The European construction equipment sector suffered less than expected in 2020, and manufacturers say they are positive about industry prospects for 2021.

European construction equipment association CECE reports that sector sales in the region's equipment market went down by 6.4% in 2020. It says this seemingly modest drop is due to the performance of high-volume light and compact equipment, whose sales were almost unaffected at -3%. In contrast, heavy construction machinery suffered a 19% fall in sales, in what emerged as a challenging year.

Less expensive machines were sold at almost normal levels during the pandemic, while investment in more capital-intensive equipment suffered from the economic uncertainty. CECE says that these economic figures are the result of a combination of anticipated cyclical downturn after years of growth and a slowdown in business activity due to the Covid pandemic.

Unlike earlier years, concrete equipment, earthmoving equipment, road equipment and the tower cranes business experienced similar market patterns, despite the impact of stronger sales of light equipment.

2020 began in line with expectations, with a 5% market decline in the first quarter – a cyclical downturn that had been anticipated. However, in the second quarter, lockdowns across Europe began to take their toll and pushed the market to 28% below the levels of the previous year. The decline in sales in Q2 also reflected the impact of the comparison with the quarter in 2019 when the bauma exhibition was held, and the usual short-term boost in sales from it. With relaxation of lockdown measures in Q3, sales reached similar levels as 2019 and were flat year-on-year. The last quarter of the year saw the expected improvement in demand, and sales in Europe went up by 9%. This also reflected the benefit of business postponed in the first half of the year materializing in Q4.

From a geographical perspective, market sales in most countries reflected the impact of the pandemic and the lockdowns, but there were a few exceptions. Most notably, the Italian market reached the same level of sales as 2019, and the Turkish market recovered from its 2019 crash.

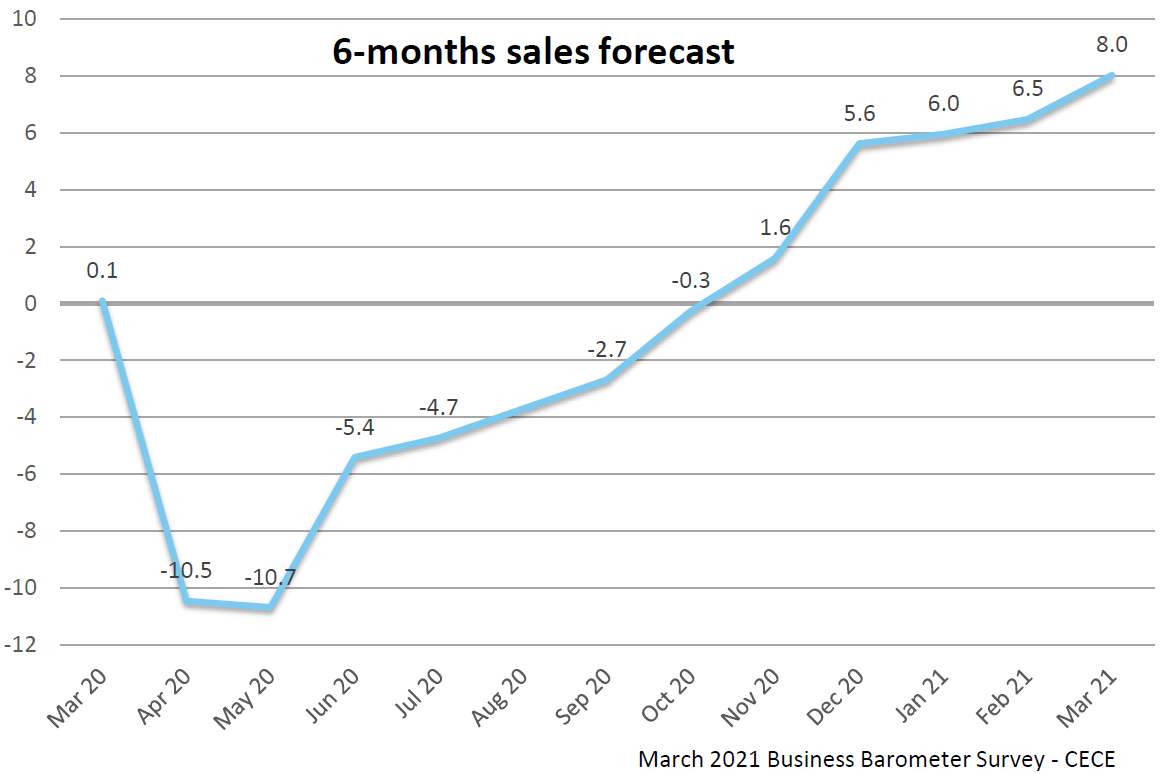

In terms of outlook for 2021 CECE says that, while the short-term macroeconomic outlook remains uncertain with further risks from the spread of Covid variants, the business climate within the European equipment industry remains positive.

After months of improvement, the business climate index in CECE’s Business Barometer survey is significantly higher in March 2021 than at the outbreak of the pandemic in spring 2020. A significant majority of manufacturers expects business to grow in the first half of the year, and the level of satisfaction with current business has also improved significantly. In addition, the order intake for European manufacturers has been growing year-on-year since December 2020 and, sales on the European market are also on a clear growth path. This is consistent with the improvement in equipment sales seen in Q4 2020.

A forecast of 5% growth in the European equipment market is a realistic assessment of prospects for 2021. However, against a background of continued uncertainty and high absolute levels of sales, even a flat market in 2021 would not be a disappointment. The world market is also likely to show moderate growth in 2021, but the volatility of the Chinese market and its significant influence on the overall outcome means that it is difficult to quote reliable figures for overall global growth levels. In the medium term, the construction equipment industry faces many substantial risks. One of them are higher debts in many countries that will become a problem, as public infrastructure investments will suffer when austerity measures must be put in place.

CECE secretary general Riccardo Viaggi said that business expectations are at the highest level for many years among Europe's construction equipment and component suppliers.

"We expect a 5% increase to be possible from sales in the European market in 2021," said Viaggi.

He added that CECE members were pleased with the recent move by the Biden administration and the EU for a four-month suspension of the tariff war that had affected construction equipment sales between the US and EU. The multi-trillion dollar US infrastructure plan that President Biden has approved is further good news for equipment manufacturers.

Viaggi struck a cautionary note in observing that long-terms trends for the construction industry are unstable. The increase in smart and home working following the pandemic means there could be less building projects for office spaces, and urbanisation could slow down post-Covid.

Michel Petitjean, secretary general of the European Rental Association, said the main impact on the region's rental equipment sector came in Q2 2020. The second half of 2020 was better than expected, although France, the UK, Spain and Italy continued to lag behind the average performance for the region. Petitjean said the recovery is continuing in 2021 although much of this will be due to construction activity resumption, with Germany, the Netherlands and Denmark being the only rental markets likely to reach pre-Covid levels of activity by the end of 2021.