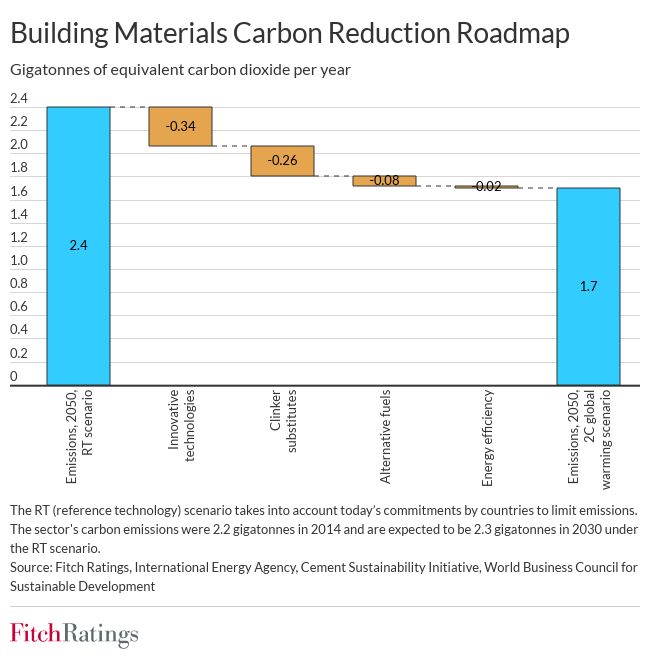

The market analyst says that emissions in the industry are ‘hard-to-abate’ as there is no low carbon solution readily available. However, it expects alternative fuels and energy efficiency to deliver incremental emission cuts in the foreseeable future, with new technologies and substrate composition providing more significant longer-term improvements.

Fitch Ratings adds that such improvements will require significant investment and research, which it expects to be back-end loaded post-2030 to meet more stringent 2050 targets. Capital or operating costs for companies may be significant as a result, with government incentives as yet uncertain. However, due to the very long-term timeline of these changes Fitch does not expect companies’ financial profiles to be transformed within its rating horizon.

The analyst expects cement producers to maintain their ability to pass increased costs on to customers due to the lack of substitutes. Furthermore, it predicts demand for building materials will grow, supported by increasing needs for infrastructure to cope with the transition to a low-carbon economy and the physical effects of climate change.

Up to 60% of emissions in cement production comes from making clinker, one of the main components of concrete, due to a chemical reaction. Those emissions cannot be eliminated by changing energy sources or improved energy efficiency. About a third of emissions are due to burning fossil fuels to heat kilns and less than 10% comes from fuels for mining and transport; these parts of the process may be more amenable to decarbonisation.

Cement (and by association, concrete) production is a key source of carbon emissions, responsible for 7%-8% of the global total. Fitch says it expects regulatory scrutiny and increasingly stringent reduction targets, investor activism with growing ESG considerations and green-funding, as well as societal pressures with end-consumers’ attention on recyclable components to drive environmental changes in the sector.

The industry has made significant progress with an 18% reduction in the global average CO2 intensity of cement production since 1990. However, due to growing demand for cement the sector’s gross emissions have increased by 50%.

Regional efforts to cut emissions in the cement industry vary. China and India are by far the largest global concrete producers (55% and 8%, respectively) and their actions carry significant weight. China’s Provincial Emission Trading Schemes have been in operation since 2013, and a national system, covering the cement industry, could be implemented shortly. Government regulations have evolved, including new requirements for dry-process modern kilns, excess heat recovery and lower clinker content.

Fitch states that Europe’s decarbonisation regulations are, and most likely will remain, the most demanding. The cement sector has been a major beneficiary of free carbon allocations under the EU Emission Trading System, which are likely to be reviewed to align with the 2030 emissions reduction targets. The cement industry in the US will attract increasing scrutiny given the new administration’s greater focus on ESG.

Several strategies could help introduce incremental emission cuts in the cement production process. Promoting material efficiency may reduce a clinker-to-cement ratio by substituting some of the clinker with alternative materials, such as fly ash, limestone or slag. Switching to lower-carbon fuels, such as sewage sludge, waste oil and biomass, instead of coal, natural gas or fuel oil could cut emissions from fuels used. Furthermore, energy efficiency could be improved by replacing all wet-kilns with the modern technologically advanced dry-kilns or similar upgrades.

However, Fitch says the most notable difference could only be made by advanced process and technology innovations, which are not yet commercially available at scale. These include carbon capture and storage technologies, capturing carbon generated during clinker production, or next-generation cements that may reduce clinker-related emissions.