The Eastern Europe construction outlook is increasingly gloomy for 2023 amid mounting headwinds, says GlobalData, a leading data and analytics company.

Construction output in Eastern Europe is forecast to contract by 2.5% in 2022, before declining by a further 2.7% in 2023. The decline in activity is due to the heightening risk of recession and tightening monetary policy across the region, coupled with low investor confidence and high construction costs stemming from the Russia-Ukraine conflict, reveals GlobalData.

Joel Hanna, economist at GlobalData, comments: “The European energy crisis is creating a very challenging environment for construction companies in Eastern Europe. In addition, slowing economic growth and an increase in borrowing costs will weigh heavily on the residential, commercial and industrial sectors, and continue to dent investor confidence.

“As a result, the overall construction activity over the coming quarters is likely to be impacted by stalling progress on current projects as well as a lack of new starts due to subdued investment. On the upside, EU funding, including the NextGenerationEU [pandemic]recovery fund, could help to partially offset the rise in borrowing costs in some markets and support the continuation of activity in transport and energy infrastructure development.”

GlobalData’s report, Global Construction Outlook to 2026 (Q3 2022), reveals that the construction output in Russia – the region’s largest market – is forecast to expand marginally by 0.6% in 2022 before posting a sharp contraction of 6% in 2023. The second-largest market, Turkey, is expected to contract by 8.1% and 3.3% in 2022 and 2023, respectively. Elsewhere, Poland and the Czech Republic are projected to grow by 4.9% and 2.9% in 2022, respectively, before posting respective contractions of 2.8% and 2.4% in 2023.

Hanna continues: “Owing to strong growth in the first half of the year in some of the major markets such as Russia, Poland, and the Czech Republic, the annual growth rates for 2022 in these markets are expected to be positive, despite a significant fall in the activity in the second half of the year. However, the impact of tightening monetary policy, low investor confidence, and sustained upward pressure on construction costs will be reflected in relatively sharp contractions in 2023.”

In the case of Russia, the growth forecast for 2022 has been revised upwards from 8.5% due to unexpectedly strong levels of activity since its invasion of Ukraine. However, weakening public revenue owing to the depressed export activity is expected to weigh heavily on output over the next year.

Hanna concludes: “Following a weak performance in 2022 and 2023, GlobalData expects construction activity in Eastern Europe to rebound in 2024 reaching a growth rate of 3.3%, before averaging a growth of 4.3% in 2025 and 2026. Output levels are now expected to remain below pre-pandemic levels until 2025 owing to current headwinds.”

Aggregates Business’s St Petersburg-based freelancer, Eugene Gerden, reports that the 720mn tonnes/year Russian aggregates sector faces the deepest crisis in its modern history.

In a piece filed for this magazine this autumn, Gerden says: “Probably one of the biggest problems for them [Russian aggregates producers] is currently related to logistics and financial issues. Many local aggregates producers face serious problems associated with the delivery of new equipment and machinery for their plants and quarries, as well as transferring payments for it. Most local industry analysts expect the current situation to continue to deteriorate, as most of industry players are unable to continue the modernisation of their fixed assets, while almost all Western machinery suppliers and producers have suspended their supplies to Russia.”

Gerden says that there is a strong possibility that the international sanctions imposed on Russia following its invasion of Ukraine will put an end to the further growth of the country’s aggregates sector “for years to come”, after its steady growth since the start of the 21st century. “They [the sanctions] will also affect all the planned new projects in the industry, including those which involve the discovery and development of new [aggregate production] fields. Most industry analysts expect implementation of these plans will be impossible amid the current economic conditions in the country and the ever-growing sanctions pressure.”

Most aggregates production in Russia is traditionally concentrated in Russia’s northwestern district (in and around St. Petersburg), with central Russia a lesser production hub. Before the Russia-Ukraine war, Gerden notes that the Russian aggregates industry consisted of more than 1,000 enterprises, but the continuing conflict has seen these numbers decline “significantly”. “This is mainly due to the market withdrawal of many producers, primarily those of small and medium size,” he explains.

While a long way behind Russia, Europe’s biggest annual aggregates producer, Poland, is still among the bigger national producers in Europe at around 270mn/tonnes a year, a similar level to the UK’s annual output.

Holcim recently completed the acquisition of Izolbet, one of Poland’s leading players in the specialty building solutions market.

Izolbet has delivered double-digit growth in sales and EBITDA over the last three years. The acquisition will strengthen Holcim’s footprint in the highly attractive market for renovation, thermal insulation and finishing and will complement Holcim’s recent investment in a new production facility for dry mixes in Kraków.

Miljan Gutovic, Holcim region head EMEA, said: “I warmly welcome all Izolbet employees to the Holcim family as another step in our expansion of Solutions & Products, advancing Strategy 2025 – Accelerating Green Growth. Specialty building solutions have been a key focus for expanding Solutions & Products in Europe, notably with the recent acquisitions of PRB Group in France as well as Cantillana and PTB-Compaktuna in Belgium. I’m excited to be welcoming all of Izolbet’s employees into the Holcim family to unleash our next chapter of growth together.”

Izolbet employs around 170 people and has four production plants in Budzyn´, Gostynin, Kleszczów and Chmielów. Its products are sold through distribution sales channels across the country, with most of its business in the high-growth repair & refurbishment market.

The acquisition advances Holcim’s Strategy 2025 – Accelerating Green Growth with the goal to expand its Solutions & Products business to 30% of group net sales by 2025, entering the most attractive construction segments, from roofing systems to insulation and renovation.

Caterpillar is a major global original equipment manufacturer (OEM) with a strong market share in Poland.

Speaking to Aggregates Business, Jarosław Wojtanowski, quarry and aggregates market manager at Bergerat Monnoyeur (Poland), Caterpillar’s Polish market dealer; and Lukasz Machniak, board director of the Polish Association of Aggregates Producers, and a lecturer at the Mining and Metallurgy University of Krakow, gave their thoughts on the Polish aggregates and quarrying sector.

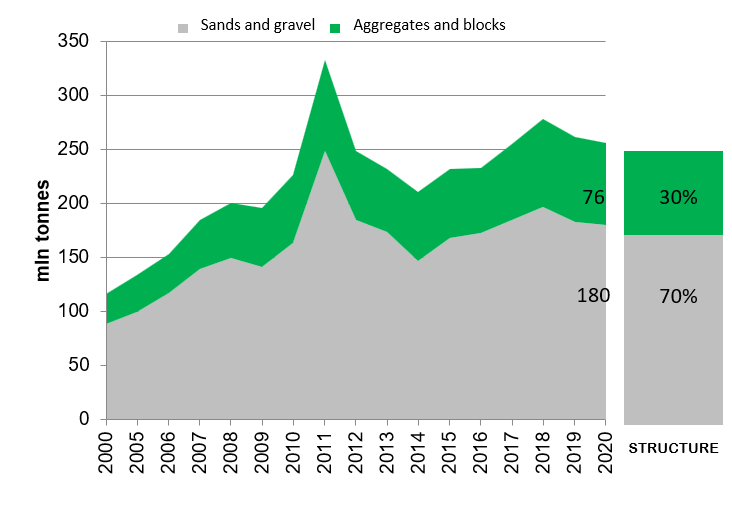

“In the last decade, the Polish aggregates market has been increasing,” says Machniak. “It was not the same high-level dynamics in the first years after Poland joined the EU (2004-2011). Two-thirds of the Polish aggregates production is sand and gravel, the other third is crushed aggregates. The average annual mineral extraction of aggregates in this period was approximately 260 million tonnes plus about 10 million tonnes of aggregates produced as different types of minerals. However, the sold production was lower because for sand and gravel, it is estimated that about 30-40 million tonnes of the sand proportion, after sifting out the gravel part, goes back to the quarry site.

“During this period, the number of active mineral extraction quarries did not change significantly. There were on average 330 solid rock quarries and 2,500 sand and gravel quarries. For sand and gravel, one could speak of a deconcentrating of quarrying and production sites, i.e., even coverage of the country by producers of these aggregates. At the same time, the quality of the deposits was differentiated expressed by the sand content, which was the most favourable in the southern district (approx. 50-60%), and the least favourable in the central districts (80-100%). Overall, the country's quarries’ average sand content is about 70%, which proves the dominance of the sand percentage. In the case of crushed aggregates, it can be said that the extraction is concentrated in two out of 16 districts. About 75% of crushed aggregates are extracted and produced in the Dolnos´la˛skie and S´wie˛tokrzyskie districts.”

Machniak says the COVID pandemic distorted the relationship between Polish aggregate production and GDP. “From an aggregates market point of view, it is important that GDP is driven by investments, and not, for example, by private aggregate consumption or exports. However, looking at this relation historically and in the longer term, according to the research conducted at Krakow Mining and Metallurgy University (AGH), the positive signals for the aggregates market show when the GDP growth is at least 3% year-on-year.

“The years 2020-2021, especially 2020, when we faced the COVID-19 pandemic, raised many concerns about the situation on the aggregates market. Despite a 2.5% decline in GDP, it was possible to keep investments at a sufficiently high level. This means the aggregates market was stable with slight drops of around 3% compared to 2019. The year 2021 saw the return of the 2019 production volumes. It was a record year in terms of volume of (residential) construction, which generated a considerable demand for gravel and grits. The record levels were the result of postponing investment decisions from 2020.”

Machniak says that in 2021, domestic producers of natural aggregates delivered about 85-90 million tonnes of crushed aggregates, 45-50 million tonnes of gravel and 100-110 million tonnes of sand. In addition, approximately five million tonnes of aggregates were imported, mainly from Scandinavia. We must also mention recycled and industrial (post-metallurgical) aggregates. Machniak says there is no reliable information on the volume of their production of recycled aggregates.

“The greatest demand is for sand. It is estimated that about 100-110 million tonnes are used each year and 50 million tonnes of aggregate mix,” he continues. “Such a high demand for sand and aggregate mix is for use in road construction (road and motorway network), which is approximately 60% complete, as well as for road investments carried out by local governments. For gravel aggregates (gravel), demand is generated mostly by producers of concrete products, including ready-mixed concrete. In recent years that demand was estimated at about 45 million tonnes/year.”

Asked about commercial opportunities for Caterpillar in the Polish market, Wojtanowski says: “In quarries, machines work in cycles. The repeatability of the cycles allows us to work out the cost per hour of a working set of machines and compare their efficiency to provide a cost per tonne of material from the loading face to the primary crusher hopper.

“The cost per tonne is one of the most important parameters for our customers. They know that with Cat machines they can achieve the lowest cost per tonne thanks to high productivity, durability, and uptime. The Total Maintenance & Repair contracts (TM&R) we provide include the regular maintenance, inspections, and preventive repairs of Cat machines. Bergerat Monnoyeur is increasingly delivering more of those solutions and our Service Department is well prepared to support the demand.

“Another important parameter in the cost per tonne is fuel consumption and fuel efficiency (litres per tonne). In quarry applications, Cat machines are extremely fuel-efficient. Bergerat Monnoyeur (Poland) together with Caterpillar can guarantee a maximum fuel consumption for each machine in a specific application with specific performance and idling ratio.”

Commenting on specific large construction projects fuelling Polish aggregates demand, Machniak says: “The largest investment is undoubtedly the Central Communication Airport. However, there is considerable resistance in the towns and villages both with the airport itself and with the railway connections and this may have a significant impact on the original construction schedule. The investment may extend over time, which means that the generated annual demand for aggregates will not make a significant difference on the aggregates market. For the aggregate market it is important that the investment in the basic network of motorways and expressways continues and that there is investment stability from local government.

“Road construction is estimated to use approximately 110-120 million tonnes. Building construction is in second place, generating a demand for about 60 million tonnes of aggregates, only for the construction of buildings.

“We are at the beginning of the new EU financial plan. Historically, we need around two years to achieve a good level of spending. So, the visible effects are not expected until around 2024. In the present situation, the resources from the NextGenerationEU (NGEU) - in Polish KPO - Krajowy Plan Odbudowy) – are an absolute priority.”

Looking ahead to the next 18 months and the major developments set to impact on the Polish quarrying and aggregates sector, Machniak says: “The situation is dynamic and basically unpredictable. It is difficult to talk about forecasts. It could negatively impact the production of concrete (ready-mix).

“This year and 2023 will be difficult for aggregates producers because of the war in Ukraine. Producers face rising production costs and a declining demand. The price of fuel and energy is breaking all records, and this will undoubtedly impact the economic situation. Apart from the high prices, the fluctuation is disturbing and makes it impossible to plan and evaluate deliveries with future deadlines. The greatest concerns are related to continuing to keep large infrastructure investment projects going. Those projects represent a significant part of the portfolio for aggregates producers. We are also starting to notice a slowdown in home building and general construction. In the first half of 2022, it was approximately down by 20% than in the corresponding period of 2021, but at a comparable level to 2020 and 2019.

“Currently, the transport of coal from ports and agricultural products from Ukraine by train is a priority. In the previous years, around 45 million tonnes per year were transported by rail and it therefore raises concerns about the timely delivery of aggregates. At the start of the war in Ukraine, the import of crushed aggregates from Ukraine and Belarus was stopped. The quantities imported in recent years amount to approximately 1.5 million tonnes. However, that can be easily replaced with domestic production. That situation will have no global impact in the aggregate market, however in case of regional market (in Eastern districts) it has forced a change of direction of the supplies.”

Powerscreen, one of the world’s leading crushing, screening, and conveying equipment manufacturers, has appointed IRCAT as its authorised distributor for Romania, an 85mn tonnes/year plus aggregates market.

IRCAT will provide full coverage in this territory including Powerscreen machine sales, spare parts and service support.

Powerscreen, a Terex Materials Processing brand, says IRCAT, which was established in 2003 and is headquartered in Bucharest, has a reputation for providing high performance equipment solutions and professional aftersales support to end customers across Romania.

IRCAT’s Adrian Dragomir says: “For almost 20 years we have continuously grown our business based on high-quality products and strong partnerships. Now we are honoured to represent Powerscreen in Romania. We believe that the high-performance solutions and their corporate culture aligns with our business goals, and that the results of our collaboration will be increasing customer profits and satisfaction.”

In addition to the sale and support of Powerscreen equipment, IRCAT has taken advantage of a flexible stocking line from Terex Financial Services.

The demand for aggregates and other construction materials in Czech Republic and Slovakia is steadily growing despite prolonged COVID-19-induced disruption.

Michael Junge, chairman of Czech Republic-based aggregates producer EUROVIA Kamenolomy (part of the EUROVIA CS Group), says that despite the pandemic, 2020 was a record year for the company in terms of sales in the domestic market.

The company is a leading player in the Czech aggregates market, managing 26 facilities, including 21 quarries and two sand pits. Junge estimates the current annual demand for aggregates at 40mn tonnes in the Czech Republic and 28mn tonnes in Slovakia. According to other industry experts, those annual demand volumes are impressive given the toll COVID-19 has had on the neighbouring nations.

Rudolf Mackovicˇ, managing director of Zväz výrobcov cementu Slovenskej republiky (The Slovak Cement Association), tells Aggregates Business that the country’s cement production is back to pre-pandemic levels.

Many Czech and Slovak aggregates producers expect to see an increase in sales due to new national and regional infrastructure projects that are part or largely funded by the €750bn (€806.9bn as of November 2022 prices) NextGenerationEU recovery fund, designed to help Europe's economies and societies recover from the pandemic.

Despite its geopolitical challenges and amid understandable concerns over how a still-to-be-defeated coronavirus will react to the onset of winter, the Eastern European aggregates sector has some grounds for optimism going into 2023.