russia-Ukraine war does not dramatically worsen, the situation in terms of Spanish aggregate demand will remain stable, with two elements that could lead to a slight improvement: the public investment in an election year and the expected arrival of the European coronavirus recovery funds which, to date, have had “almost no effect due to delays in their management.”

Luaces Frades says that during a FdA-ANEFA meeting with Xavier Flores, the Spanish Government secretary-general for Infrastructures, held on 11 January 2023, Flores expressed optimism about the investment and infrastructure program planned for 2023 and 2024. The investment allocated to projects in Catalonia and Madrid, which will briefly begin a series of very important projects that will transform the urban physiognomy of several parts of the city, or the progress of the Mediterranean railway corridor, among others, may mean that some regions will perform better than others.

Luaces Frades continues: “The situation of the aggregate-producing companies in Spain is stable in terms of the players that take part in the process, which, basically, remain the same. But, at the same time, it is also true that there have been several sales of assets related to some multinational groups. This is causing the market shares in them to change considerably.

“However, the relative weight of these groups compared to that of the SMEs remains stable and represents a lower percentage, in relation to the total sum, than in other neighbouring countries such as France, for example. The most noteworthy development in recent years in this field is the one executed by Sodira Rocas Industriales, which acquired the majority of LafargeHolcim's aggregates quarries in Spain.”

Speaking about FdA and ANEFA’s current campaigns and projects on behalf of its member businesses, Luaces Frades says: “In addition to all the political lobbying work we do to highlight the complex situation of our industry and the great number of recommendations and research we carry out and present to administrations, businesses, and political parties, the main project accomplished by FdA/ANEFA recently has been the launch of the revision of the strategic plan for the industry titled Aggregates 2030. The main goal of this important tool is to help the sector to progress and advance along the path of profitability, climate neutrality, and sustainability.

“In 2022, we achieved some important accomplishments related to the way public administrations in Spain perceived our fragile business situation at this moment in time, and have agreed to significantly modify the aggregates prices to compensate our companies for the unbearable increases in production costs.”

Luaces Frades is proud that FdA and ANEFA, along with UEPG, are coordinating the delivery of the two most important European Commission-funded projects for developing a more digitised and sustainable aggregates industry.

“One of them, DIGIECOQUARRY, is a European Union H2020 Project comprised of 25 partners (11 from the EU; 2 from non-EU countries, and 10 more Linked Third Parties),” he explains. “The consortium involved in this project is combining the latest researched and advanced technologies applied to quarrying with the integration of selected innovative digital solutions. DIGIECOQUARRY aims to design, develop, and validate in 5 pilot environments an Innovative Quarrying System (IQS) comprising sensors, processes, tools, and methods for data capture, processing, and sharing to provide integrated digitalised, automatic, and real-time process control for aggregates quarries.”

Luaces Frades notes that DIGIECOQUARRY’s goals are to improve health and safety, and security conditions for workers; enhance selectivity and efficiency of aggregate extractive sites; maximise sustainability and resource efficiency and improve social acceptance. “We expect to have significant results by 2025,” he says.

“Regarding the issue of digitisation, I must highlight that in our industry, this is a very complex topic, as there are parts in the aggregate industrial process that are very difficult to come around in this sense.

“The second EU-funded project that we are coordinating is ROTATE, a Horizon Europe project with 21 partners from 11 EU countries. ROTATE is based on 2 pillars: reducing the environmental footprint in the sector and increasing the circularity of the extractive industry to contribute to climate neutrality by 2050 and it’s also linked to DIGIECOQUARRY's digital solutions. This project, which has just started, will bear fruit in 2026.

“Both projects are designed to have a direct application and impact on the European aggregates industry.”

According to UEPG ( European Aggregates Association) aggregates production estimates, around 146mn tonnes of aggregates were produced in Spain in 2019 (96.8mn tonnes of crushed rock, 44.6mn tonnes of sand and gravel, 3.5mn tonnes of recycled aggregates, and 1mn tonnes of manufactured aggregates). The same source reports that in 2019, Spain was home to 1,056 aggregate producers/companies who operate 1,848 extraction sites between them.

Caterpillar is a big player when it comes to supplying premium equipment to the Spanish aggregates industry. Speaking to Aggregates Business, Nuria Monjas Llorente, quarry and mining segment manager at Finanzauto, Caterpillar’s dealer in Spain, says: “It is clear we are living in a period of transformation that is, of course, affecting the Spanish aggregates and quarry market. Together with Caterpillar, we are working to help our customers increase productivity and efficiency as well as safety by investing in technology and innovation as well as training.

“Increasingly, our Spanish quarry customers look for solutions that go beyond the machine that load or haul material and ask for a complete service solution that helps them meet their goals. We are talking about fuel cost reduction, Rebuild and Reman options, data monitoring, Cat Productivity, and new features such as Operator Coaching available on the large Cat wheeled loaders.”

Llorente says customers choice of machine is influenced by their required applications. “For example, the Cat XE wheeled loaders offer premium performance and efficiency , with up to 35% better fuel efficiency for the Cat 966 XE, 972 XE, 980 XE and 982 XE models.

“We now are offering Cat Command technology for dozers and excavators that enables operators to control machines both at and away from the quarries to manage more from a safe and convenient distance.”

Llorente explains that the Block Handling market is a key part of the Spanish quarrying sector. She notes that Caterpillar has a portfolio of machines specially designed to provide customers with the best tools, not only for the marble and granite quarries but also the slate quarries located in the northwest Spain.

“Although public investment in Spain is around 60% lower than the average of the three largest European economies, there has been strong growth in public bids for construction projects in 2022, which led to an equipment demand increase of around 10%. This is the case for both new and used equipment,” highlights Llorente. “Rental is also performing well, with activity around 45% higher than the previous year. In general, all segments are experiencing growth: building, construction and, above all, civil works, which represent close to 65% of the volume tendered and have experienced very positive behaviour during recent months. Railways increased the most (+185%) and environment and urbanisation (approx. +70 to 80%). However, roads, ports and waterworks decreased a bit.”

Llorente says the Spanish aggregates industry’s focus on the circular economy is growing. “Proof of this is not only the growing demand for artificial aggregates. The use of by-products in construction in Spain has doubled in the last two years.”

Asked what she think will be the major developments in the Spanish aggregates industry over the next 18 months, Llorente replies: “Taking into account on the one hand the upward trend in energy and fuel prices and on the other hand the greater awareness of sustainability that is palpable every day in our society, I do think we have to bet on technology and innovation as our best tools for success.

“From my perspective, technology in the quarrying and aggregates sector is not an option but a definite need. That’s why facilitating digitisation and providing premium performance machines help keep our quarries within sustainable and high production rates. Other challenges faced at present in quarries are the lack of qualified operators and technicians. We are pushing to look for solutions for our customers with our FSA (flexible spending account) service network and our very experienced mechanics. We are investing more resources in training, not only externally with operator application training for customers but also internally within our employees, so they are ready for the challenges of the future. This is crucial to succeeding in quarry operations safely and efficiently.”

Llorente adds that demand for CVAs (customer value agreements) has grown among Spanish aggregate business customers as they help increase machines’ uptime and keep equipment availability high with good cost control from a maintenance point of view.

Volvo Construction Equipment (Volvo CE) is another prominent OEM (original equipment manufacturer) in the Spanish aggregates equipment supply sector.

Commenting on current Spanish aggregate customer machine demand, Jonas Karlsson, Volvo CE commercial manager for Spain, Portugal and Italy, says: “It very much depends on application and production targets, but for us, we see that around 20% of our machine sales go into the quarry and aggregates business, be it hard rock or sand and gravel.

“One big trend that we are seeing is a rise in our connected solutions such as CareTrack and Co-Pilot – and customers using mobile data to improve efficiencies in general. Safety is, of course, at the top of the agenda, and we expect to see our Collision Mitigation System employed as a useful tool to improve the safety of our wheel loaders in the aggregates and quarrying sector.

“We are also seeing increasing interest in the reduction of fuel and CO2, which is growing more and more important as the result of a combination of rising concern for the environment, a desire to reduce costs and, of course, the need to adhere to quarrying permits. In addition, we see increased use of recycled materials, both in asphalt production and in concrete – again in line with a need to work more responsibly.”

Karlsson says Volvo CE wheeled loaders, including the Volvo L150 and above, and crawler excavators are proving popular with aggregate customers. The company is also seeing good demand for smaller wheeled loaders for concrete bashing plants, where they mix aggregates and cement.

Looking ahead at the market’s likely progression over the next 12 months, he says: “It is very hard to predict due to the general macroeconomic outlook and uncertainty caused by the ongoing war in Ukraine. For us at Volvo CE, we have a strong order book from last year that we are delivering for Spain, but we also know that it is a tough time for customers around the world with high inflation and the increasing cost of capital and fuel. We are doing our best to help our customers navigate through these more challenging times.”

Karlsson notes that, generally, the aggregates market is a little slow in Spain for the size of the country but stresses that this is not just for the aggregates sector but for industry as a whole. “Since the huge construction boom of the early 2000s, when we saw high levels of investment in new infrastructure, the priority has mostly been on maintenance work rather than new infrastructure and urban construction projects. That said, we know our customers are working on projects such as the high-speed rail service project through Madrid in northeast Spain, which is likely to create construction equipment demand. And we are continuing to see a demand from both our key accounts customers and local quarries.”