As one of the biggest mergers in aggregates’ industry history is expected to be confirmed in the first half of 2015, we present a view from Aggregate Research Ltd, providers of strategic and operational advisory services across aggregates and related industries, whose consultancy team offers 80 years of collective commercial experience.

Industry interest was captured earlier this year by the announcement of the proposed

The vertically-integrated consolidator model of cement, concrete and aggregates’ businesses, as followed by the planned Lafarge-Holcim merger, was clearly established in the building materials industry around ten years ago, when two deals changed the competitive landscape forever:

In September 2004

The Cemex deal expanded its business into new markets whilst securing a route for cement into concrete. Holcim gained Aggregate Industries’ cement volume in the US, as well as access to the UK market where around 50% of Aggregate Industries’ profit was derived. Lafarge had already created this vertical integration model in the mature markets of France, Spain and regions of North America in 2005.

The drive for growth and share in cement through aggregate and concrete vertical integration led to more expensive and, in the main, debt-funded acquisitions with a bias toward the US market. In 2007

The increasingly expensive nature of many of these deals was mainly a reflection of the scarcity value of aggregates, especially in mature markets such as the US and UK. However, extracting that value, mainly through pricing power, is another issue altogether, especially when demand was falling as it was in the US housing market, and you are competing in what is still today a largely fragmented industry.

| Date | Acquirer | Target | EV($m) | EV/EBITDA |

|---|---|---|---|---|

| May 2007 | HeidelbergCement | Hanson | 18,810 | 12.2 |

| Apr 2007 | Cemex | Rinker | 15,300 | 10.4 |

| May 2006 | Lafarge | Lafarge North America (46.8%) | 7,310 | 9.0 |

| Jan 2005 | Holcim | Aggregate Industries | 4,659 | 9.8 |

| Sep 2004 | Cemex | RMC | 5,800 | 7.1 |

| Jan 2001 | Lafarge | Blue Circle | 7,536 | 8.6 |

| Oct 1999 | |

|

2,654 | 8.0 |

| May 1999 | HeidelbergCement | Scancem | 3,010 | 8.3 |

Moreover, in the case of the US, where the large vertically-integrated players were competing against similarly large but almost pure aggregate companies such as Martin Marietta and

By 2008 the global crisis caused demand to plummet, especially in mature markets, and the severe downturn that followed in the US, UK, Spain etc., left many vertically-integrated players licking their wounds.

Cemex was perhaps the most unfortunate due to its high exposure, mainly in concrete, to the most heavily affected markets such as the US, UK and Spain, but it also had difficulty swallowing Rinker, which ended up a value-destroying deal, and still struggles under its heavy debt burden and lack of pricing power. One could also argue HeidelbergCement was unlucky with its timing, buying at the top of a boom cycle, and it has had to wrestle value from this deal with debatable success.

Lafarge and Holcim didn’t escape the downturn either; both had similar but lower exposure compared with Cemex, particularly in the US, but their expanding portfolio in emerging markets provided some temporary relief for their downstream activities. At the same time they have been busy divesting many of their now non-core businesses such as roofing, plasterboard, and a number of asphalt paving businesses for Lafarge, in mature markets, which has helped to reduce debt following the Orascom deal in 2007.

Are these companies and their shareholders happy now? The market capitalisation of HeidelbergCement today is €10.1 billion; the Hanson acquisition, remember, cost more than that. And, of the other companies who invested in aggregates assets at the time, Cemex today has a market capitalisation significantly lower than the investment in Rinker and RMC during its spending spree. Lafarge has divested significantly over recent years but still carries a lot of debt.

Although the fallout of the global downturn in 2008 is being addressed and an appetite for further deals is returning, these large vertically-integrated players must be questioning the value of any further moves to incorporate the successful activities of smaller aggregates and concrete firms within their portfolio after having their fingers badly burnt, particularly in mature markets.

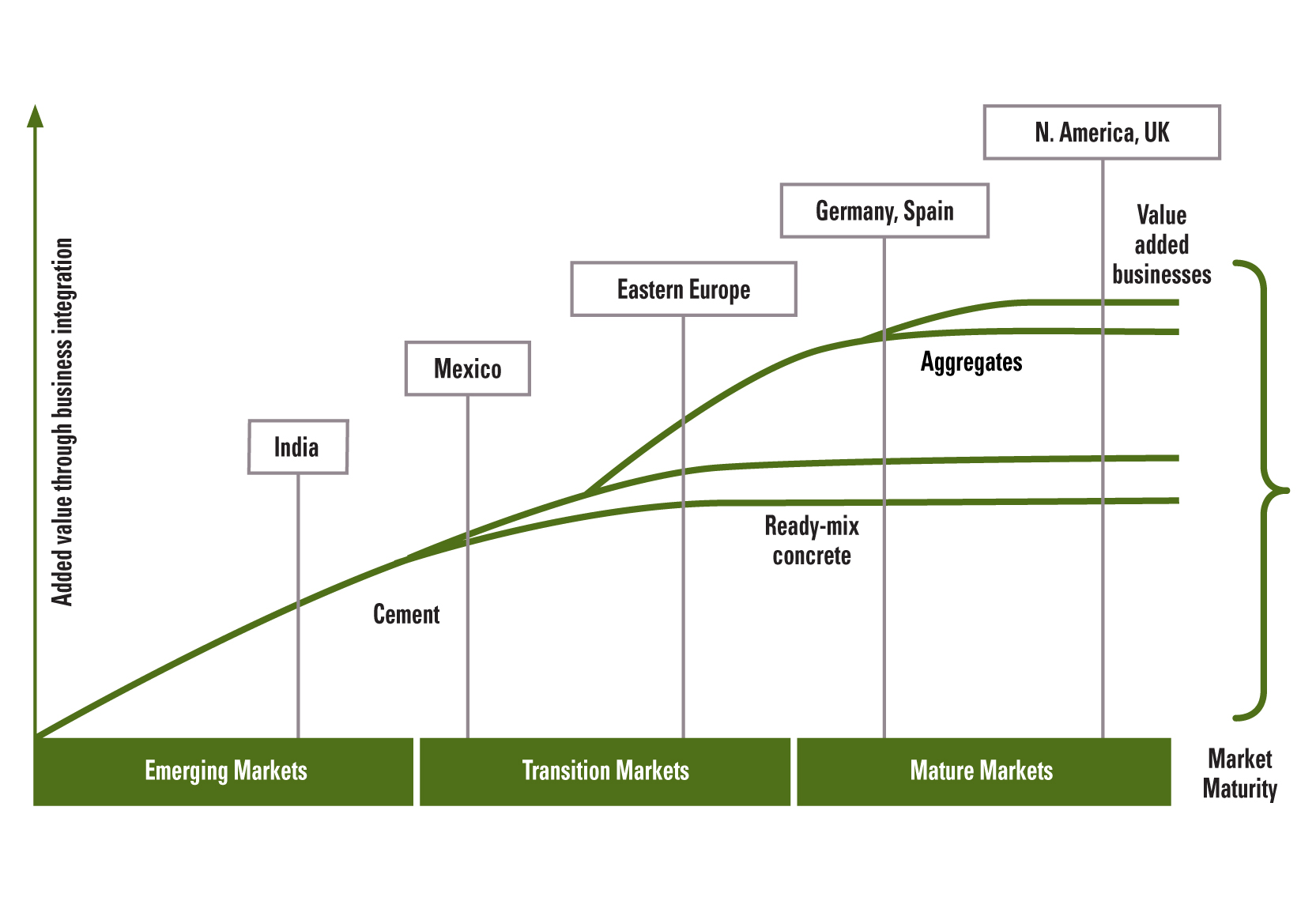

The proposed merger of Lafarge and Holcim is interesting from this standpoint: Firstly if we take a look at Holcim’s vision of building materials evolution as presented in 2005 and in 2010 (see above), we can see its view of aggregates and smaller businesses in the cement-centric vertically-integrated consolidator model. Secondly, if this same strategic thought process remained today, would the Lafarge/Holcim merger be casting aside the dominant aggregates player in the consolidated market of the UK – the recently concluded Lafarge/Tarmac JV?

The divestments announced as part of this earmarked merger are significant in some markets for both concrete and aggregates: For example, the proposed divestment of the Lafarge/Tarmac JV in the UK could not have been taken easily. Notwithstanding the fact that Holcim has no cement presence in the UK, and the divestiture of the Lafarge (Lafarge/Tarmac) UK assets means the disposal of cement capacity in this market, it is astounding that the new entity is going to sell off the dominant aggregates player in what is arguably the world’s most consolidated mature market. This is especially so in light of the recent industry investigations by the

This disposal may fit with the strategy of creating a more balanced global portfolio with a bias toward high growth emerging markets, but it raises the question of how not only Lafarge and Holcim but also Cemex and Heidelberg view aggregates within their core business?

All of which could lead one to ask how the Cemex board views the further purchase of aggregates-based companies? And could one see an appetite from Heidelberg to strengthen its aggregates position in the coming years? Will both bid for the aggregate assets to be disposed of by Lafarge and Holcim or will it be another smaller, ambitious regional player or even a new entrant from China or Russia? With the requirement to jettison some aggregate assets during mergers, and the majors often prohibited from acquiring those assets due to anti-competitive positioning (e.g. Lafarge/Tarmac JV in UK), are we about to see the rise of strong regionally-based aggregates companies? - keeping in mind that there are many private equity companies lining up to invest in some of the spun-off assets.

Aggregates remains an attractive business, but it is local, and a disproportionate component of its cost to the customer is logistics, where most of the cement companies are very weak.

In recent times, we have seen a few of these companies emerging, most notably

It is likely that the existing multinational companies, HeidelbergCement, Cemex,

One does not have to look further than the UK to see the success of the smaller regional players, and, if aggregates were to follow in the footsteps of ready-mixed cement in the UK, one would see the independent producers gaining more and more market share at the expense of the big vertically-integrated players. Maybe the landscape has changed, and the cement companies that have used aggregate assets as a defensive play, and ready-mixed concrete merely as an outlet for their own cement production, see no need to own these business lines as part of their long-term strategies.

Whatever unfolds in the short-term, the aggregates business is in for a change, and if you are an aggregate player that is operationally strong, value-focused, with a very good understanding of your market and pricing, the future could be bright indeed.