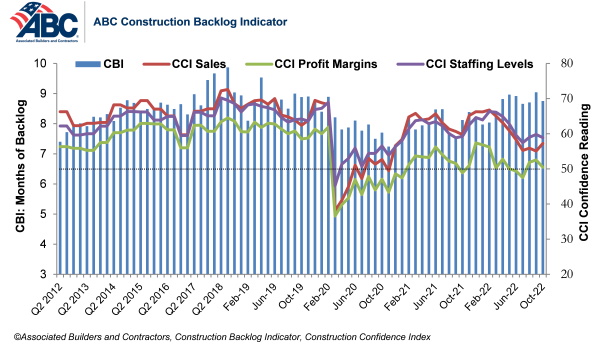

Associated Builders and Contractors (ABC) reports that its Construction Backlog Indicator declined to 8.8 months in October, according to an ABC member survey conducted from October 20 to November 4. The reading is 0.7 months higher than in October 2021.

View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for October 2022.

After surpassing its pre-pandemic level in September, the backlog is now below the reading observed in February 2020. Backlog in the commercial and institutional category posted its largest monthly decline since July 2020 and is now 0.4 months below pre-pandemic levels.

ABC’s Construction Confidence Index reading for sales increased in October, while the readings for profit margins and staffing fell. All three readings remain above 50, indicating growth expectations over the next six months.

“October’s survey data hinted at some emerging weakness in the nation’s nonresidential construction sector,” said ABC Chief Economist Anirban Basu. “While the industry continues to gain strength from significant funding for public work, pandemic-induced behavioural shifts—including remote work and online business meetings as well as surging borrowing costs—are translating into meaningful declines in backlog in commercial and institutional segments.

“With borrowing costs likely to increase during the coming months and materials prices set to remain elevated, industry momentum could easily downshift further in 2023,” said Basu. “But it is also conceivable that certain economists are overly pessimistic. There is still underlying momentum in the U.S. economy, and some believe that near-term recession is not inevitable. Contractor survey data indicate that while the backlog declined in October, it remains reasonably healthy. Moreover, the average contractor continues to expect sales, staffing and margins to grow over the next six months. Time will tell whether this lingering optimism is justified.”