Metso Outotec begins its trading life on firm foundations. Equipped with Metso’s and Outotec's impressive record of innovative premium plant and linked products in their respective sectors, joint commercial strength, identified cost and revenue synergies of over €250 million, and pooled expertise, the new business venture is set to quickly establish itself as a leading supplier of process technology, equipment and services for the global aggregates, mining and metals industries.

To emphasise the new business's good health, combined Metso and Outotec sales stood at €4.2 billion in 2019 (including the impact of Metso's late-2019-completed acquisition of crushing and screening equipment maker McCloskey International). The new company is staffed by more than 15,000 employees, of more than 80 nationalities. Metso Outotec will have a presence in more than 50 countries worldwide and be able to draw on 150 years of expertise in mining and metals.

Looking in more detail at the new venture’s combined sales, 26% are currently to aggregates customers, 61% to mining customers, and 13% to customers in the metals and recycling sectors. Geographically, 42% of sales are in EMEA (Europe, Middle East & Africa), 35% in the Americas, and 23% in Asia-Pacific.

Metso's Flow Control business is not part of the new Metso Outotec business. The newly independent entity, which posted strong sales of €660 million in 2019, will trade under the familiar global valves market name of Neles.

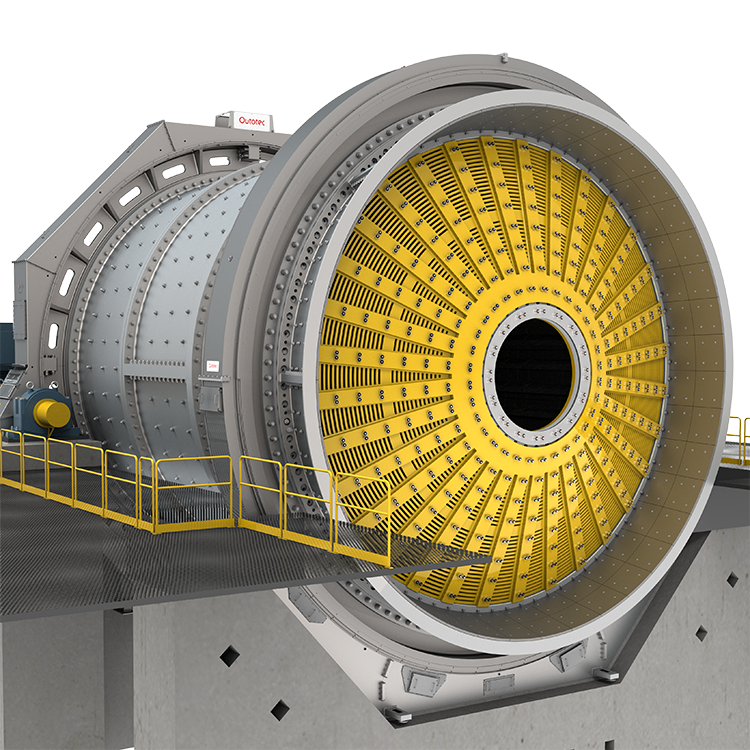

The new Metso Outotec operation will consist of six business areas: Aggregates, providing crushing and screening equipment for the production of aggregates; Minerals, providing equipment and full plant solutions for minerals processing, covering comminution, separation and pumps; Metals, providing processing solutions and equipment for metals refining and chemical processing; Recycling, providing equipment and services for metal and waste recycling; Services, providing spare parts, refurbishments and professional services for mining, metals and aggregates customers; Consumables, providing a comprehensive offering of wear parts for mining, metals and aggregates processes.

Joining business CEO and president Pekka Vauramo, and aggregates business area president, Markku Simula, in the Metso Outotec executive team are Stephan Kirsch, as president, Minerals, having served as president, mining equipment at Metso. Jari Ålgars is president, Metals, switching from his current role as Outotec CFO (chief financial officer). Uffe Hansen has become president, Recycling, moving from his position as president, Recycling, at Metso. Former Outotec president and CEO, Markku Teräsvasara, is now Metso Outotec president, Services and deputy CEO. Sami Takaluoma has taken up the post of president, Consumables, having served as president, Minerals Consumables at Metso. Finally, Carita Himberg has been appointed senior vice president, Human Resources. Himberg joins Metso Outotec from Stora Enso, where she works as senior vice-president, Human Resources, in the packaging materials division. She will start in her new role, at the latest, before the end of the year.

Several function heads who will form part of the Metso Outotec executive team have also been appointed. Most notably, Eeva Sipilä will be chief financial officer (CFO) and deputy CEO. Sipilä had been serving as Metso CFO and deputy CEO.

I am keen to discover where Metso Outotec sees its key sales markets and the type of equipment solutions that the new industry name believes will be in demand in the coming months and years.

Chinese aggregates demand currently accounts for almost half of the 50 billion-tonne annual global aggregates demand. Furthermore, the Asia-Pacific region, including China, comprises two-thirds of the worldwide aggregates market.

As such, it's no surprise that Markku Simula, Metso Outotec's aggregates business area president, points to China and the rest of Asia as a key region for the new Helsinki, Finland-headquartered venture.

"I had a couple of interesting experiences when visiting Chinese quarries. At one really big CO₂-free quarry, all the aggregates haul trucks were electric-powered trucks, and they were running all day long without having to charge their batteries. The quarry operated on a hill, and the trucks were loaded with material at the top, with the weight of the full loads creating enough energy on the downhill run to fully recharge their batteries. After unloading, the trucks were going back uphill empty, minimising battery use.

"I also saw models of quarries that had been landscaped to give the appearance of being under a cover. This would mean a regular busy quarry site could not be seen by anyone looking as close as half-a-kilometre away. China tends to be environmentally forward-thinking today. It is a tremendous change over the last couple of years. The general development of the Chinese quarrying industry is almost beyond imagination. The quarries there are getting really, really big. The American and European quarries tend to be much smaller in comparison."

As separate businesses, Metso and Outotec had strong product innovation records thanks to a firm and well-funded focus on research and development (R&D). That is set to continue with Metso Outotec, which will include 230 R&D professionals in its ranks, working out of 30 R&D centres to co-create with customers the customised solutions they need. The new business venture already has over 8,200 patents on its equipment and technology.

So, what kind of aggregates processing plant and linked technology are we likely to see being introduced by Metso Outotec?

"Many customers’ workload is not constant. They are looking for versatile crushers for specific contract crushing and other aggregates processing work," said Vauramo. "To help develop suitable plant for this and other kinds of customer need, we spend around €100 million each year on R&D. This is maybe three to four times what our next competitor is spending annually, based on what they have announced publicly. R&D is core business for us."

Simula added: "Crushing operations all over the world are getting more mobile. As Pekka says, this is partly due to workload inconsistency. Mid-sized crushing plants have been around for a long time and attract big demand. Both larger and smaller crushing plants may also grow in demand, primarily when used in recycling applications. The recycling part of our business is the one that's been growing fastest, especially in China, where there is tremendous demand for recycling-suited plants.

"We will be focusing on further developing our production in Asia. Our Asian footprint is very competitive, and the Asian market is growing. We have a broader product range becoming available in that market.

"When we acquired McCloskey, one of the key focus areas was to promote the company's plants in Asia to generate strong sales growth. We already have high-quality manufacturing facilities in China and India. Our Indian manufacturing plant is already being used to produce multiple-brand products. It enables us to be more cost-competitive, and our customers in India and south-east Asia welcome the close presence of our production sites."

Metso Outotec will be deploying 5,000 service experts operating out of 140 service locations and three performance centres globally. To put the importance to the new company of customer services in context, they made up 56% of combined Metso and Outotec sales in 2019.

"Another growth area for Metso on the aggregates side of our business has been our Life Cycle Services (LCS) contracts, particularly in India [where Metso has over 100 LCS-contracted customers] and Brazil. When LCS takes off in a country, it takes off rapidly. For example, in Brazil, we could triple the number of LCS customers in a year," said Vauramo.

Simula added: "Our Indian customers that have been using LCS contracts have recovered quicker from COVID-19-induced disruption than those that have not. It means they are back at full speed and earning money again far quicker than their competitors. Many of our Indian customers take out the top-tier LCS package, where our engineers are running their aggregates production sites for them. This tends to be customers that do not have all the skills required among their workforce. It could also be the case that our engineers are working at several different sites belonging to the same LCS customer."

Speaking about the synergies offered by the new Metso Outotec company, Vauramo said: "We will look to complete them in two-and-a-half years. We are putting two global organisations together and will become far more cost-efficient. We want to raise the ambition level in our profitability targets. Where our products and services overlap, on the minerals side, we will merge our offerings and come up with end-to-end solutions.

"Obviously, the COVID-19 pandemic has not had a positive impact on our business. When it comes to the synergies, we will need to focus more initially on cost-efficiency, as we won't be able to get the short-term benefit on the procurement side due to lower sales and revenue volumes."

Simula added: "We will be looking to utilise the power of our dealer networks. From an aggregates perspective, we have several brands. We have our Shaorui Heavy Industries (Shaorui) brand in China, which is a growing and very profitable business. We own all of Shaorui after acquiring the final 25% of the company last year. We have the Swedish company P.J. Jonsson & Söner serving mainly the Nordic market. They offer big, heavy-duty mobile equipment for quarrying and mining operations. We have Lippmann, that McCloskey [International] had acquired before we acquired McCloskey. They serve mainly the North America market, but also have a presence in Australia. Again, most of its plants are for heavy-duty quarrying and mining applications. Metso and McCloskey are brands that are present all over the world. Both offer plants and aftermarket packages that serve different customer needs. The two brands’ distribution channels are separate and will remain so."

I'm keen to find out in more detail what impact the COVID-19 pandemic has had on the launch of Metso Outotec and the new venture's initial business plans.

Vauramo said: "COVID-19 was initially a shock for everyone, especially to the aggregates business. This was particularly felt in the first four weeks from mid-March to the middle of April. Business has recovered, but we have not reached pre-COVID-19 levels. You could see from looking at Metso machine telematics-generated data that crushing and screening production was down something like 20% between mid-March and around mid-May. This is a time during spring when production normally goes up.

"The integration work around the launch of Metso Outotec has been done remotely. We were already very used to holding online virtual meetings, but COVID-19 has brought forward the business case for remote working. For example, as a result of the pandemic, we are developing an app around technical plant support which we are currently piloting with certain customers."

Simula is excited about the post-COVID-19 pandemic commercial opportunities for Metso and the rest of its aggregates sector brand range. "China has recovered extremely fast from COVID-19. Aggregates sector demand bounced back quickly and is at an even higher level than pre-COVID 19. There are a lot of big projects ongoing, such as the China Belt and Road Initiative.

"I think the rest of Asia will also recover pretty quickly from COVID-19. There is a tremendous amount of opportunities for us in China, India and the rest of Asia going forward."

Commenting on some of the other major global aggregates markets, he added: "The U.S. market is opening up again, and I think the U.S. and European government moves to speed up the construction industry will help us regain market volumes. How quickly this takes effect, we will have to see. South America is likely to be the last region to recover from COVID-19. Saying that, it has not been quite as bad for us there as some mining and aggregates activities are continuing."

I am keen to conclude the hour-long joint interview by finding out more about how Metso Outotec sees the quarry of the future.

"Achieving zero emissions when it comes to aggregates production means everything," stresses Vauramo. "People living in cities and towns near a quarry do not tend to know what is happening inside the quarry gates. Still today, a huge amount of fossil fuels is burnt in operating quarries, and the global quarrying industry needs to move forward in addressing this. A lot has been done about reducing quarry dust, and work is ongoing to reduce production noise. A fully electric-powered quarry site is where we want to get to."