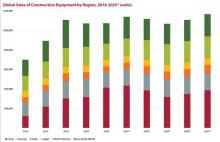

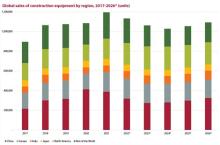

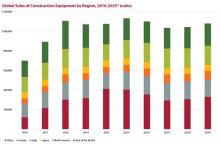

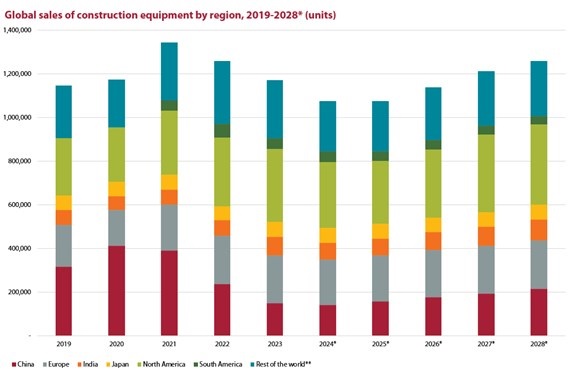

Chris Sleight of Off-Highway Research (OHR), which provided the data, says that although three consecutive years of declines are of course bad news, it should be remembered that this fall is from the abnormally high volume of machines sold in 2021. He adds that the bottom of the cycle in 2024 and 2025 will be on a par with the recent ‘normal’ peak in 2019.

OHR would therefore characterise the current market trend as a correction back to normal conditions, rather than there being a serious problem with the market or the factors which drive it.

Sleight comments: "It should also be added that in a cyclical market like the construction equipment industry, downturns normally come with double-digit percentage falls in year-on-year equipment sales. Three years of single digit declines definitely classify the current readjustment as a soft landing."

Sales are expected to pick up across all regions from the mid-2020s onwards and the long-term growth trend for the industry should mean that the extraordinary volumes achieved in 2021 might be regained towards the end of the decade as part of normal and sustainable cyclical growth.

China

After two years of abnormally high sales in 2020 and 2021 thanks to stimulus spending, the Chinese market collapsed in 2022 with a 39 per cent decline. This was not only due to the stimulus money running out. The impact was compounded by turbulence in the Chinese real estate sector, coupled with the country’s difficulties in getting to grips with the Covid pandemic. A further 38 per cent fall followed in 2023 as the issues of falling prices and mounting bad debts in the real estate segment continued to manifest themselves.

A further 4 per cent decline in sales is expected in 2024, which essentially signifies the market bottoming-out and is arguably the best case scenario for the country. More bad news and insolvency among property developers could push the equipment market down even further.

Europe

Last year started strongly for Europe, with brisk sales thanks to the backlog of orders from 2022. By the middle of the year these had largely been fulfilled and the market was seen to slow – particularly in terms of the order intake. However, retails held up reasonably well and as a result the European market maintained the high level of sales which had been seen in 2022.

The outcome for 2023 was better than had been anticipated in the second half of last year, when it was reported that order intake was dipping sharply. However, it seems likely that there will be a downturn in sales this year, and Off-Highway Research puts it at a -6 per cent decline.

India

With its 21 per cent rise in equipment sales, 2023 was the year that the Indian market finally bounced back. Last year’s steep rise took demand to 4 per cent above the previous record volume, which was seen five years earlier.

This year’s general election will disrupt the industry as it always does, and a 10 per cent decline in sales is expected as a result. However, with India continuing to invest in infrastructure (regardless of the election result), long-term growth in equipment sales is expected to continue, and last year’s record high is expected to be surpassed again in 2027.

Japan

The 7 per cent rise seen in Japan’s equipment market last year was an unusually steep one for the country. It is more common to see demand move by one or two percentage points per year.

It is anticipated that public investment will continue to be strong in 2024, which should in turn stimulate a further 1-2 per cent rise in domestic equipment sales. A downturn is expected to follow, but, in keeping with the generally stable Japanese market, is expected to be modest.

North America

North America enjoyed a third consecutive year of record equipment sales in 2023, with a 6 per cent increase. To some extent this represented a fulfilment of orders placed in 2022, but the underlying drivers of equipment sales were very good in the region last year. House building slowed slightly in response to rising interest rates, but still stayed at a historically high level. Meanwhile the CHIPS act and the general move to reshoring of production drove a surge in factory construction, while the effects of the post-pandemic stimulus plan and the Inflation Reduction Act drove an increase in infrastructure spending.

The market is widely expected to fall this year, as the one-off economic effects pass and demand cools following three sensational years. The prospect of a presidential election could also dent consumer confidence. However, even if sales fall by the 10 per cent forecast, it will still be the third best year in the market’s history in terms of the number of machines sold.

South America

After strong growth during the pandemic, the construction equipment market in South America declined 21 per cent in 2023.

Sleight says: "The historic context of this is that the sales achieved in 2022 represented a record high, and a very welcome return to buoyancy for a market which had been unnaturally weak for almost a decade. Brazil is the economic motor of the region and the weakness during the 2010s was due to the paralysis of the country’s construction industry caused by the Petrobras bribery scandal. Even though some of the region’s smaller markets developed well during this period, their growth was not enough to offset the depression in Brazilian construction equipment sales."

The OHR forecast for this year is for a 3 per cent increase in sales across the region. Brazil is expected to enjoy a modest rebound and further slight growth is expected in Chile and Peru. Colombia will see a further readjustment back to more sustainable levels, and the only bad news will be in Argentina, where extremely high inflation is expected to pull the market down by more than 40 per cent.

Rest of the world

Sales in the rest of the world fell 8 per cent in 2023, with a further 14 per cent decline anticipated for this year. The biggest emerging markets tend to be commodity producers, and as a result, equipment sales rise and fall depending on demand for materials and pricing.

The driver of commodity prices tends to make equipment sales in the rest of the world more volatile than in other markets. The forecast for rest of the world markets is based on the premise that the current inflationary pressures of the last few years will continue to recede in 2024 and 2025, driving down demand for commodities and therefore the equipment to extract them in the large emerging economies.