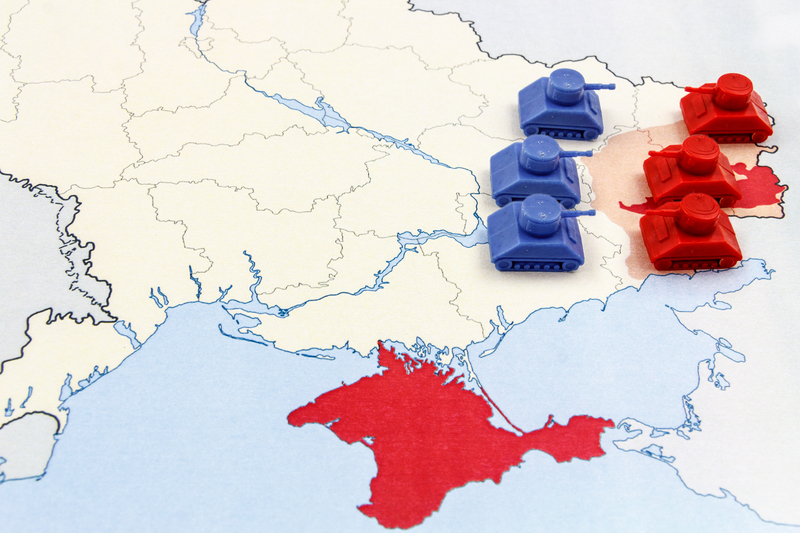

It forecasts that construction output in Eastern Europe and Central Asia will contract by 3.4% in 2022. This is due to heavy contractions in the Russian and Ukrainian construction sectors, which are expected to contract by 8.5% and 69.1%, respectively. Excluding Ukraine, construction in the region will decline by 1.6% and without Ukraine and Russia, the industry will record a growth of 1.5%.

Joel Hanna, economist at GlobalData, comments: “Construction in Russia, the largest market in the region, will continue to suffer from punitive sanctions placed on the country following its invasion of Ukraine. Despite sanctions so far failing to deter Russia from prolonging its invasion, the underlying economic and investment conditions are gradually weakening."

Hanna added that declining oil and gas export volumes owing to Western trade embargoes could depress government revenues over the coming quarters, despite revenues currently being buoyed by high oil and gas prices. Fears of a global recession could put downward pressure on energy prices which may, in turn, prompt Russia to cut its supply further to maintain high prices, increasing the country’s exposure to energy price fluctuations. Hanna said these conditions are likely to weigh heavily on investment in Russia and in the construction sector.

Russia’s original forecast of -9.2% was upgraded slightly in Q2 to -8.5% reflecting a stronger than expected first quarter. Moreover, construction in the wider region will also be impacted by the war in Ukraine as commodity prices rise. Rapidly increasing construction material costs are the main contributor to the slow growth expected this year.

GlobalData says the impact of these headwinds will hit Eastern Europe harder than Central Asia, which has been less disrupted by the impact of Western sanctions. Eastern European countries are collectively expected to register growth of 1%, while Central Asian countries (consisting of Kazakhstan, Uzbekistan and Azerbaijan) are predicted to record a growth of 5.8%.

Hanna adds: “In addition to global commodity market volatility, construction in the region still faces downside risks stemming from currency depreciations fuelling higher import costs and capital flight owing to weak investor confidence. Interest rate hikes are also expected to dampen output due to the impact of higher borrowing costs on both the supply and demand sides.

“On the upside, residential construction could be spurred by rising demand for safe assets if high inflation becomes expected over the long term. Moreover, the drop in private investment will be partially offset by increased government spending on transport and energy infrastructure over the next four years funded through the EU’s Recovery and Resilience Facility.”

GlobalData expects construction in Eastern Europe to rebound partially in 2023, growing by 2.1%, before averaging growth of 3.2% between 2023 and 2026. The industry is expected to remain below pre-pandemic levels until 2024.