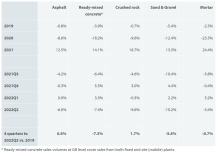

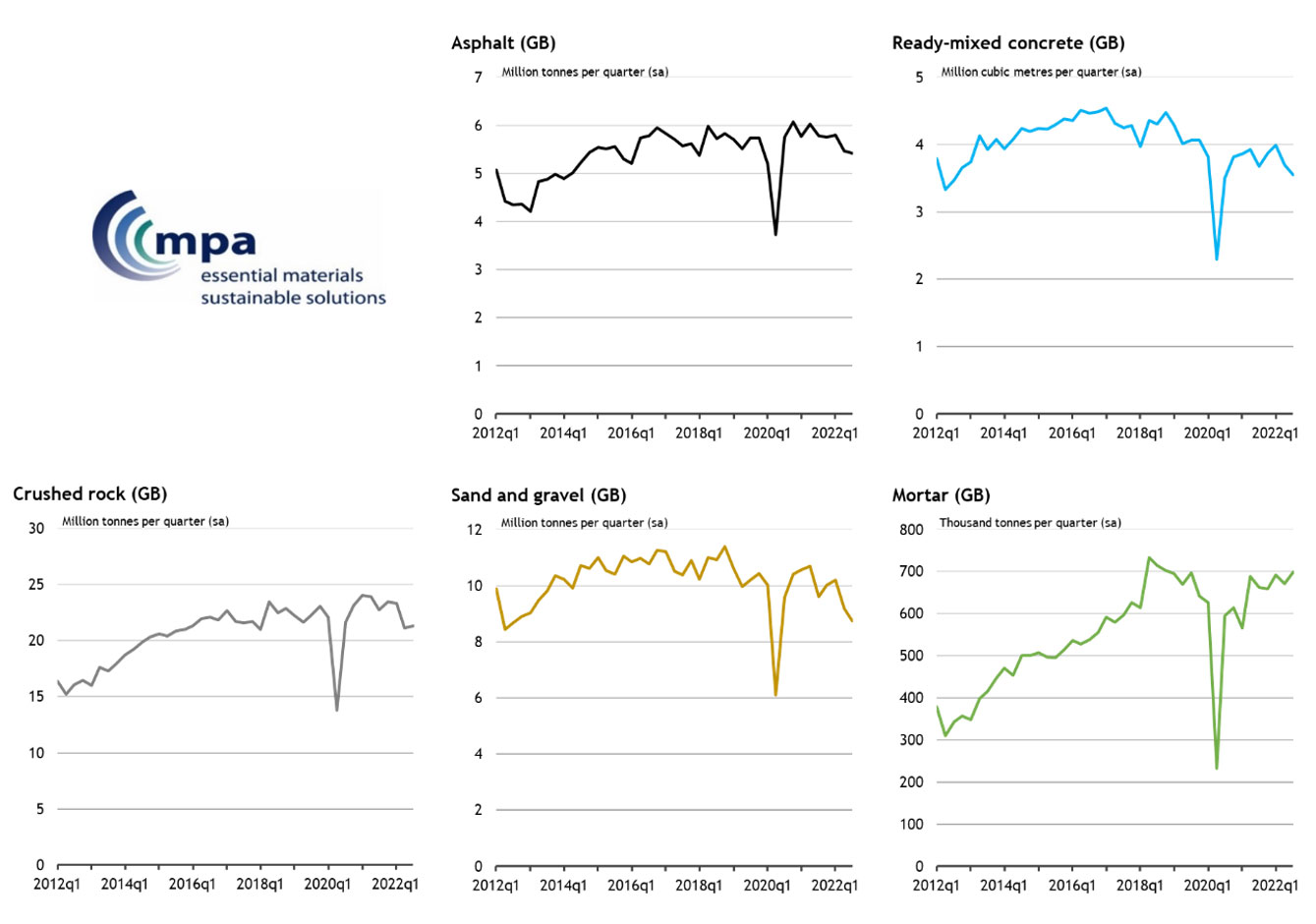

The MPA's latest quarterly survey shows that the demand for aggregates, asphalt and ready-mixed concrete, declined for a second successive quarter in 2022Q3.

MPA members supply around 90% of the total market for minerals and mineral products in Great Britain, predominantly to the construction industry. These materials are needed in the early phases of construction projects, forming the foundation and structure for roads, railways, housing, commercial and industrial developments, as well as key national infrastructure including for energy and water.

The association says that the essential requirement of these materials in construction means that the tonnage sold provides a crucial gauge of the construction sector’s wider health. Whilst softer growth in sales volumes was expected this year following the sharp covid-related recovery in 2021, the downward correction has been deeper and occurred more quickly than anticipated. The decline in demand over the summer suggests that a more widespread cooling in construction activity may already be underway.

The latest 2022Q3 survey revealed that sales volumes for primary aggregates (quarried crushed rock, and land-based and marine-dredged sand and gravel), as well as for asphalt and ready-mixed concrete were not only down on 2021, but also below their 2019 levels. Over the past year compared to 2019, aggregates sales have fallen 2.3%, asphalt by 1.1% and ready-mix concrete by 10.1%.

Momentum in mineral products demand dropped off markedly from June, with the main concern being that widespread cost inflation throughout the construction supply chain may have started to negatively impact on demand. An otherwise solid pipeline of future construction projects is being hindered by the unprecedented cost pressures for energy, raw materials and labour, and paving the way to a wider industry slowdown.

Most sectors of construction are vulnerable to the impact of cost increases and a wider economic slowdown, whether directly or indirectly. Directly, surging cost inflation and higher borrowing costs negatively impacts on the commercial viability of future projects and undermines household incomes. Indirectly, investment decisions are also held back by lower business and household confidence.

The MPA says that, as a result, whilst demand for mineral products continues to be supported by activity on major infrastructure projects and in housebuilding, broad weaknesses are starting to emerge.

Within aggregates, sand & gravel sales have been muted across all English regions and devolved administrations due to languishing sales of ready-mixed concrete, which accounts for around two-thirds of total sand and gravel demand. Ready-mixed concrete demand has been held back by subdued appetite for big office and retail projects in recent years, due to heightened economic and political uncertainty. Sales of sand & gravel and ready-mixed concrete remain well below pre-pandemic levels and have drifted further down in the past year.

Crushed rock sales are also weaker than they were a year ago. HS2 and road projects have bolstered demand for crushed rock as fill material and in the manufacture of asphalt, but road upgrades and maintenance work is now under considerable pressure from rising costs, especially given already strained Local Authorities' budgets. In the past year, both asphalt and crushed sales have declined by around 5%.

Mortar sales by contrast are largely driven by housebuilding activity, with high property prices having helped drive an upturn in new housing starts in the first half of 2022. As a result, mortar demand in the past 12 months resulted in sales volumes exceeding pre-pandemic levels (+0.6%). However, whilst current housing activity remains robust, the cost of living crisis and increases in interest rates are chipping away at confidence and hampering next year’s prospects.

Luke George, economic and policy analyst at the MPA, warned that the reduction in demand for minerals is expected to continue in the final months of the year and into next year: “The slowdown in mineral products sales volumes over the summer reaffirmed that the confidence loss in June has become more entrenched. Prospects for the UK economy and construction activity look bleak given major headwinds from high inflation and the new Government’s fiscal U-turn, which will almost inevitably lead to higher taxes, lower spending and lower confidence.

“We still expect that major projects like HS2 and investment in new energy infrastructure will help to support demand for minerals and mineral products in the medium term, albeit government backing for new capital projects cannot be guaranteed as the Treasury seeks billions of pounds in spending cuts. The need to balance the books is well understood, but as we have seen since the aftermath of the financial crisis in 2009, cutting capital infrastructure spending can create longer term structural imbalances in the economy and impact on growth delivery."

George added that sectors most closely linked to household incomes, such as new private housing and home improvement, will be vulnerable with interest rates at their highest level in 14 years. He said the current economic backdrop is not conducive of new investment and big financial commitments.

Aurelie Delannoy, director of economic affairs at MPA added: “Unprecedented uncertainty at the heart of Government’s policy is an unhelpful distraction and potential cuts to capital budgets a drag on industry confidence. A lack of emphasis on planning reforms continues to ignore the MPA’s repeated calls for better delivery of infrastructure projects and the activities that support them, including the extraction of essential construction minerals. Support on energy bills is welcomed, but a lack of stability and longer-term strategic thinking remains a cause of concern for our industry.”