Responding to a journalist when asked in the early 1960s what is most likely to blow governments off course, Harold Macmillan is purported to have said, "Events, my dear boy, events".

Alistair Horne, the former Tory prime minister’s official biographer, thinks the famous, yet still unconfirmed, quote may have been a response to John Profumo, Macmillan’s secretary of state for War, being found to have lied to parliament and forced to resign from the cabinet in 1963 over the Christine Keeler sex scandal.

The claimed quote is also apt to describe the threat to UK aggregates industry output from significant ongoing events, notably the bitter parliamentary conflict over Britain’s imminent departure from the

Given all the above, it was a good time to catch up with Mineral Products Association (MPA) chief executive Nigel Jackson last month at the association’s Victoria, central London HQ, to get his take on some of the key evolving issues facing the British mineral products sector, a sector worth £20 billion a year in materials sales and services provision to the wider UK economy.

Jackson was speaking just days after the MPA, which represents over 530 companies, had put out a statement calling for all MPs, whether ‘leavers or remainers’, to wake up to the call for the national interest to trump party politics over the coming weeks.

“Economic health is always our number one issue, with or without Brexit. Unless there is sustainable economic growth it’s difficult for companies to plan confidently for the future and invest, and 1.4% [current UK] economic growth per annum is anaemic. It is not acceptable. Historically, we’ve enjoyed growth of around 2.5% per annum. Anything less than 2.5% is lost prosperity, tax, momentum and hope. Therefore, our message to the government is ‘stick to the knitting’ and create an environment which enables the private sector to grow the economy. Without a growing economy you also starve the public sector of the investment it needs.

“Where Brexit becomes relevant is that our members show a common concern in the way the government has chosen to interpret and negotiate Brexit, which has created uncertainty, and that uncertainty does fuel a lack of confidence and investment, and the economy has been declining.

“Everybody would just like to see the uncertainty end. It would be nice to think there would be a ‘certainty dividend’; and inflow of confidence in that we were found to be too cautious. However, it’s still currently impossible to predict the final outcome [of Brexit].”

Although shovel-ready infrastructure projects failed to materialise in 2018, MPA figures show that mortar sales increased by 14.3%, suggesting that housebuilding in Britain remained buoyant. Year-on-year UK aggregates sales volume increased by 2% last year, but ready-mixed concrete sales – a bellwether for general construction activity - fell 1.6%. Beyond housebuilding, Jackson believes the current mineral products sales outlook for 2019 remains muted, partly due to significant government underfunding and poor management of public services.

“I don’t think the competence within government collectively is good enough to deal with the domestic issues that confront us. There is tremendous frustration in business at the calibre of senior politicians and over many decisions that have been made, such as within the Department of Transport. There is significant underfunding of our roads. From a local perspective, the potholes problem is well evidenced and understood. We can’t continue to drip-feed sticking plasters onto what is a strategic problem.

“The government has to firstly recognise that there is a problem that needs a fix. Whether its via tax or borrow [money] or tax and borrow, if you want a sustainable logistics and transport system which are the arteries of the economy, you have to fix the roads.”

On a more positive note, Jackson says he and MPA members welcomed the July 2018-launched Construction Sector Deal, setting out an ambitious partnership between the industry and the government that aims to transform the sector's productivity through innovative technologies and a more highly skilled workforce.

“There is recognition in there of the central role that mineral products play in it, but it has to convert into tangible delivery. There is a lot that can be done if they follow through on the aspiration. There’s no point talking about more housing and infrastructure if you don’t understand how it’s linked to the supply chain. That gets into the whole issue of planning and permitting.

“Sajid Javid, when he was business secretary (March 2016), talked of taking £10 billion of costs out of industry by cutting red tape. The government seems to have lost its nerve on that, and we will be reviving a campaign calling for more effective implementation of regulation, as we still think the link between planning and permitting is dysfunctional. The cumulative costs of getting planning permission and the various permits is an issue. We will launch the campaign in quarter two or quarter three, when we are a bit more over the hill with Brexit.

“Just because the government didn’t follow their red-tape cutting pledge through, doesn’t mean we aren’t following it through. My members’ cumulative costs in getting their mineral resource pipelines converted into mineral reserves are as acute as ever. The government failed to take out the costs they said they would do. Some may have forgotten this, I haven’t.”

Last July also saw the launch of the UK Minerals Strategy. Prepared on behalf of the mineral products industry by the

It identifies four key measures needed to achieve this:

•Recognition that minerals and mineral products, and the industry that supplies them, are essential to the economy and our quality of life;

•Recognition that supply cannot be assumed: it needs to be planned, monitored and managed;

•Ensuring a steady and adequate provision is made, primarily through the land-use planning system

•Establishing a supportive policy, operating and trading conditions to enable UK industry to thrive and invest in future supply.

“We are very pleased that organisations such as the RICS [Royal Institution of Chartered Surveyors] and RTPI [Royal Town Planning Institute] have put their support behind it,” says Jackson. “There is a lot more latent support out there. The way we are looking at this is not so much to have an outbreak of working groups and reviews, but to make everything we do tie back to the UK Minerals Strategy.

“The primary piece of work we are working on is a ‘National Statement of Need’. We want to revive and reshape that statement, which used to be there. While the NPPF [National Planning Policy Framework] review has left the minerals chapter broadly unchanged, we need something outside of planning which says, ‘Mineral products are essential for the economy and it’s in the national interest to have them’. This would put a bit more weight behind public understanding that it’s not really a choice not to do this, but a choice of where to do it, and that’s what the planning system sorts out. The unconventional oil and gas sector has it, not that they have produced one cubic foot of anything yet. We do a million tonnes a day and have no National Statement of Need. Looks a bit odd to me.”

Jackson says the MPA is trying to support MHCLG [Ministry for Housing, Communities & Local Government] in having greater resource to manage mineral planning issues. “They have virtually no resource, which is unprecedented for probably 50 years. It’s ridiculous when we know that replenishment rates are diminishing on aggregates, that there is no resource in government to manage the understanding of the potential consequences.”

In January this year, the MPA welcomed the publication of the National Infrastructure Commission (NIC) interim report, the ‘Future of Freight’, notably the highlighting of how the operation of the planning system can restrict the operation of key aggregates facilities such as wharves and rail depots.

The mineral products industry delivers 30 million tonnes of materials by rail and water annually, and mineral products are now the largest rail freight commodity in terms of tonnes lifted.

Speaking after the NIC interim report’s release, Jackson said: “Planning policy and policy implementation must provide effective long-term safeguarding for key industry operations such as wharves and depots. The fact that the NIC has identified ‘the forgotten element of spatial planning’ as one of three critical issues which need to be addressed to enable the UK’s freight system to continue to provide cost-effective services and contribute to the sustainability improvements is a significant moment in addressing this problem.”

Earlier this month, HM Treasury set out the terms of reference for the government review of the controversial UK Aggregates Levy.

The review was first announced in February 2019, and HM Treasury says it will report back and announce any next steps from the review by the end of the year.

The Aggregates Levy was introduced in the UK as part of the Finance Act 2001 and came into force in April 2002. It is a tax imposed upon the commercial exploitation of rock, sand and gravel in the UK. The levy has been largely unchanged since its introduction and has been frozen at a flat rate of £2/tonne since 2009.

The forthcoming review will be led by HM Treasury and will report to the chancellor of the exchequer. HM Treasury will work closely with HMRC (HM Revenue & Customs), other relevant government departments and agencies and the devolved administrations.

The MPA (England & Wales) will be part of an expert working group made up of representatives of industry and other relevant organisations. Other confirmed members of the working group are British Geological Survey; Mineral Products Association Northern Ireland; Mineral Products Association Scotland;

The Treasury says that the levy has historically brought in between £240million and £410million of annual revenue. In recent years, receipts from the levy can be apportioned as follows: 67% for England, 15% for Wales, 10% for Scotland and 8% for Northern Ireland.

A significant proportion of revenue comes from larger, multi-site operators. The Treasury adds that, because the tax is charged on the first commercial exploitation, taxpayers are concentrated in areas with significant aggregate quarrying activity.

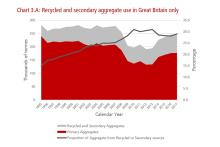

“A lot has changed since the Aggregates Levy came in,” says Jackson, “the most obvious being the virtually maxed-out nature of recycling. Although we never accepted the link between the levy and recycling, it was more about the landfill tax. That was the real driver. Whatever the absolute causal link, recycling and use of secondary aggregates has increased dramatically from where we were in the late 1990s.

“Overall, the industry has moved forward enormously since then in its CSR [corporate social responsibility], sustainability and general environmental performance. Given that our members pay over 90% of the levy, we will be very actively involved in its review.”

Jackson stresses that the mineral products industry is already paying its full whack on environmental taxes. “My challenge to government is, ‘Tell me an industry that does not have environmental impacts where the externalities have not been internalised?’ We are taxed on extraction, anything we put into a landfill, and we are taxed on our CO₂ output. We are at least triple taxed, but because carbon tax is complexed, we are probably quadruply taxed. We’ve also got the Apprenticeship Levy. You tell me another industry paying that many taxes?

“Energy costs are another major concern, particularly in the energy-intensive industries. We are planning to publish a paper on this comparing our industry with others, as we feel we are at a disadvantage in that area.”

The Zero Harm health and safety in the workplace philosophy is strongly supported by the MPA, which shares best practice with its members and celebrates vital work in this area through its annual well-attended Health and Safety Awards event in London.

“2018 was less tragic for our industry [compared with 2017, when there were seven fatalities], with one third-party fatality,” says Jackson. “We’ve possibly held the line on LTIs [lost time injuries] and reportables. But we failed to meet our five-year hard target on LTIFR [lost time injury frequency rate] to reduce incidents by 65%. However, we did get half way. The hard target was an effort worth making, and while there’s disappointment that we only got half way, it’s an improvement.

“Our health and safety committee is reviewing the next hard target. We want to look at the right indicators – complement lagging indicators with leading indicators. This year we, along with others, are working very forcibly on contact with machinery in isolation – entrapment. We are also very focused on struck by vehicles and falls from height. I’m doing a blitz of our LOTOTO [lock-out, tag-out, try-out] brochure and we want to get it into the pockets of everyone on the ground. Even if we only get halfway, we’d have done something.”