The post-2007 recovery in the ready mix concrete market has started to erode over the last two years, as the impact of Brexit and a general slowdown in the construction market have started to take effect.

During the middle part of this decade the ready mixed sector recovered a significant amount of the ground lost as a result of the 2007 recession, returning to annual outputs of more than 25 million m3.

The leading five companies continue to account for over 60% of the total market but a new report from

June 24, 2019

Read time: 2 mins

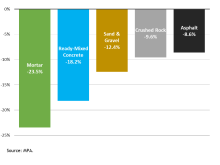

The post-2007 recovery in the ready mix concrete market has started to erode over the last two years, as the impact of Brexit and a general slowdown in the construction market have started to take effect.

During the middle part of this decade the ready mixed sector recovered a significant amount of the ground lost as a result of the 2007 recession, returning to annual outputs of more than 25 million m3.

The leading five companies continue to account for over 60% of the total market but a new report from 671 BDS Marketing Research has found that this share is declining as independent producers account for more of the new plants constructed in recent years. Additionally, the share accounted for by the on-site batched (volumetric) sector has continued to grow and is now thought to exceed 10%. The report predicts this sector is set for some degree of change in the coming years following the introduction of new regulations introduced by the Department of Transport last year.

The outlook for the industry is still weak in the short term, but growth is expected to return from 2020 as major infrastructure projects start to progress and housebuilding levels improve. The report predicts that pre-recession levels of market activity could be reached by the end of 2022.