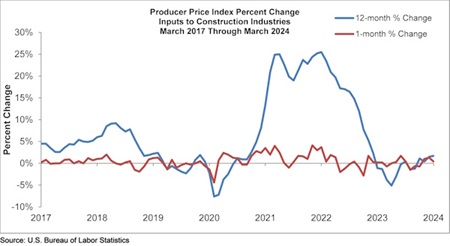

Both overall and nonresidential construction input prices are 1.7% higher than a year ago. Prices fell in all three energy subcategories last month. Natural gas prices were down 37%, while unprocessed energy materials and crude petroleum were down 6.9% and 0.8%, respectively.

“There has been growing evidence of resurfacing inflationary pressures in the nation’s nonresidential construction segment during the past two months,” said ABC Chief Economist Anirban Basu. “Were it not for declines in energy prices, the headline figure for construction input price dynamics would have been meaningfully higher. A new set of supply chain issues is emerging, including the cost of insuring ships and bottlenecks in the Red Sea, the Panama Canal and Baltimore.

“This is not especially good news for those who purchase construction services,” said Basu. “In addition to supply chain issues, there is an abundance of publicly and privately financed megaprojects around the nation, massively increasing demand for certain inputs, and a majority of contractors expect their sales to increase over the next six months, according to ABC’s Construction Confidence Index. With continuing wage pressures and elevated borrowing costs, the implication is that financing construction projects will remain expensive relative to historic norms for the foreseeable future.”