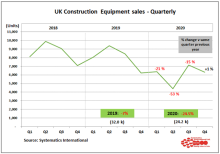

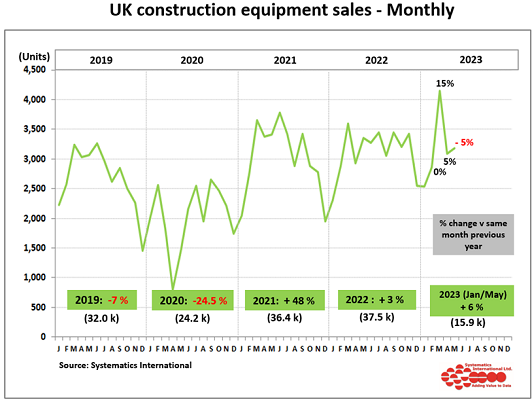

Sales this year were 5% below May 2022 levels and took sales in the first five months of the year to 15,900 units. This is still nearly 6% above the levels seen in the same period last year but has fallen from a 9% increase reached after the first four months of the year to April.

A slowdown in sales has been expected and is consistent with comments made by some members at the recent Plantworx show at The East of England Arena in Peterborough that the market is showing signs of easing back after seeing record levels of activity last year and in the early months of 2023. Further modest reductions are expected in the second half of the year in anticipation that overall equipment sales this year will fall behind 2022 levels.

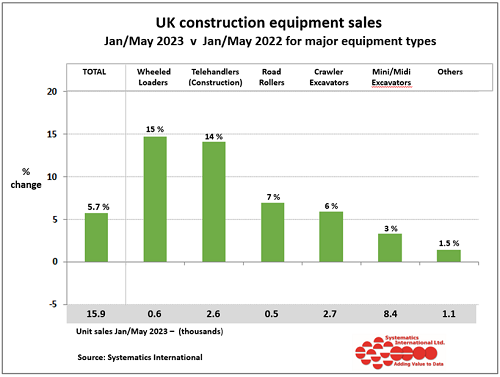

The pattern of sales for the major equipment types is shown in the second chart below, comparing sales between January and May this year with the same period last year.

This shows percentage changes in sales for the different machine types. At this stage, wheeled loaders show the strongest growth across the first five months of the year at 15% above last year's levels. Product sales have been showing a changing pattern in recent months, with Road rollers showing the strongest growth after four months and Crawler excavators being the strongest in the first quarter. However, one feature consistent in recent months has been the modest growth shown by the most popular product in the UK market, mini/midi excavators. This product remains near the bottom of the ranking with only 3% growth after the first five months, compared with 2022.

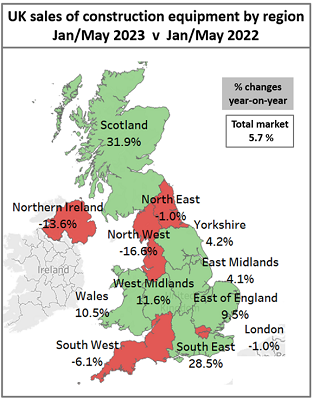

The pattern of sales on a regional basis in the UK and N Ireland is shown in the map below for the first five months of the year compared with the same period in 2022.

This continues to show a mixed pattern across the regions. This year's strongest sales are still in Scotland and the South East of England, where sales remain around 30% ahead of last year's. Similarly, the weakest sales remain in the North West of England (-17%) and Northern Ireland (-14%).

Equipment sales in the Republic of Ireland are also reported in the statistics exchange. Sales in May were at the same level as 2022. As a result, sales in the first five months of the year are 2.6% above last year's levels.

Systematics International Ltd runs the construction equipment statistics exchange. This scheme partners with the Construction Equipment Association (CEA), the UK trade association.