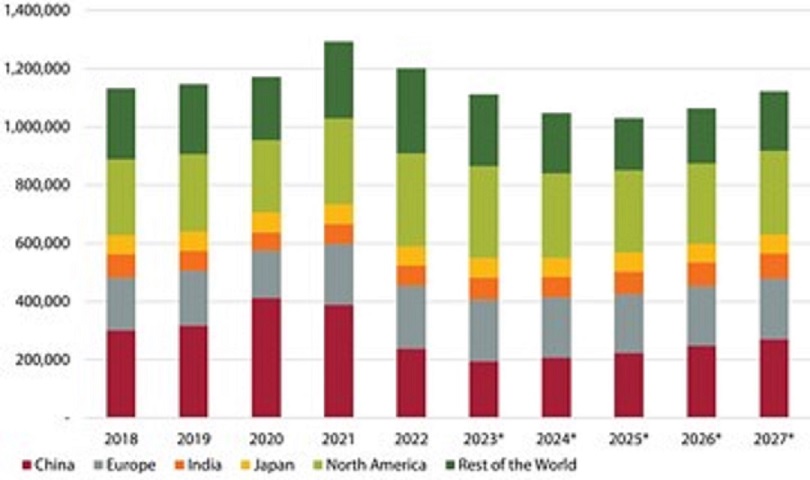

The downturn was entirely due to the collapse of demand in China, according data from to Off-Highway Research. Sales in the world excluding China grew 7% in 2022.

Off-Highway Research’s forecast is for a 7% decline in global sales in 2023. This is a slightly steeper downturn than envisaged a year previously, due to the weakness of the Chinese market. Stripping China out of the equation, the remaining countries of the world will only see a 5% downturn overall.

Off-Highway Research would still classify the 2022-2025 downturn as a soft landing. Only single-digit year-on-year falls in equipment sales are expected, and the volume of machines sold throughout the forecast period should stay above 1 million units per year. Prior to the current up-swing, such a volume was only achieved twice before.

The forecast is based on the premise that infrastructure investment will be strong and that although interest rates are rising, they will only slow down residential construction, rather than push it over a cliff.

However, there are risks to the forecast and they are almost entirely on the downside. Inflation was a serious issue throughout 2022 and although improving, it remained too high in early 2023. Add to that the war in Ukraine, which continues to heighten inflationary pressures worldwide and is therefore also exerting upward pressure on interest rates.