The current challenges facing Germany’s aggregates market are directly linked to the effects of the war in Ukraine.

German aggregates federation MIRO says that the supply chain problems connected to the conflict are clearly noticeable. “Our companies are waiting significantly longer for the necessary spare parts and for new systems and machines, the manufacturers of which are also struggling with the effects,” says Christian Strunk, who was elected as MIRO president in November 2021.

He adds that the global market is still feeling the effects of the COVID-19 pandemic, with computer chips for control systems of all kinds that are manufactured in Asia in short supply (exacerbated by the Ever Given accident that blocked the Suez Canal in March this year).

Strunk says the situation has improved somewhat, but companies in the aggregates industry will still have to deal with these shortages in the coming months.

MIRO vice-general secretary Walter Nelles says that the insecurity about the supply for raw materials and exploding energy prices is also putting the German aggregates industry under enormous pressure.

“We hear from companies that want to reduce their production capacities, although business shutdowns cannot be ruled out," Nelles adds. “Ultimately, the constantly rising production costs mean that building raw materials and building material products continue to become more expensive. The construction sector has significantly lowered its forecasts for the near future, both in terms of private construction and public construction.”

In 2021, aggregates industry demand around the regions of Germany was inconsistent. According to MIRO the overall demand for building gravel and building sand fell by -5.1% to 249 million tonnes. The value of the demanded production amounted to €2,021bn and was therefore +3.3% above the previous year's value.

In the crushed rock sector, the quantity demanded was 219 million tonnes, -1.7% below the 2020 level. The value of crushed rock production amounted to €1,765bn, which was €45m or +2.6% above the previous year's figure. MIRO states that estimates assume demand will decrease somewhat this year and next due to the economic situation described. In building construction, the use of gravel/sand from aggregate for concrete dominates, while in terms of infrastructure, crushed rock is the preferred option for road construction.

The industry is also struggling with the ‘energy transition’. Due to the designation of areas for renewable energies (wind power and photovoltaics), raw-material extraction areas are over-planned and are therefore no longer available for raw material supply.

In addition, MIRO says that, due to European and national regulations, permission procedures are becoming more complex, with companies needing an average of more than ten years to obtain a new permission.

“All in all, the overall situation is more than unsatisfactory, which in particular also calls into question the country's security of supply with the important raw materials, crushed rock, gravel and sand – although the demand continues to be high,” Nelles comments. “The government has already issued several ‘relief packages’ of a tax nature in order to defuse the unprecedented situation.”

In terms of the equipment German quarry operators are currently looking for, Nelles says that the aggregates industry relies on proven machine and plant technology in order to be able to make qualified building raw materials available to the market as efficiently as possible.

“Even if predominantly stationary plants are operated, however, a trend towards mobile plant technology can be seen, which can increase the flexibility of the company,” he adds. “There is no question that, in addition to energy efficiency and the environmentally friendly operation of machines and systems, components for process optimisation also play an important role.”

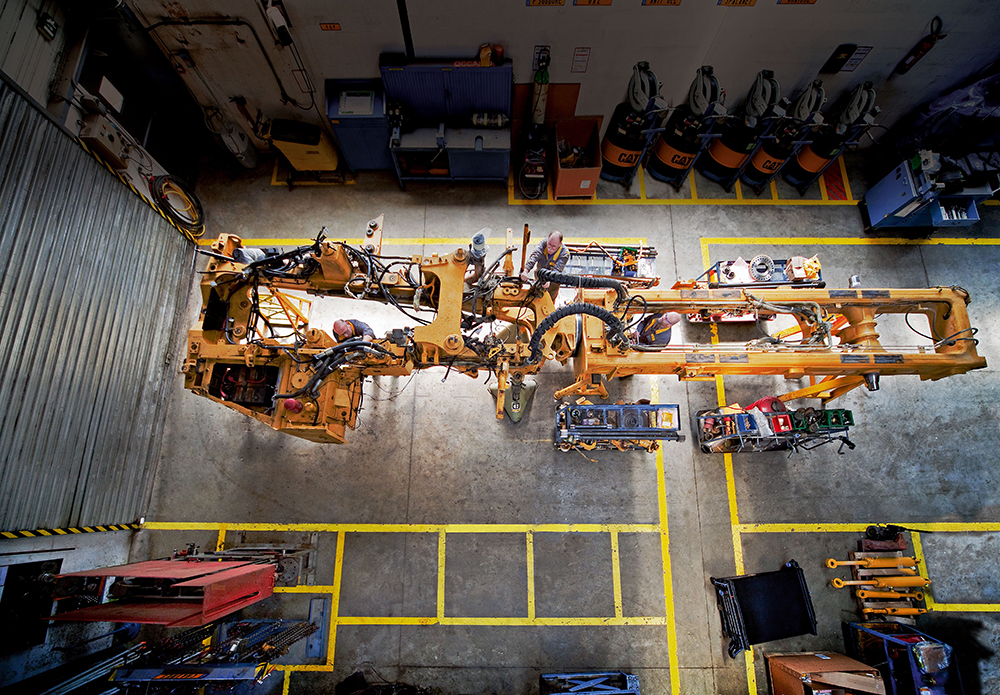

Machines with the lowest total cost of ownership are understandably very popular among German operators, according to Simon Husemann, senior product manager, large machines at Zeppelin Baumaschinen, dealer for Caterpillar equipment in Germany.

He says that popular machines include the Cat 988K XE large wheeled loader with electric drive, in addition to the other XE performance models such as the medium wheeled loaders with continuous variable transmission: the Cat 966 XE, 972 XE, and the recently introduced 980 XE and 982 XE.

“They significantly improve fuel efficiencies compared to powershift models and increase productivity,” says Husemann. “The XE medium wheeled loaders can be found in yard loading and sand and gravel operations where our studies show they offer the lowest total cost of ownership.”

Michael Schwarz, sales manager Europe, at crushing and screening plant manufacturer Kleemann, says that from his company’s viewpoint, the trend is shifting towards multi-stage crushing and screening processes.

“The individual plants have to be intelligently linked with each other,” he adds. “Production or even quality fluctuations can be significantly reduced with innovative linked systems, and the result can be seen in lower costs per tonne.

“Mobile linked solutions often supplement or even replace stationary systems. With our high-performance plants, Kleemann can provide a high degree of flexibility. The linked plant ‘moves’ along the demolition wall, and stockpile conveyors integrated into the process ensure efficient stockpiling and optimised site logistics with as little machine traffic as possible.”

Erich Kribs, product manager GPE at off-road equipment manufacturer Volvo CE – region EU/INT, says that productivity services are the main opportunity for the company’s business at the moment, as it sees customers needing to take great steps forward in reaching their carbon-reduction goals while still increasing productivity, profitability and safety.

“Our CO2 Reduction Program is a key focus for us in this area – and the advantage being that every save we make is also a save for the customer,” he adds.

Looking at large construction initiatives in Germany that are influencing the demand for aggregates, the federal government that was newly elected in September 2021 has set the goal of building 400,000 apartments per year.

MIRO states that the significant expansion of energy production from renewable resources such as wind power, in addition to pending road and rail projects, cannot be carried out without the use of mineral raw materials, not to mention the numerous pending maintenance measures for a third of all bridge structures in Germany. The demand for primary mineral raw materials is therefore unchecked and is also preordained for the next few years, according to MIRO.

Husemann says the federal government's expenditure for road and rail construction remains at a good level and requires more aggregates output.

“We need to keep tabs on the capital expenditure for the maintenance and renewal of bridge structures as these require very few minerals (21,000 tonnes per bridge) compared to regular road construction (216,000 tonnes per km of motorway),” he adds.

Kribs of Volvo CE says that the main trends in construction influencing demand are ongoing infrastructure projects for building and maintaining highways and bridges, in addition to the electrification of railway networks.

Schwarz of Kleemann, adds that the expansion and maintenance of the rail network requires large quantities of high-quality track ballast.

In Germany, around 200 million tons of mineral construction waste are generated every year, more than 90% of which is recycled. Around 70 million tonnes of recycled aggregates are produced and used from this.

MIRO’s Strunk says that, ultimately however, this can only cover 12-13% of the demand for aggregates – and this percentage has not changed significantly in recent years. “Since recycling is also being legally enforced by the federal government, the recycling industry faces major challenges,” he adds. “Companies in the primary aggregates industry have recognised this and are increasingly involved in the recycling sector. They have the appropriate know-how in this regard.”

Strunk says that differentiated use of recycled aggregates in Germany, particularly concerning the aggregate for recycled concrete, is only possible through further additional processing. “Although this seems desirable, the quantities used for this are then no longer available for unbound construction, for example in road construction,” he says. “Unfortunately, the processing waste from this process step cannot be used for other purposes and would therefore have to be disposed of.”

The European Green Deal, climate change and the current Ukraine crisis have thrown the spotlight on electricity generation from renewable energies in Germany and the need to expand this as quickly as possible. The use of floating solar panels (floatovoltaics) on extraction-site lakes is one such source of renewable energy.

Strunk says the installation of floating solar systems on quarry ponds involves significantly fewer conflicts of use than is the case with naturally existing lake areas.

“Unfortunately, the federal government does not want to see this potential,” he adds. “On the contrary: there are strict restrictions on the size of floating photovoltaic systems on quarry ponds. In addition, although the extraction of raw materials in the so-called outdoor area enjoys higher priority, this does not apply to the installation and operation of photovoltaic systems!”

Strunk says that companies that want to operate floating photovoltaic systems on their quarry ponds for their own power supply and for feeding into the public grid are thus put under a legal ban. Quarry companies who want to set up stationary photovoltaic systems on their areas and on their systems experience the same situation.

He adds that MIRO is demanding that the federal government eliminates the legally enshrined ‘reasons for impediments’ and gives companies the opportunity - in particular through simplified and swift permission procedures - to be able to actively participate in the ‘energy transition’.

The exact number of floating photovoltaic (PV) systems on German quarry ponds is not known, but Strunk says that it is very low due to the legal restrictions mentioned. He adds, though, that the potential is immense, especially since around 60% of the gravel/sand extraction operations are operated as ‘wet extraction’.

“The largest PV system on a quarry pond in Germany has the area of two football pitches and generates almost 3,000 megawatts of electricity per year,” he says. “We know that in France, for example, the situation is very different and very large photovoltaic systems are operated on quarry ponds.”

In terms of current opportunities in the quarrying sector for equipment manufacturers, Husemann of Zeppelin Baumaschinen says the ongoing trend of decarbonisation is a prime consideration in many machine purchases.

“With our Cat portfolio, we are in a good position to provide fuel-efficient machines that help our customers save fuel, CO2 and as a result, costs,” he adds. “Many quarry customers update their fleets to the latest and most efficient generation of machines.”

Schwarz says the best cost-per-ton ratio continues to be the decisive factor for Kleemann’s quarrying customers.

“What is needed are machines and solutions that are powerful, versatile, efficient and flexible,” he adds. “Sustainability and environmental awareness are also playing an increasingly important role – and not only due to increased fuel costs.”

Looking at key trends and developments in the German quarrying sector over the next 18 months, Kleemann’s Schwarz says that electrification will play an increasingly important role.

“The focus will be on environmentally friendly processes and lower CO2 emissions,” he adds. “With our diesel-electric-drive concept with the option of an external power supply, as with our new MOBIREX MR 130 PRO impact crusher’s all-electric drive concept, the customer is ideally positioned.”

Kribs of Volvo CE says: “The most important factors to look out for will be to take care of cost increases which are happening in all areas, as well as the challenge in finding operators for our equipment.”

Husemann of Zeppelin Baumaschinen says aggregates-industry supply issues will not be fixed until the first half of next year as there is still a shortage of microchips and other components.

“We hope to see a positive spin in the second half of 2023,” he says. “The private - home construction sector is likely to change. At present, one home requires, on average , 105 tonnes of aggregates.

“The industry will recover a normal pace. It is currently at a healthy level with a good demand for both aggregates and equipment.”

Nelles of MIRO says that, in the current situation, it will be important for aggregates industry companies to be able to maintain their economic activity despite the immense ‘restrictions’.

He adds that, to this end, the federal government must focus more attention than before on ‘domestic’ raw materials in order to guarantee Germany's security of supply with these important raw materials.

“This is in no way intended to negate the topic of ‘globalisation’, but it does reduce the dependencies that we are currently feeling very clearly,” Nelles says. “The transport of raw materials is costly and CO2-intensive. Short distances are clearly essential. This advantage must also be used in relation to climate change: all regions of Germany have raw-material deposits. The nearly 3,000 quarries and gravel/sand pits in operation are spread across Germany.”

The return for the first time since March 2019 of the bauma quarrying, construction and mining equipment event in Munich (October 24-30) is welcome news, Nelles says.

He adds that, as the world's largest construction machinery trade fair, bauma will again set trends and focus on optimised and energy-saving machines and system components.

“This is important and necessary, as German companies also have to invest in new equipment again in order to be able to meet the requirements mentioned,” he adds.

“At the same time, bauma should also be used as a signal that, despite the drastic measures taken as a result of the Ukraine war, the construction industry is networked worldwide and continues to rely on globalisation, which cannot be influenced by individual world powers swerving out. It is to be hoped that the signal of ‘togetherness’ will also go out from bauma.”