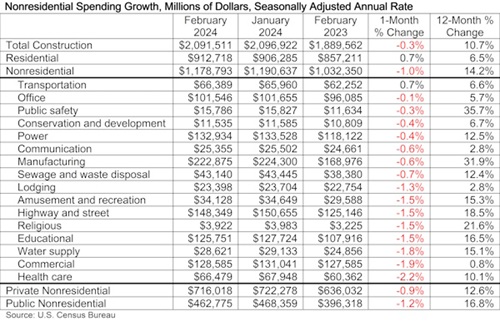

Spending was down in a monthly basis in 15 of the 16 nonresidential subcategories. Private nonresidential spending fell 0.9%, while public nonresidential construction spending was down 1.2% in February.

“Virtually every nonresidential construction segment experienced a decline in spending in February,” said ABC chief economist Anirban Basu. “In certain instances, the monthly decline was sharp, including health care (-2.2%), commercial (-1.9%) and water supply (-1.8%). The optimist will likely shrug off both the January and February nonresidential construction spending declines as merely reflecting winter weather. The pessimist will proclaim this release a wake-up call to contractors and an indication that higher interest rates have finally begun to make their mark.

“As always, interpreting the data is complicated,” said Basu. “While 15 of 16 nonresidential construction segments recorded monthly declines on a seasonally-adjusted basis, all segments have experienced year-over-year growth in spending. In 10 instances, construction spending has increased more than 10%, including 36% growth in the public safety category and 32% in manufacturing. Moreover, ABC’s Construction Confidence Index indicates that contractors remain confident with respect to their sales over the next six months, signalling that the data could improve with the weather.”