The Cologne, Germany-headquartered company says the outbreak of the war in Ukraine has not harmed demand so far. DEUTZ says its business activities in Russia, Belarus, and Ukraine account for only around €20 million of its total annual revenue. DEUTZ has no branches in Ukraine or Belarus and no direct suppliers based in the crisis-hit region.

“In spite of the outbreak of the war in Ukraine, we increased our revenue by around 21 per cent to €930.4 million. At the same time, we raised our adjusted EBIT margin by 2.4 percentage points to 4.6 per cent. We want to sustain this growth because we still have a long way to go to reach our envisaged target range. But we have taken the first important steps toward achieving this goal, for example, by strengthening our focus on disciplined cost management,” said CEO Dr. Sebastian C. Schulte.

“Our orders on hand totalled more than three-quarters of a billion euros at the end of June and were thus at a very high level. This means that we are tackling the coming months from a solid position. Nonetheless, our full-year guidance is still subject to change. The supply situation remains challenging, and the geopolitical implications of the war in Ukraine are very uncertain. The trajectory of macroeconomic conditions is a cause for concern and highlights once again that we need to make DEUTZ even more resilient to economic downturns. However, we are making good progress on this front.”

As well as a healthy operating performance, DEUTZ reached further strategic milestones. At the start of 2022, the company initiated a multi-phase strategy process called Powering Progress to secure its long-term competitiveness. Its objectives include improving the company’s commercial performance and technological capabilities. To this end, four priority areas of action were defined together with a range of sub-initiatives, such as passing on increased costs to customers in the short term in the form of multiple rounds of price increases and establishing a process to completely overhaul pricing in the Classic business.

DEUTZ says an aim for 2022 is to implement price increases of between 8 and 12 per cent for the new engine portfolio. DEUTZ also set itself the target of increasing the amount of annual revenue generated by its high-margin service business to over €500 million by 2025 through both organic growth and growth by acquisition. Two initial acquisitions for the service business were made at the start of May, with DEUTZ acquiring its former service partners AUSMA Motorenrevisie B.V. (Netherlands) and South Coast Diesels (Ireland). The two companies sell and service diesel engines in their home markets, operating as multi-brand dealers.

The newly launched strategy programme also aims to accelerate the development of alternative drive solutions. At the end of June, DEUTZ reached a key milestone on the path toward preparing its TCG 7.8 H2 hydrogen engine for volume production. An H2 genset has gone into operation in a joint pilot project between DEUTZ and Cologne-based energy provider RheinEnergie. The combination of a DEUTZ hydrogen engine and a generator will deliver electric power of up to 170 kilovolt-amperes during the initial six-month test phase. This electricity will be fed directly into the local power grid. In a second step, the genset’s waste heat is to be utilised. The solution being piloted by DEUTZ and RheinEnergie has huge potential for the local, carbon-neutral supply of energy in urban centres. With an output of around 200 kilowatts, the hydrogen engine is generally suitable for all current DEUTZ applications. Volume production of this engine model is scheduled to begin in 2024.

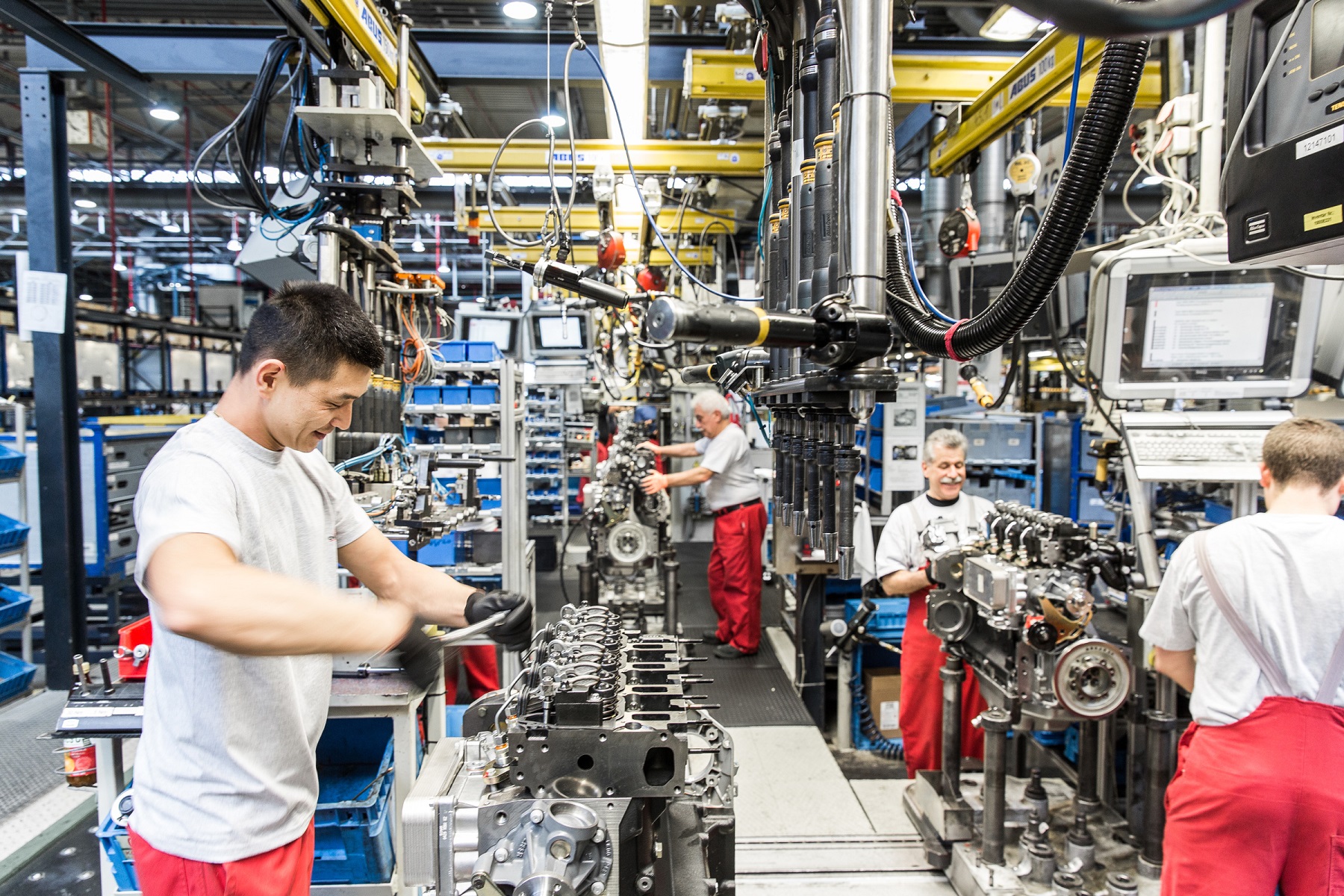

Having sold a total of 108,741 engines, the DEUTZ Group grew its unit sales by 16.1 per cent in the first half of 2022 with the two largest sales regions, EMEA and the Americas, contributing double-digit percentage growth. Unit sales of DEUTZ engines rose by 19.9 per cent to reach 90,462 engines sold. Unit sales of electric boat drives at DEUTZ’s subsidiary Torqeedo were slightly higher year on year at 18,279 (H1 2021: 18,196 electric drives). All the major segments generated significant growth, with Material Handling making the largest contribution to unit sales growth in absolute figures.