FMI adds many construction materials (CM) buyers started 2021 with well-structured balance sheets and access to low-interest debt. Election results are signalling the anticipation of new federal infrastructure funding, with CM operators poised to benefit.

On January 14, then President-elect Joe Biden released his plan for a US$1.9 trillion stimulus package. According to Bloomberg, “economists see much to like in Biden’s stimulus [plan], even if imperfect.” Public companies in the sector are seeing boosts in their stock values, encouraging an acquisitive atmosphere. The promise of capturing future earnings through solid economic fundamentals creates an attractive landscape for mergers & acquisitions (M&As) in the CM sector.

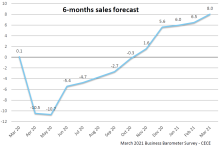

FMI says the results of this momentum for the construction materials sector will likely be seen in full force later in 2021, depending on the timing of infrastructure spending and the rollout of vaccines. For M&A activity, the momentum began during the second half of 2020 and is expected to accelerate into 2021 as the industry buyers see long-term improvement in the construction markets, driving performance.

George Reddin of FMI commented: "The last 12 months have brought a battle of unique challenges, including economic distress, severe weather and political upheaval – all set against the backdrop of a global pandemic. This 'black swan' event triggered a freefall across society, and the subsequent economic toll impacted every industry, including Construction Materials (CM – including crushed stone, sand, gravel, hot mix asphalt and ready mixed concrete)."

Assessing the impact of Covid throughout 2020, Reddin says that despite the fact that the industry was deemed essential, construction materials was still affected by the pandemic.

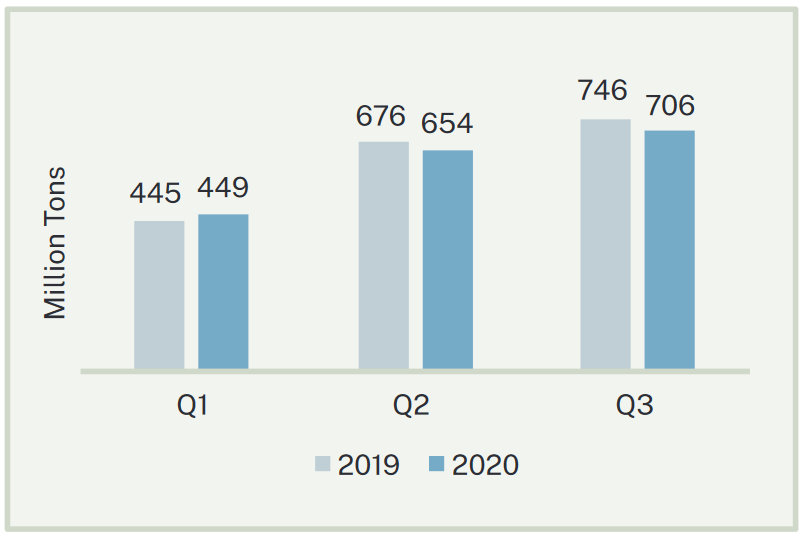

Aggregate producers were negatively impacted and the US Geological Survey reported a fall of 660 million tonnes in the amount of construction aggregates that was produced in the second quarter of 2020, a 3.2% year-on-year decrease from Q2 2019.

FMI predicts that the 2020 election results will likely have both positive and negative impacts on the US construction materials industry. On the plus side, the federal government should have more capital for road and infrastructure projects as part of President Biden’s “Building Back Better” platform.

Conversely, increasing corporate taxes results in lower cash availability for firms. On Martin Marietta’s third quarter earnings call, CEO Ward Nye’s assessment was that “[if] Mr. Biden is elected... [with a] Democratic-controlled House... [we are] looking at a 41% increase in highway spending.”

Nye added that increased regulations and taxes could spur M&A activity in the CM sector because “closely held kind of businesses start reconsidering...their long-term future.”23 Should the new administration’s control result in more stringent regulations, the results will be mixed for Construction Materials. Regulations often require further investment in equipment, raising CapEx requirements. However, FMI says that from a market standpoint, this often rewards strong, cash-positive businesses by creating new barriers to entry and operating hurdles for competing businesses.