Construction industry demand for big-volume mineral products like aggregates and concrete showed resilience in the first quarter of 2021, despite renewed COVID-19 lockdown restrictions, Brexit and particularly wet winter weather hampering activity.

The latest survey from the UK Mineral Products Association (MPA) warns that an encouraging start to the year should not distract from real challenges that lie ahead.

The MPA says the recovery in construction must not be taken for granted because so much depends on the government’s policy stimuli in housing and its delivery of the UK’s planned infrastructure programme. ONS data shows that construction output has flatlined since September, whilst new contract awards have been weak for most of the past year.

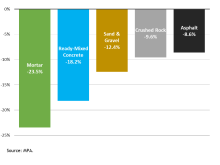

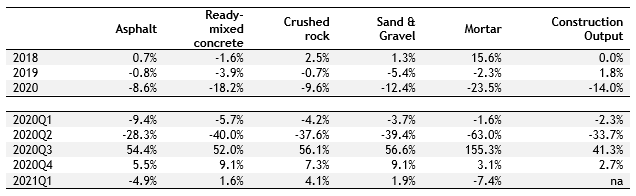

Whilst broadly positive, sales volumes for essential mineral products show mixed results for heavy-side building materials such as aggregates, ready-mixed concrete, asphalt and mortar. These core products are mostly used in the early stages of construction — for example, foundations and structures — so their sales provide a unique barometer for the start of new projects rather than the completion of finished ones.

In the latest MPA survey, building materials manufacturers who supply around one million tonnes of mineral products every day reported a slow but steady start to the year, with construction demand in March much stronger than in January. Sales volumes for primary aggregates and ready-mixed concrete increased by 3.4% and 1.6%, respectively, in the first quarter of 2021 compared to the last quarter of 2020. Still, both asphalt and mortar sales volumes declined over the quarter, down 4.9% and 7.4%, respectively. Robust housing activity, particularly in landscaping and home improvement, and an acceleration in infrastructure work driven by Highway England’s roads programme and the HS2 rail project, were tempered by a combination of factors, including supply-chain disruptions, rising COVID-19 infections and a particularly wet winter affecting work on site.

Longer-term recovery for asphalt is supported by renewed momentum in roads construction and maintenance, and market demand has rapidly recovered to pre-pandemic levels. At the start of the year, total sales volumes for asphalt were significantly higher than their previous five-year average (2014-19). Likewise, sales volumes for crushed rock aggregate have also been recovering well, boosted by roadworks and HS2, driving demand for asphalt and bulk-fill materials.

Aurelie Delannoy, director of economic affairs at the MPA, said that a balanced perspective is required: “Mineral products manufacturers are busy supplying post- lockdown, pent-up demand, particularly for domestic activity such as landscaping, repair and maintenance, and home improvements, as well as infrastructure projects already in the pipeline, including momentum building on HS2.

“The outlook for this year and next is also positive, but the stakes are high. Any optimism assumes activity is not disrupted by renewed outbreaks of COVID-19, and most importantly, relies on the government delivering on its planned infrastructure commitments.”

The MPA says the weak recovery path for ready-mixed concrete is a concern, and is likely to be held back by a combination of sluggish new housing activity and a lack of new projects in commercial construction. Over 60% of ready-mixed concrete is used either in new housing or other non-infrastructure projects, mostly in commercial buildings, with London and the South East representing a third of all sales. The total sales volume of ready-mixed concrete at the start of the year remained more than 9% below the previous five-year average, despite three consecutive quarters of growth since last year’s initial lockdown.

In May, aggregates and building materials supplier Hanson informed customers that it would be reducing allocations of bagged cement due to the UK’s current cement shortage.The company said the main factors causing the shortage have been a huge increase in demand across the UK cement market, cement plant shutdowns during the COVID-19 pandemic, and shortages in the availability of both haulage and packaging/pallets.

Packed products director Andrew Simpson said that Hanson is looking to increase capacity by importing cement, although this is difficult as the increase in demand is global and there is reduced availability of shipping.

Hanson says that the cement market has seen an increase of around 30% across all sectors since mid-2020, and that this is unprecedented as the market normally fluctuates with high levels of activity in one sector being counterbalanced by lower levels in others.

The bulk cement market consumes roughly 80% of total cement production and Hanson Cement has an even split between bulk and packed cement. The main sectors for cement usage are ready-mixed concrete, concrete-product manufacture, construction site activity and builders’ merchants.

Also part of the fallout from COVID-19 was the postponement of Hillhead, the UK’s biggest quarrying, construction and recycling equipment event. Originally scheduled for 22–24 June this year, the event is now slated for 21-23 June 2022 at its usual site in a former Tarmac quarry near Buxton in Derbyshire. As part of the ‘new normal’ following the pandemic, event organiser The QMJ Group, for the first time, staged the exclusively online Hillhead Digital event, which attracted 4,988 attendees over two live days from March 30-31.

Adam Benn, director, capital sales, North EMEA, Russia & CIS and Southern Africa at Metso Outotec, says that quarrying and aggregates markets in both the UK and Ireland were impacted heavily in the early days of COVID lockdown in Q2 2020, with many operations having to close temporarily.

“Once the initial challenges were understood and new COVID protocols introduced, the ‘rebound’ was, on the whole, a positive one with the majority of the aggregate producers reporting surprisingly solid production figures, all things considered, but generally down about 10% year-on-year,” Benn says.

He adds that the busy end to 2020 has continued into 2021 with a very positive sentiment in terms of business levels, and in fact shortages of cement and some bulk aggregates in certain regions.

“The current demand is expected to continue in the short to medium term albeit with cautious optimism especially with regards to longer term outlook,” Benn says.

He adds that, in general, the demand for aggregates as a result of road and infrastructure activity is positive, although dependant on rate of spend over the next few years and the potential reduction in investment/government budget as a result of the impact of COVID.

“Building products in particular have enjoyed a busy period and are facing longer than normal lead times in some areas due to strong house-building activity and in particular the increase in home-improvement projects during the various COVID lockdown periods,” says Benn.

The UK’s HS2 rail project should significantly increase the demand for quarrying and aggregates machinery over the next few years, according to Kenny Price, regional sales manager for EMEA at Terex Trucks.

He says this should provide good business opportunities for his company: “In the first stages of the project, articulated haulers such as our TA300 and TA400 could be used for preparatory tasks and transporting materials before the main construction work can begin. This includes jobs like vegetation clearance and earthwork for tunnel portals and compound facilities.”

He added that, with rail projects always requiring the use of track ballast, the demand for a range of aggregate materials will increase as well.

“A project of this size is a boost for everyone involved in the supply of equipment, materials, as well as services and allows those companies to plan with a more sure-footed outlook,” Price says.

Manufacturers of hauling trucks for quarries felt the impact of the pandemic, especially in the first half of 2020 when global demand for equipment sharply declined. Price says that in 2019, more than 400 articulated haulers were sold in the UK in total, but in pandemic-stricken 2020, sales decreased by almost 50%. Around the end of March 2020, in line with its parent company the Volvo Group, Terex Trucks temporarily suspended production at its facility in Motherwell, Scotland, to ensure the health, safety and wellbeing of employees.

Price says that demand returned in the second half of 2020 and the recovery feels like it is well underway.

“Our order book is strong and we’re currently recruiting new team members to match the increase in production, so I’m expecting a good year,” he adds. “In Q1 2021, we’ve already seen very encouraging signs in the articulated hauler market in the UK and Ireland. Machine sales are on an upward trend after a challenging 2020, and the outlook for the rest of the year and into 2022 is positive. We’ve also had a really good order take-up for our new Stage V machines.”

In terms of future aggregates-industry prospects, an interesting area is the UK government’s proposed overhaul of the UK planning system, announced in the 2020 White Paper ‘Planning for the Future’. The proposals were set out in the Queen’s Speech in March 2021 and could lead to a sharp rise in building material demand through the construction of more high-quality sustainable homes due to a streamlined and speeded-up planning process.

UK retail sales of construction and earthmoving equipment in March 2021 were close to double the levels seen in the same month last year when the impact of the coronavirus was felt for the first time.

As a result, sales in the first quarter were 30% above 2020 levels and reached over 8,000 units, according to data published in April by the construction equipment statistics exchange run by Systematics International in partnership with the Construction Equipment Association (CEA).

Sales in the first quarter of the year were expected to show a big increase on last year due to the pandemic, so it is interesting to compare sales with Q1 2019 to put the strength of the recovery into context. This shows that sales this year were 2.9% above 2019 levels and suggest significant momentum in the market in the early months of the year.

Sales in Ireland are also recorded in the construction equipment statistics exchange and saw a more modest increase in March than in the UK. This resulted in Q1 sales this year ending up at 12% above Q1 2020 levels.

According to the latest figures from industry association Irish Concrete, the country’s 500-plus active quarries produced 38 million tonnes of aggregates in 2019, while national production of ready-mixed concrete totalled 5 million m3. Two million tonnes of bituminous road-surfacing materials were produced, 0.75 million tonnes of agricultural lime, and 2 million m2 of paving products.

The Irish Concrete Federation (ICF) and the national Health and Safety Authority (HSA) jointly supported the “Vehicle and Pedestrian Safety in Quarries” Spring Quarry Safety Campaign that took place in Ireland from 1-12 March this year.

The campaign replaced the previous “Quarry Safety Week” that was typically held in the autumn of the year.

Dr Sharon McGuinness, chief executive officer of the HSA, urged employers to lead the way in delivering safer workplaces, saying: “Since 2011, four people have lost their lives in quarries and many more have suffered serious, debilitating injury which is why Quarry Safety Week is so important – we need people to return home safely from work.”

As part of the campaign, the HSA carried out safety inspections at ICF member quarries, and ICF and HSA are presenting online briefings for quarry management, supervisors and safety officers on topical issues related to vehicle and pedestrian safety.

Irish equipment distributor McHale Plant Sales has called for the country to consider new tax relief on investments in plant and machinery, similar to those recently introduced by UK Chancellor of the Exchequer, Rishi Sunak. The appeal was made in a letter from the company to Finance Minister Pascal Donoghue. McHale, based in Birdhill and Rathcoole, represents quarrying and construction equipment manufacturers Komatsu, Metso Outotec, Terex Ecotec and Merlo in Ireland.

The new UK regulations, operative from April, include a provision that companies investing in qualifying new plant and machinery assets can benefit from a new temporary tax arrangement that delivers a 130% first-year capital allowance. McHale says this is greater in many cases than the purchase price of the machinery itself.

Designed to stimulate business investment, the measure increases the incentive to invest in plant and machinery by offering higher rates of relief than were previously available.

UK HM Revenue & Customs says the measure is expected to bring economic benefits. In explanatory information accompanying its introduction, it states that the new arrangement “will have a positive impact on business investment...by reducing the tax-adjusted cost of capital for millions of companies, large and small, investing in qualifying plant and machinery assets”.

In the letter to Minister Donoghue, McHale Plant Sales finance director Liam Foley expressed his company’s support for the measure, and encouraged the Irish government to introduce a similar provision “in its next Budget or at such earlier opportunity as may present”.

“In circumstances whereby COVID-19 has brought about a halt to major infrastructural development and a virtual closure of the house-building and construction sectors – with all of the consequential losses this has brought to companies operating in the plant and machinery business - the introduction here of an equally attractive provision would be one that would bring great benefit and stimulate employment in the sector,” Foley said.

“Moreover, it would level the playing field between here and Northern Ireland and remove any cross-border sales and marketing imbalances that might arise and could impact negatively on locally-based distributors.”