The big drive to meet China Nonroad Stage IV emission standards is creating eye-catching competition among the world’s leading off-highway machine engine manufacturers, many of whom are benefiting from far more encouraging global trading conditions. Guy Woodford and Liam McLoughlin report.

It has been a good trading year for

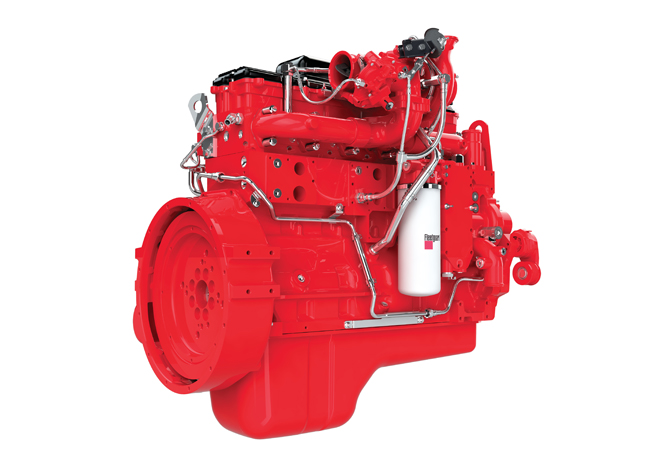

Looking forward to celebrating its centenary in 2019, the Columbus, Indiana-founded and globally headquartered Cummins has 58,600 employees worldwide and develops, designs and manufactures products in six continents. The company is a long-standing engine provider for loaders, trucks, dozers and other machines manufactured by some of the world’s biggest construction and quarrying original equipment manufacturers (OEMs) including

The 75kW to 320kW range of Cummins new Stage V engines comprises the F3.8, B4.5, B6.7 and L9 models, with the B6.7 and L9 currently in production at the Darlington plant. Each Stage V engine is said to offer on average 20% more torque and 10% more power than its predecessor; higher reliability and availability, and easier packaging through a lighter and more compact product design. Oil servicing with the new Stage V engines is every 1,000 hours, up from 500 hours for Stage IV power units. The Stage V engines are also said to be simpler and easier to install than their predecessors.

Speaking during a recent visit by Aggregates Business to the Darlington plant, Steve Nendick, Cummins marketing communications director, said: “Stage V is a significant engineering and cost challenge for construction and quarrying machine manufacturers. Many of the top OEMs build their own engines, but there are gaps in their ranges that Cummins can help fill.”

Commenting on future trends within diesel engine manufacturing for construction and quarrying machine markets, Nendick said: “Stage V has followed the automotive emissions regulations and brought in the particulate count measurement to significantly improve air quality. Whilst there is no clear direction from the EU beyond Stage V, the automotive standards could point the way. They include ever more stringent onboard diagnostics which monitor the engine system to ensure it meets the regulations for the useful life of the vehicle. If there is a fault, the system alerts the operator to react. If they don’t, the engine capability can be reduced such as a torque de-rate to prompt action.”

Refurbished in 2016, the engine technical centre at the Darlington plant includes 12 state-of-the-art engine test cells plus a vehicle pilot test centre. The cells are used for emissions testing, product performance and durability evaluation, with the capability to test and measure to any global emissions standards. The F3.8 Stage V engine testing is currently in progress there. Around 70% of vehicle testing focuses on heavy- and medium-duty trucks. However, Aggregates Business was told that the ratio of construction/quarrying machine testing is likely to rise in the next few years.

Cummins’ new quarrying machine-suited Stage V power unit range is proving popular with customers. As reported previously in Aggregates Business, the range was successfully showcased at the

The 75-503kW Cummins Stage V power units represent a drop-in power solution for key applications such as crushers, screeners, drills, air compressors and concrete pumps. More than 70% of the power unit’s content is pre-approved for installation, making its integration process simpler, while also reducing customer lead times.

China is Cummins’ biggest and fastest growing overseas market. At bauma China 2018 (27-30 November) in Shanghai, the company unveiled a new powerful and efficient L9 engine meeting China IV emissions regulations. The new 170-300kW unit is said to be ideal for wheeled loaders and crawler excavators working in the vibrant Chinese construction sector.

Since entering the market in 1975, Cummins has delivered more than three million of its Chinese plant-made engines to domestic and overseas customers. The manufacturer and its affiliated entities have invested over US$1 billion in China. This makes Cummins the largest foreign investor in China’s diesel engine industry. Of Cummins’ 1.2 million global customer diesel engine shipments in 2017, around 500,000 were from the company’s Chinese plants.

Cummins has a firmly established national HQ in Beijing, and more than 10,000 employees and over 2,000 authorised Cummins/joint venture (JV) dealers nationwide. Cummins’ Chinese business portfolio includes 19 engine, genset and component plants, two regional tech centres (Wuhan and Wuxi), a national parts distribution centre in Shanghai, four regional distribution centres (Shenyang, Beijing, Shanghai, Xi’an), 16 regional service centres and 33 customer support platforms.

Cummins is a supplier of engines to leading Chinese original equipment manufacturers including

“Perkins engines offer a proven solution to OEMs who are looking to make sure their machines meet not just China NR IV standards but also the highest emission standards in their export markets in Europe and North America,” said Tommy Quan, Perkins director of sales and distribution for Asia.

Perkins’ 1204EA-E44TA and 1206EA-E70TA engine models, specially developed for the Chinese market, are an evolution of the Perkins highly successful U.S. EPA Tier 4 Final/EU Stage V engines. With responsive performance and exceptional power density, the engines are said to support the needs of manufacturers looking to upgrade existing machines with smaller, more efficient engines to meet China NR IV standards.

Among the company’s bauma China display was the Perkins 403EA-17 engine, alongside the Perkins Syncro 3.6 litre, the 4.4 litre 1204EA-E44TTA, the 6 cylinder 2406EA-E13TA and the 6 cylinder 2806J.

Alongside new parts, Perkins customers can take advantage of a new-for-old service plus factory-remanufactured parts carrying a 12-month warranty. Among the options are remanufactured turbochargers, long and short blocks, and now fuel pumps and injectors.

“Our customers are at the heart of everything we do,” said Sophia Xing, commercial manager. “This means making sure they get the right parts at the right price.”

bauma China visitors were also able to see demonstrations of the groundbreaking Perkins My Engine App in its new updated version. The app, which is free and available in seven languages, acts as an electronic service book for owners and operators of Perkins-powered machines with service prompts and quick reference information. Siobhan Scott, marketing manager, said the app has a new user interface with a clean, modern look and feel and many new features designed to make engine management simple.

Volvo Penta, the sister company of Volvo CE, has unveiled a series of engine solutions at the bauma China event that it says meet the country’s new China IV emissions regulations.

The solutions are optimised for tough off-road applications, and are designed to offer ease of installation, operation and maintenance – as well as significantly improved fuel efficiency and lower emissions.

The final version of the China IV regulation has not yet been published but it is expected that particulate numbers will have to be reduced and a diesel particulate filter (DPF) will be required for engines of 37-560 kW. It is also expected that nitrogen oxides will be further limited via selective catalytic reduction (SCR) and that the legislation will come into force in January 2020.

“Environmental care – especially air quality – is a topic that’s high on the agenda of social awareness in China today,” say Giorgio Paris, head of the Volvo Penta industrial segment. “Today there is no requirement for SCR or DPF in China, so this will be a big change, requiring significant investment by OEMs, and we want to make it as easy as possible for them to achieve their aims.”

If China IV legislation is implemented as indicated, Volvo Penta’s new engine platform to meet the standards will cover its engine range from 5-13 litres, with power options from 105 to 405 kW (143-543hp). Each solution features a high-performance engine and perfectly matched exhaust after-treatment system (EATS).

It is expected that legislation for engines over 560 kW will remain at current emissions levels, and therefore not require an EATS or DPF. If this proves to be the case,

“Volvo Penta is committed to offering an engine platform for all customers across any application, and so we will continue to provide the best solutions for the immediate future and in years to come,” says Paris.

The company provides a range of flexible solutions for OEMs and operators, comprising an engine and matched exhaust aftertreatment system. Volvo Penta says its technical experts are also on hand to help in the transition to new engines and emission standards.

“We have a breadth of knowledge of the ways in which emissions legislation around the world affects customers in different regions and so we are able to provide a good offer to customers in China, to ensure their needs will be met,” says Paris.

“As OEMs and operators prepare for China IV standards we will help them adjust, so they are ready to meet the new standards in a productive way. Our global expertise, along with research and development facilities and our focus on working closely with customers, means that we are well placed to understand what they want and how to find a solution to their requirements. We have improved fuel efficiency for our China IV range and operators can be assured that the same high performance they have already with our engines will continue to be a feature of the new models.”

Remaining in China, German off-highway diesel engine manufacturer DEUTZ has sold its 50% stake in DEUTZ Dalian, its Chinese joint venture, to JV partner First Automotive Works (FAW). The parties have agreed not to disclose any commercial details, and the transaction is subject to approval by the Chinese authorities.

Despite ending the long-running JV, DEUTZ and FAW will continue to collaborate on the basis of a customer-supplier relationship. DEUTZ can still procure engines for off-highway applications from FAW upon request. To this end, the two companies have reached an agreement to explore further possibilities for collaboration in future. The withdrawal from the DEUTZ Dalian joint venture is not expected to significantly impact on earnings this year.

“This step allows us to realign our Chinese activities. We are now reorganising our presence in China in order to generate stronger growth and be even more successful there. Talks on new alliances with major local partners in the construction equipment and agricultural machinery industries have already reached an advanced stage,” said chairman of the DEUTZ board of management, Dr Frank Hiller. The company plans to publish further details in the current year.