In July 2024, Cummins officially opened its new, fuel-agnostic powertrain test facility at its state-of-the-art Darlington, northeast England site. An expansion of its European Technical Operations (ETO) function, the new facility puts Cummins at the forefront of ultra-low and zero-emissions power technologies as the off- and on-highway industry focuses on reducing greenhouse gas contributions and improving air quality. Guy Woodford was among the trade and local media attending the big opening, followed by a Darlington engine plant tour and an insightful Q&A with senior Cummins executives.

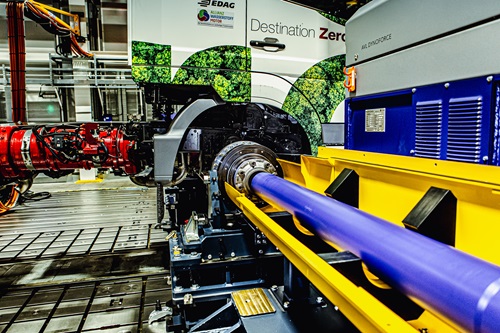

It was a great pleasure to meet V.E.R.A. After all, it’s not every day you get the chance to get up close to a virtual engineer robotic assistant. V.E.R.A is a central and eye-catching feature of Cummins’ new 738m² powertrain test facility at the US on- and off-highway power solutions giant’s 1,800-plus employee Darlington campus. More than £13 million ($16.65mn) has been invested in the two-storey site that will significantly increase Cummins’ testing capacity, focusing on a wider range of vehicles and machinery powered by hydrogen, renewable natural gas, advanced diesel, or battery electric. It is also the latest standout element of Cummins’ Destination Zero strategy, supporting the company and its customers’ energy transition goals.

During a presentation before our powertrain test facility tour, Tom Partridge, Cummins director of laboratory operations within ETO, explains that Cummins engineers are expanding their capabilities using highly advanced dynamometers to test chassis-installed powertrains. Previously focused predominantly on engine testing, they can now develop full drivelines for on-road use, from compact SUV (sport utility vehicle) size to 44-tonne trucks and double-decker buses, plus off-road use in construction and agricultural machines. These can be two- or four-wheel drive.

The new powertrain test facility and wider Cummins engineering focus also support compliance with regulatory standards, including those linked to CO₂ heavy-duty vehicle emissions and the upcoming Euro 7, which lays down emission limits for road vehicles and battery durability. Indeed, Partridge notes that 80%-90% of powertrain test facility work in its first two years will involve on-highway trucks due to the need for them to meet Euro 7 rules, which come into force on 1 July 2025. A second powertrain testing chamber within the facility will be used as on- and off-highway customer demand increases in the coming years.

“This is the only facility of its kind that Cummins has globally. We expect to pull in work from all over the world. For example, I expect we’ll have 15-25 on-highway trucks in a year, each being here for an average of two to three weeks,” says Partridge. “I think it’s also the only facility of its type in Europe, and OEMs will likely come and use it for some of their internal powertrain testing, including some testing of non-Cummins powertrains, which will be fine. In those instances, we have set up the facility so any data relating to those tests will travel via a secure network only the customer can access.”

Talking about the rationale for the new Darlington powertrain test facility, he continues: “In 2018, I was asked to look at what it would take to get us where we needed to be beyond Euro 6 [on-highway engine emission regulations] to meet Euro 7, and then assess what was coming at us. Were our existing [Darlington] facilities good enough, or did we need to do something different? I spent a lot of time researching this, and what became clear was the need to move to vehicle-level rather than just engine-level understanding and development.

“A big part of Euro 7 concerns vehicle-level CO₂ emissions and VECTOs (Vehicle Energy Consumption calculation TOols). When you look at what Cummins can do, we can do engines, transmissions, and axels. We are not yet doing tyres, and we are not doing aero[dynamics]. Those two parts are down to [vehicle] OEMs [original equipment manufacturers]. My research and others supporting me found that we needed vehicle-level fuel consumption [testing capability] to have real high confidence in our actions. We also needed fuel-agnostic [engine testing capability], an understanding of a much wider range of duty cycles, and, with Euro 7, a deep understanding of how to analyse a lot lower pollutants. A whole part of my team is now dedicated to MUAs [measurement uncertainty analysis] to see how accurate we are in measuring low [pollutant] values, be it fuel economy or emissions. It’s a massive part of what we didn’t have to do before.”

Partridge stresses that the new Darlington powertrain test facility had undergone a full CFD [computational fluid dynamics) assessment. CFD uses computers to predict liquid and gas flows based on the governing equations of conservation of mass, momentum, and energy.

“One of the most important things in making a fuel-agnostic powertrain test facility is the need to be safe in hydrogen mode. Over 20 computers took five to six weeks to do the full CFD. It included analysing what would happen if we had a credible hydrogen leak on a vehicle and an ignition source. The CFD told us we needed to protect the people in the control room and our assets at the back of the facility. As a result, the facility’s concrete walls have the highest level of blast protection, including tethered blast-relief panels. In the worst-case hydrogen leak scenario, the walls would move but not crack and carry on supporting everything. This was a big part of the blood, sweat and tears Emma [Laidler, Cummins ETO powertrain operations manager] as project leader and I experienced during the build. It drove up costs, as did the COVID-19 pandemic, which increased the cost of building materials and made concrete harder to source. To get the facility built in two years is pretty good given its size and complexity.”

Partridge highlights that besides supporting the development of cleaner power solutions, the Darlington powertrain test facility also provides local environmental benefits as part of its daily operation. The advanced dynamometers feature energy recovery systems to generate £10,000-a-month worth of free electricity that can be used across the Cummins site and reduce the impact on the local grid. Additionally, water consumption is reduced by harvesting rainwater, using a similar system already in place in the engine plant.

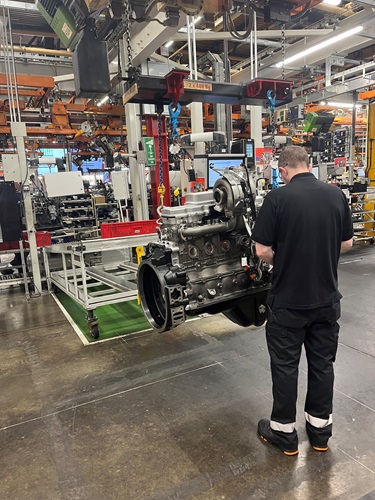

Cummins’ Darlington campus also has a pilot centre for customer equipment repower. The pilot centre and powertrain test facility operate as the company’s European Technical Operations division. The Darlington engine plant assembles Cummins’ 3.8-litre-9-litre diesel and natural gas-powered engines, of which 72,325 were assembled and shipped in 2023 alone. For context, Cummins’ global off-highway business sold 200,000 engines last year. Another notable plant feature is its specialist marine [engine] up-fit centre.

Darlington is also home to Cummins’ Emissions Solutions division, where automotive and industrial aftertreatment production, development and testing occur. A total of 41,785 aftertreament solutions were shipped from Darlington last year. Furthermore, the Darlington campus houses Cummins Business Services, which includes shared services of human resources (HR), finance, IT and other resources.

Partridge highlights that further earmarked investment in the Darlington site includes a new $30 million Long Block [engine assembly] line, upgrades to the Short Block [engine assembly] line, and the transfer of the company’s Euro 6 Module line to Darlington.

In an earlier presentation, Marina Savelli, the head of Cummins’ global off-highway business, outlined Cummins’ global footprint. The company, whose product portfolio includes 2-litre to 15-litre on- and off-highway diesel or alternative power engines, has 75,000 employees and trades in 190 countries and territories. The 105-year-old business has 19,000 certified dealer locations, with its off-highway OEM customers including Komatsu, Hyundai, LiuGong, Hitachi Construction Machinery, Volvo, Liebherr, and Doosan.

Cummins’ 2023 revenue stood at $34.1 billion (£26.6bn) – with 80% relating to on-highway and 20% to off-highway business. Cummins’ EBITDA (earnings before interest, taxes, depreciation, and amortisation) in 2023 was 15.4%. Last year, Cummins invested $1.4 billion (£1.09bn) in research and development. The company also launched Accelera by Cummins, a significant step forward in its efforts to achieve its Destination Zero strategy. It focuses on evolving Cummins technologies to reach zero emissions across its product portfolio. The Accelera by Cummins' launch followed the previous year’s acquisition of Meritor, a major global supplier of drivetrain, mobility, braking, aftermarket and electric powertrain solutions for commercial and industrial vehicle markets.

Under its Planet 2050 environmental sustainability strategy, Cummins aims to reduce Scope 3 absolute lifetime GHG (greenhouse gas) emissions from its newly sold products by 25%. It is also targeting a 55-million-tonne cut in Scope 3 GHG emissions from its products in the field, a 50% reduction in absolute GHG emissions from Cummins’ facilities and operations, and a 50% drop in volatile organic compound emissions from plant and coating operations. Cummins is devising a circular lifecycle plan for every [engine] part to ‘use less, use better, and use again’. The company wants to generate 25% less waste in facilities and operations as a percentage of revenue. It intends to reuse or responsibly recycle 100% of packaging plastics while eliminating single-use plastics in dining facilities, employee amenities and events. Cummins aims to cut absolute water consumption in its facilities and operations by 30%.

Later the same day, our off-highway trade media party had a tour of the Darlington engine plant led by Patrick McGonigal, the plant’s operations manager. In 2023, 72,325 engines were assembled at the plant and shipped – with a daily target of 280 fully assembled units (including testing). Equipped with the latest robotic and other technology to assist employees, the engine plant runs three shifts Monday to Friday: 6 am-2 pm, 2 pm to 10 pm and 10 pm to 6 am. Plant maintenance shifts are often also available as overtime on Saturdays.

McGonigal stresses Cummins’ emphasis on plant employee health, safety, and welfare. Popular company-organised social events involving plant employees and their families are held several times yearly. At a day-to-day level, big whiteboards are prominently placed around the plant to encourage employee feedback, including suggestions to improve each stage of the engine assembly process. Among several large and colourful company message boards near the entrance to the plant is one detailing ten elements of ‘Operational Excellence’. In numerical order, they are: Put the customer first and provide real value; Synchronise Flows (Material, Physical and Information); Design Quality in Every Step of the Process; Involve People & Promote Teamwork; Ensure Equipment & Tools are Available & Capable; Create Functional Excellence; Establish the Right Environment; Treat Preferred Suppliers as Partners; Follow Common Problem Solving Techniques; and Use Six Sigma as the Primary Improvement Method.

A new CRM (customer relationship management) system was due to be installed in the Darlington engine plant in September 2024. Another standout feature of the facility is its dedicated training and education area, where younger employees can practice and hone the skills required for engine assembly under the guidance of experienced plant technicians.

In a Q&A before we toured the Darlington engine plant, Ali Baynes, Cummins director of off-highway sales, outlined that 80% of Cummins’ off-highway sales are related to construction customers, 10% to agriculture, and 10% to defence and underground mining.

She describes current market conditions: “The construction market is experiencing quite a decline in Europe, by 20% or more. Although we predicted that to some extent, it’s quite a challenge for us. In other parts of the world, though, we are seeing market stability or some levels of growth. China is holding up quite well, and North America is slightly more progressive than expected in that region. Overall, the global market is flattish. There are a lot of changes in [national] governments this year. We are keeping a close eye on major infrastructure projects kick-starting again.

“When you consider the longer term and at what point the construction [machine] market starts to transition away from diesel, we have a pretty good idea that that is a long time away. In the meantime, Cummins is investing significantly, initially in on-highway platforms. This allows us to see how this investment impacts at scale and how these platforms can be adjusted and adapted for construction and other off-highway markets.”

Baynes says Cummins has also brought forward some of its product development, including the Intermat 2024 Paris launch of its Next Gen X15 Performance Series. The platform offers 10% better fuel economy than its predecessor, improved greenhouse gas efficiency, and longer service intervals.

Cummins’ constriction business is, says Baynes, also being more targeted in its approach to growing market share: “In the construction [machine] market, we have traditionally seen growth solely linked to changes in engine emissions regulations. We are now focused on understanding where we will take market share from our competitors over the next four years. We have a good story about our [acquisitions and R&D] investment and some of our other capabilities. I think we can help a lot of large and critically important off-highway OEMs be successful more quickly. We also see a lot of interest from off-highway machine customers in what we’re doing on hydrogen internal combustion engines [Hydrogen ICE for on-highway truck customers]. A lot want to just test out the technology, even if it’s still up to 10 years from coming onto the [off-highway machine] market.”