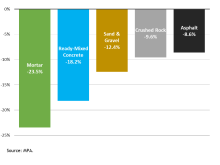

The UK Construction Products Association’s State of Trade Survey for 2020 Q3 found that one-third of heavy side manufacturers reported a rise in sales compared to Q2, improving from the weakest balances in nearly 12 years.

Sales of light side products were reported to have increased by 48% of manufacturers. Mirroring ONS data on construction output during the quarter, product sales remained lower compared to a year earlier.

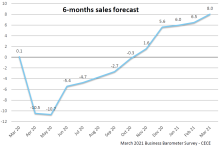

It was a more mixed picture for manufacturers’ forward-looking expectations, however. Both heavy side and light side manufacturers expect the recovery to intensify in Q4, with 56% of all firms anticipating a rise in sales in the next quarter, on balance. However, when looking to the next 12 months, 24% of heavy side anticipated a fall in sales, contrasting with 21% of light side manufacturers anticipating a rise. Reflecting the uncertainty over the outlook for construction in 2021, negative balances remain for manufacturers’ investment intentions in new structures, plant and machinery, whilst adjustments to newer working practices mean that investment in e-business remains a priority.

Rebecca Larkin, CPA senior economist, said: “Despite the welcome news of a pickup in activity, the Q3 survey captures the uncertainty over the recovery path for the economy and construction next year. There are already clear signs of differences in the outlook by sector, with house building subject to volatility as the stamp duty holiday ends and employment backdrop worsens, infrastructure benefiting from new and ongoing major projects, and commercial facing near-term unknowns over demand for office and retail space depending on how embedded homeworking becomes in future."

She added that the uncertainty is proving to be a catalyst for manufacturers to prepare for how new ways of working may change supply chain distribution, notably through increasing investment in developing e-commerce. Sixty-five per cent of heavy side firms and 43% of light side firms, on balance anticipated increased investment in e-business over the next year.