Aggregates production in Indonesia has increased heavily in 2021 after the slowdown due to the COVID-19 crisis. Demand for building materials is likely to be driven by President Joko Widodo’s programme to improve basic infrastructure such as roads, airports and seaports.

The country’s 2021 state budget allocated Rp414 trillion (US$28.5bn) for infrastructure development, a 47% increase from the 2020 budget.

A number of current major projects are fuelling demand for aggregates and quarrying equipment in the country, according to Gerrit Lambert, head of market Indonesia at Volvo Construction Equipment.

These include the Jakarta-Bandung and Jakarta-Surabaya high-speed rail (estimated cost around US$5.5bn); the Trans-Java toll road (estimated cost: IR51.6 trillion (around US$5.5bn) for 619 km; the Trans-Sumatra toll road (estimated cost: IR351 trillion (around US$36bn)); the Jakarta MRT (mass rapid transit) (estimated cost: varies from IR15.5 trillion (around US$1.7bn) to IR23 trillion or around US$2.3bn); the Jakarta LRT and Greater Jakarta LRT (Estimated cost: IR23.8 trillion or US$1.8bn).

Another major international project supporting materials demand is the Pan-Borneo Highway which began construction in 2017 and connects the Malaysian states of Sabah and Sarawak with Brunei and Indonesia’s Kalimantan. More than 3,000 km of the highway is in the Indonesian section and around 170 km in the Brunei section. The Pan-Borneo Highway is part of the Asian Highway Network, also known as the Great Asian Highway, a cooperative project between some countries in Asia and Europe with the United Nations Economic and Social Commission for Asia and Pacific (ESCAP) to improve highway systems in Asia.

Indonesia’s recent resurgence of COVID-19 infections is a threatening development for the aggregates and construction materials sectors. Financial analyst S&P Global has lowered its GDP growth forecast in fiscal 2021 downwards to 3.4% from 4.4% for 2021 on the back of the escalating wave of cases. “Mobility-related, confidence-sensitive, and working-capital intensive sectors (e.g., retail, consumer, real estate, cyclical transportation, tourism, lodging and entertainment, construction, and light manufacturing) are likely to be hardest hit by extended lockdowns,” S&P Global states.

One early casualty of the initial wave of COVID-19 last year was the government’s plan to begin infrastructure work related to the US$33bn capital city relocation project in 2021. In September 2020 the National Development Planning Agency (Bappenas) announced that the project had been formally put on hold due to the economic impact of the pandemic. Although construction has been suspended, the government will continue to move ahead with its planning, with infrastructure work now expected to commence in 2022 or 2023.

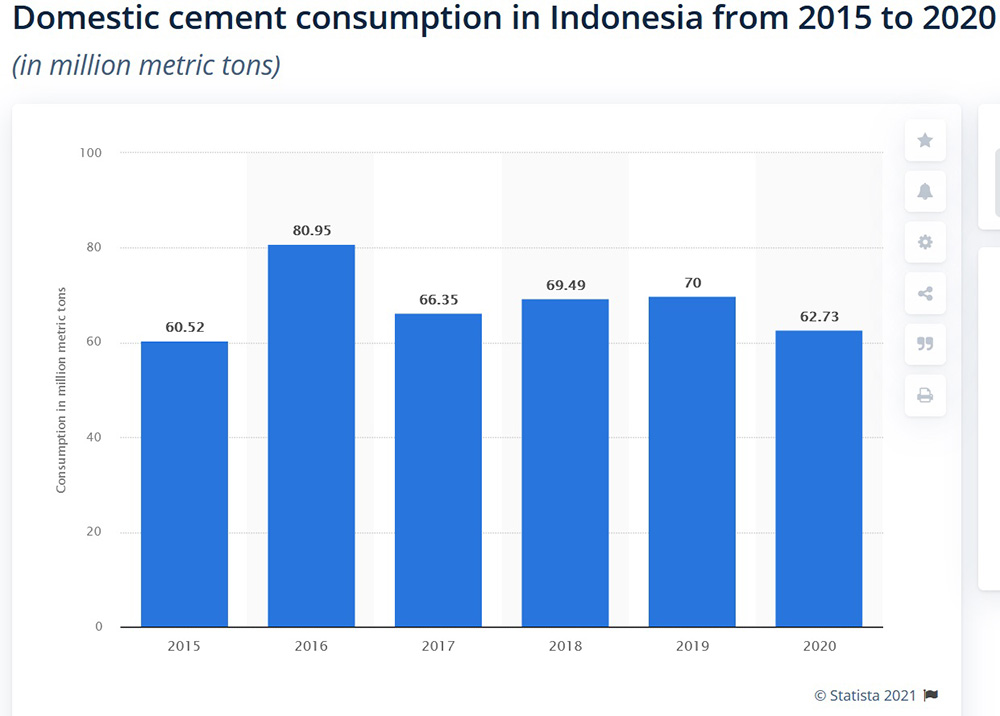

According to the latest annual presentation material from Semen Indonesia Group (SIG), which is the biggest cement producer in the country, national cement demand dropped -10.4% in 2020, with the largest decrease coming from bulk demand, which dropped -22.1%). Bulk demand represents demand from industry or major infrastructure projects for concrete and road construction.

Lambert says that in terms of aggregates production “all sectors are now coming back to a better situation, sometimes even higher than before the crisis. This is to make up for time lost during the pandemic. Most of our customers are now back to a high production level and need our full attention to support them with machines, services, uptimes and parts.”

In terms of the effects of COVID-19, he says: “Some governmental projects have been delayed due to budget reallocation but others are still ongoing. Overall, Indonesia will continue to grow and the quarrying and aggregates market will be part of this evolution.

“The budget for infrastructure development in 2021 has increased to IDR 414 trillion from IDR 281 trillion in 2020. This will certainly mean an increase in aggregates supply.”

In the January-May 2021 period, Indonesia’s bulk cement consumption by infrastructure activities decreased by 58% year-on-year to 5 million tonnes, according to figures from the Indonesian Cement Association (ASI). The association says this was due to domestic manufacturing companies still preparing for construction.

Cement news website Cemnet quotes ASI figures showing that sector growth was particularly strong in the Sulawesi market, where demand was up 64% year-on-year in May to 457,000 tonnes, representing a gradual recovery from a 11.8% fall in 2020. The Maluku and Papua regions reported a 29.1% advance to 142,500 tonnes in May. Cement consumption in Java was up by 282,000 tonnes to 1.85 million tonnes in May, while from January-May 2021 the increase was 4.89% to 12.45 million tonnes.

Cement consumption in Java Island added 282,000 tonnes year-on-year to 1.85 million tonnes in May 2021, according to news website Mosolaki.com. For the January-May 2021 period, it grew 4.88% to 12.45 million tonnes. Cement consumption in Kalimantan grew 2.3% to 1.49 million tonnes in the January-May period, and accelerated with a 16.1% increased to 245,000 tonnes in May 2021. Cement consumption in Bali and Nusa Tenggara decreased by 5.6% to 203,000 tonnes in May 2021, and it declined 6.8% year-on-year to 1.18 million tonnes in the January-May 2021 period.

Indonesia’s cement export growth weakened in May 2021. Exports totalled 1 million tonnes, lower than 1.2 million tonnes in March and April 2021. But for the January-May 2021 period, it increased by 119% year-on-year to 5.69 million tonnes. This year, the ASI predicts national cement export to grow 29% to 10 million tonnes.

Indocement - Indonesia’s second largest cement producer after Semen Indonesia - says the nation’s cement production capacity increased by 1% in 2020 from 114 million tonnes (2019) to 115 million tonnes per annum.

The company adds that the cement market outlook is positive for 2021: “Growth is estimated at +4% to +5% from last year as we foresee higher bulk sales volume, especially in the second half of the year.”

It adds that the creation of Indonesia’s Sovereign Wealth Fund in 2020 should attract more investment for infrastructure projects. The government fund has been created to manage national investment and contribute to Indonesia’s economic development.

To meet the anticipated demand from infrastructure projects, Indocement opened a new aggregates quarry in October 2020 at Pamoyanan in West Java, close to the capital Jakarta. Its production target is 100,000 tonnes/month of aggregates product for the first year, and an annual production capacity of 2.5 million tonnes/year.

The company says the quarry is ready to supply strategic projects in the metropolitan Jakarta (Jabodetabek) area such as the high-speed railway, Jakarta-Cikampek II South Toll Road, the Harbour Toll Road, and the light rapid transit (LRT).

Unlike the cement sector, Indonesia’s quarrying industry has yet to form a national association and - also in contrast with cement - most quarrying companies are relatively small family concerns.

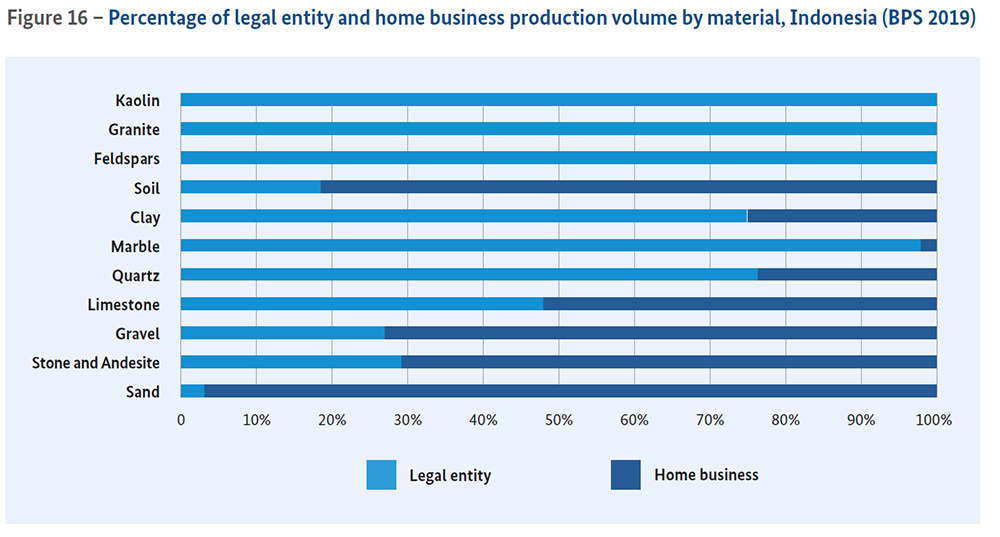

A study on construction raw materials in Indonesia, published by Germany-based BGR in May 2021, states that East Java is the province with the largest number of quarrying establishments with 13,465 in total, of which 13,387 are home businesses and 78 are legal entities. This count includes sand, stone and andesite, gravel, limestone, quartz, marble, clay, soil, feldspars, granite, kaolin, and a number of less important materials.

The study adds that the importance of East Java for the quarrying sector is even more pronounced when looking at worker numbers in the home-business sector, which is the highest of any Indonesian province.

“Although home businesses tend to employ fewer workers per entity – an average of 3 workers per home business compared with 35 for legal entities – they nevertheless remain the more important employer, comprising 93% of the province’s total quarrying workforce,” the BGR report states.

In terms of what buyers of Volvo CE’s quarrying and aggregates equipment are currently looking for, Lambert says this depends on the customer.

“There are two kinds of customers in quarrying and aggregates, he adds. “One is big companies such as Pioner Betron (Heidelberg Group) and Holcim (Semen Indonesia Group). These companies expect high quality and product support. We offer many services such as CareTrack telematics, Volvo ActiveCare (proactive monitoring and predictive maintenance), Volvo Co-Pilot and Volvo Certified Rebuilt to help these customers use their machines at their best and achieve optimum uptime and profitability.

“There is certainly an interest from these customers in electromobility solutions, such as the Volvo Electric Site concept but the market is not there yet. We expect them to be keeping a close eye on the solutions we develop in this area over the coming years.

“The other customer type is small, local quarry operators. Their usual priority is low-cost equipment that they can count on to get the job done. This is where our value brand SDLG comes in. We are able to offer these customers SDLG machines that are reliable, powerful and efficient.”

SDLG launched the LG953 wheeled loader for the Indonesian market at the end of 2020. With its ability to handle tough working conditions and its durable build, the medium-to-long wheelbase wheeled loader is designed for use in the country’s construction sites, factories, ports, quarries, and mines.

Lambert adds that Volvo’s 20-tonne excavators with breakers are ideal for quarries and these are among its highest-selling machines in Asia.

“Meanwhile, our EC480D crawler excavator is perfect for mining applications. We also recommend our 5-tonne SDLG wheel loaders for batching plants. All these machines are gaining traction on the market.”

A Volvo CE customer who operates a sand quarry in central Java has been operating a Volvo EC210D excavator at his site in Borobudur, Magelang since 2017 to load sand from the river into a crushing unit. The customer – called Happy New Year – says he is pleased with the reliability and fuel efficiency of the machine.

The EC210D is used continuously for 8-10 hour shifts every day. “I chose the Volvo EC210D over excavators from other brands because of the good performance, reliability and quality of the unit over a long-life cycle,” said Happy New Year.

The EC210D is built with durable components for strong performance in all applications, securing lasting machine value and an excellent return on investment. Happy New Year intends to continue using the EC210D for a further five to eight years, during which time he expects it to generate considerable cost savings. “The Volvo EC210D is very efficient in fuel consumption,” he adds. Beyond the machines, Lambert and Volvo CE believe that connectivity, uptime and productivity services will continue to transform the industry by improving performance. “By providing premium machines and services with proven performance and a low total cost of ownership, Volvo CE is ready to accompany Indonesia to the next step,” he adds.

Market analyst GlobalData says Indonesia’s construction industry is expected to recover in 2021, with growth of 7.2%, assuming work at construction sites returns to normal levels.

Following the rebound in 2021, GlobalData expects the Indonesian construction industry to stabilise, and grow at an annual average rate of 5.4% between 2022 and 2025, supported by investments on the development of infrastructure.

Under the National Medium-Term Development Plan (2020-2024 RPJMN), the government plans to invest IDR6 quadrillion (US$412bn) on the development of transport, industrial, energy and housing infrastructure projects by 2024. The ambitious infrastructure plan includes investments in 25 new airports and an abundance of renewable and waste-to-energy plants, as well as mass transit projects.

Business analyst Mordor Intelligence says growth in the construction and building materials sectors is expected to be supported by the government’s focus on infrastructure development to revive the country’s economy.

The Indonesian construction industry is expected to stabilise and record growth between 2021-2024, supported by infrastructure investments under the National Medium-Term Development Plan.

Although construction activity in recent years has been concentrated in Jakarta and the surrounding provinces of Banten and West Java, the Joko Widodo administration is aiming to decentralise business activity away from Java.

Millennials will drive demand for construction and associated building materials, according to Mordor Intelligence. It cites Indonesia’s Central Bureau of Statistics (BPS) figures showing about 50% of the total population in 2019 was at the working age of between 20 and 54 years old, of which 84 million were millennials with significant purchasing power.

“Residential housing is an important market segment in Indonesia and millennials are a vital demand source,” the analyst states. “Developers are targeting this demographic segment and adjusting their sales processes, especially in the wake of COVID-19.”

More than 4,800 landed houses were launched for sale alone in Greater Jakarta or JaBoDeTaBek (Jakarta, Bogor, Depok, Tangerang, and Bekasi) in the second quarter of 2020, which was around 26.3% more than new launches in 4Q 2019.

Indonesia is one of three countries – along with Malaysia and Singapore – where Volvo CE has rolled out the Fuel Challenge programme that rewards customers for the fuel-efficient operation of excavators.

The incentive programme remunerates Volvo EC200D and EC210D excavator customers in the three nations with aftermarket credit for consuming less than the stipulated fuel consumption target for their respective country.

Volvo CE says the scheme benefits customers as they reduce fuel cost, lessen environmental impact and save money on parts and services.

It adds that fuel is typically the single highest contributor to operating cost, often accounting for 30-40% of a machine’s total cost of operation.

The manufacturer states that lowering fuel consumption across various segments by optimising performance and supporting increased operator efficiency also contributes to its sustainability commitments for the environment.

When buying a new machine, a customer can choose to enrol it on the programme. The objective is to encourage the use of machines in the right work modes and for operators to consciously avoid using high work modes. This is facilitated by Volvo CE by activating a passcode for the higher modes.

“The Fuel Challenge programme is a win-win for all stakeholders, while ensuring that we lower carbon footprint for a better tomorrow,” says Joseph Low, product manager at Volvo CE Region Asia.

The Volvo Fuel Challenge programme is open to customers of the Volvo EC200D and EC210D crawler excavators in Indonesia, Singapore and Malaysia.