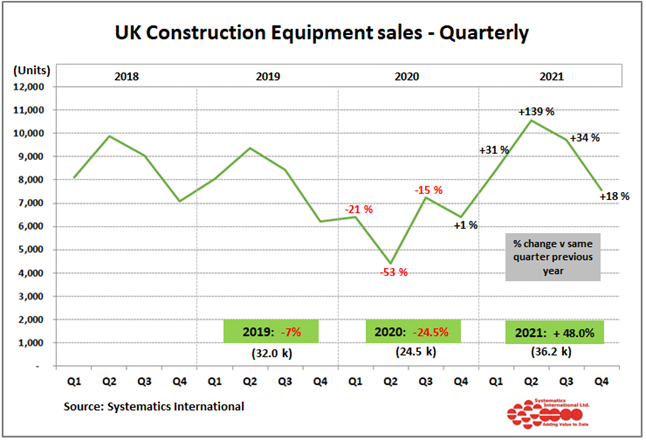

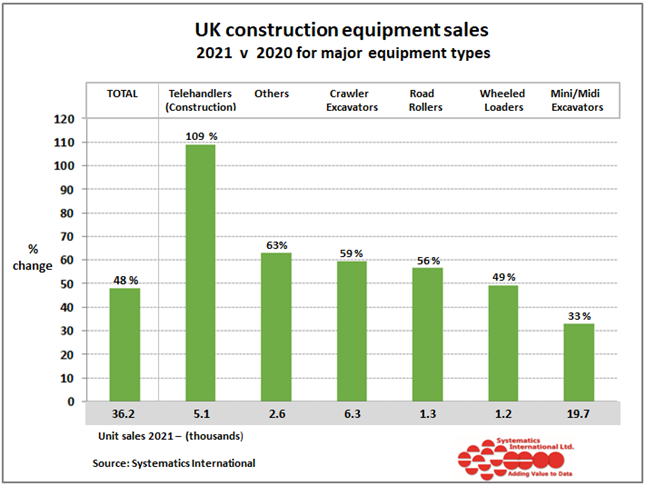

As a result, sales for the whole of 2021 finished the year at 48% above 2020 levels. They reached over 36,000 units for the equipment types covered in the construction equipment statistics exchange, according to the latest figures and analysis from the UK's Construction Equipment Association (CEA). This means that sales last year exceeded the levels reached in 2018 and 2019, which were reported as being peak levels for the industry since before the financial crash in the decade before. This is consistent with comments from many CEA members who have said that 2021 was a record year for product sales.

Telehandlers for the construction industry saw the strongest growth, with sales reaching more than double the 2020 levels. In contrast, the weakest sales were experienced by mini and midi excavators up to 10 tonnes. The rate of increase fell back to 33% in 2021, after being the strongest growing product in the previous year.

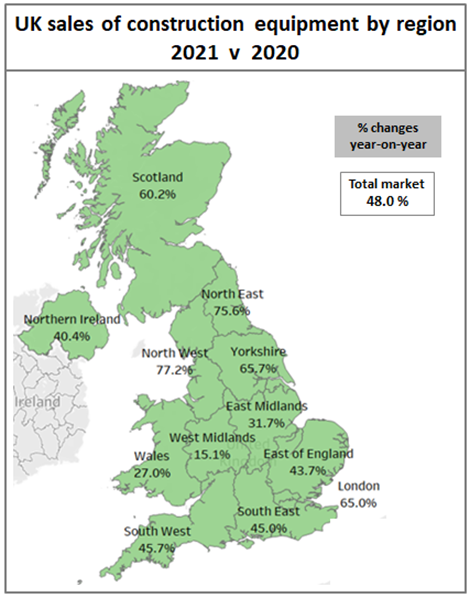

Systematics International runs the construction equipment statistics exchange with the Construction Equipment Association. It covers sales on a regional basis in the UK and Northern Ireland.

Overall, sales were the strongest in England's North West and North East, at over 75% above 2020 levels. In contrast, the weakest sales were experienced in England's West Midlands, at only 15% above the previous year's levels.

Equipment sales in the Republic of Ireland are also reported in the statistics exchange, separate from UK sales. Sales in the past two quarters of 2021 were similar to the previous year. They recorded modest increases of around 2% for both quarters on sales in Q3 and Q4 of 2020. However, after experiencing strong sales in the first half of last year, sales for the whole of 2021 finished at 26% above 2020 levels.

Commenting on the latest figures, CEA CEO Suneeta Johal said: "The latest statistics have revealed that sales maintained their strength in the closing months of the year and were 18% up in Q4 compared with the last quarter of 2020, which is very positive news for our sector. As a result, sales for the full year ended up at 48% above 2020 levels and exceeded 2018 and 2019 levels.

Commenting on the latest figures, CEA CEO Suneeta Johal said: "The latest statistics have revealed that sales maintained their strength in the closing months of the year and were 18% up in Q4 compared with the last quarter of 2020, which is very positive news for our sector. As a result, sales for the full year ended up at 48% above 2020 levels and exceeded 2018 and 2019 levels.

"The increase in demand for telehandlers and larger machines can be attributed to major infrastructure projects such as HS2. The construction equipment sector is thriving and supporting the government strategy for growth."