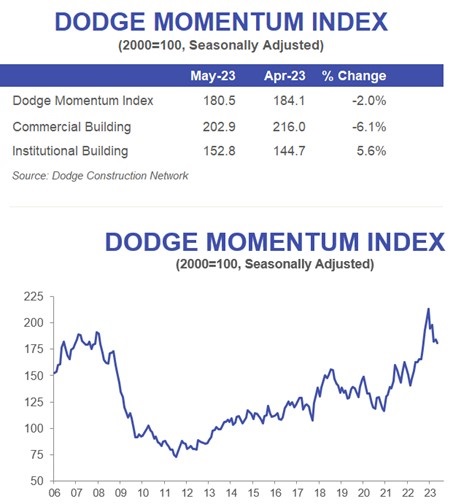

“The DMI dipped in May amid sustained weakness in commercial planning activity,” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. “Conversely, institutional planning steadily improved over the month as research and development laboratories and hospital projects steadily entered planning. Sustained elevation in the federal funds rate and tighter lending standards will likely constrain growth in the DMI over the second half of 2023; however, the index remains above the historical average. This paints an optimistic landscape for non-residential construction in mid-2024, as the economy recovers and the Fed begins to pull back rates.”

Continued weakness in office and hotel planning activity negatively impacted commercial planning in May. Institutional planning accelerated alongside steady growth in education, health and amusement projects. The DMI remains 11% higher yearly than in May 2022. The commercial and institutional components were up 7% and 18%, respectively.

Thirty projects valued at $100 million or more entered planning in May. The largest commercial projects included Buildings 3 and 4 of the Blue Sky Data Center project in Omaha, Nebraska, each valued at $466 million, and the $400 million Prime Data Center building in Avondale, Arizona. Leading the way on the institutional side were the $500 million Tennessee Performing Arts Center in Nashville and the $440 million Rady Children’s Hospital ICU/EMS Pavilion in San Diego, California.

The DMI is a monthly measure of the initial report for non-residential building projects in planning, shown to lead construction spending for non-residential buildings by a full year.

Watch Associate Director of Forecasting Sarah Martin discuss May’s DMI here.