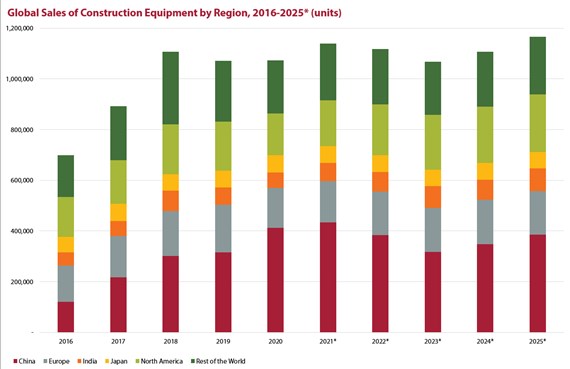

New data from Off-Highway Research (OHR) has identified the most important factor in this remarkable performance as being the huge stimulus spending in China, which saw the market rise from already buoyant levels of 2019 by a further 30%.

OHR managing director Chris Sleight says that at the end of 2019 it was anticipated 2020 would see a modest downturn of around 5% in global construction equipment sales, following the peaks of the two previous years.

The picture worsened in March 2020 as the Covid-19 pandemic took hold and national lockdowns came into force around the world, and it was feared that global markets would crash. Annual declines of 20-40% were anticipated in worldwide equipment sales.

However, the final result for 2020 was that there was almost no change in global sales. Indeed, Sleight says the market performed better in the pandemic than it was expected to prior to the Covid outbreak.

In addition, the downturn in other parts of the world was not as severe as was feared when the lockdowns started. Instead of the anticipated falls of 30% or more, most markets declined by 10-20%, and some even grew. The overall fall for the world, excluding China, was 12% in 2020.

"Having reached very high levels in 2019 and 2018, these downturns meant that most markets remained at reasonable levels in 2020, albeit with a pattern of sharp declines in the first half of the year and roaring recoveries in the second half," Sleight comments.

He adds that the forecast for 2021 and beyond is also now generally better than was expected prior to the Covid outbreak.

The components of this are continued modest growth in China in 2021, combined with a bounce back in sales in other countries around the world – generally of the order of 5-10%. These increases have the potential to take global construction equipment sales to a record high in 2021.

"The buoyancy is such that the question is not so much whether there will be demand for equipment, but whether manufacturers will be able to meet it," says Sleight. "History has shown that a global volume of 1 million units or more can equate to supply shortages in critical components."

In early 2021, this was exacerbated by the fact that so many suppliers in the industry had cut production in 2020 – either because they decided to slow output in the face of an uncertain future, or because their volumes were affected by lockdowns and reduced production by their suppliers. Ramping back up to former levels remained challenging due to on-going Covid restrictions and production constraints further down the supply chain.

A further factor was that over the course of 2020, equipment producers, their suppliers and their distributors alike took steps to reduce their inventories and focus on cash flow. "As understandable and prudent as these measures were, they clearly contributed to the difficulties in meeting demand which were being seen in early 2021," Sleight comments.

It is therefore expected that 2021 will be characterised by equipment supply constraints and long lead times for machines. OHR believes these factors are the major challenge to its forecasts and the industry reaching its sales potential, rather than any demand-side impediments.