HM Treasury has set out the terms of reference for the government review of the controversial UK Aggregates Levy.

The review was first announced in February, and HM Treasury says it will report back and announce any next steps from the review by the end of the year.

The Aggregates Levy was introduced in the UK as part of the Finance Act 2001 and came into force in April 2002. It is a tax imposed upon the commercial exploitation of rock, sand and gravel in the UK. The levy has been largely unchanged since its introduction and has been frozen at a flat rate of £2 per tonne since 2009.

Following introduction of the levy in 2002, industry representatives have been challenging the government both in the UK and EU through a series of ongoing legal claims.

In February HM Treasury Exchequer Secretary Robert Jenrick MP stated that the legal claims regarding the levy had been concluded, with the litigation against the Government and the European Commission being withdrawn.

The forthcoming review will be led by HM Treasury and will report to the Chancellor of the Exchequer. HM Treasury said in a statement that it will work closely with HMRC, other relevant government departments and agencies and the devolved administrations.

It added that the government will consider all aspects of the Aggregates Levy, such as new and existing evidence on the impact of the levy (including its environmental impact), and the nature of the wider industry.

The government says it will engage widely with stakeholders throughout the process, and that written representations are welcomed by 5 July 2019.

There will be an expert working group made up of representatives of industry and other relevant organisations. The confirmed members of the working group are: British Geological Survey; Mineral Products Association (England and Wales); Mineral Products Association Northern Ireland; Mineral Products Association Scotland; British Aggregates Association; British Ceramics Confederation; CBI Minerals Group; Environmental Services Association; Civil Engineering Contractors Association; Construction Employers Federation; Royal Society for the Protection of Birds; Wales Environment Link; and Northern Ireland Environment Link.

The Treasury says that levy has historically brought in between £240million and £410million of annual revenue. In recent years, receipts from the levy can be apportioned as follows: 67% for England, 15% for Wales, 10% for Scotland and 8% for Northern Ireland.

A significant proportion of revenue comes from larger, multi-site operators. The Treasury adds that, because the tax is charged on the first commercial exploitation, taxpayers are concentrated in areas with significant aggregate quarrying activity.

"The cost of the tax can be passed through to the construction industry; it generally makes up a small proportion of construction costs," the Treasury said. "Due to construction activity slowing down during the financial crisis, revenue from the levy also declined during this period."

The levy has not been comprehensively reviewed since its introduction. The Treasury says that reviewing the efficacy and impact of policies is "good practice, and the government is keen to do so given that litigation on the legality of the levy has now ended. There is now an opportunity to consider whether the policy context, the industry and its regulatory environment have evolved, the impact of the levy and whether its design could be amended in line with the principles of tax design, such as fairness, simplicity and clarity."

In 2011, the Office for Tax Simplification’s Review of Tax Reliefs highlighted the levy’s many exemptions, and asked whether the levy could be simplified.

In 2014, the government committed to devolve the levy to the Scottish Parliament once litigation had been concluded and the government says it remains committed to this devolution. The government says it will keep the devolution of the levy to the Welsh Assembly under review, with the intention of devolving in the future subject to state aid issues and any cross-border market distortions having been worked through in full.

HM Treasury says the levy was designed with various exemptions to encourage the use of less environmentally damaging sources of aggregate. The extraction of fresh aggregate can cause noise, dust, visual intrusion, loss of amenity and damage to biodiversity. When it was introduced, the objectives of the levy were described as being: to address, by taxation, the environmental costs associated with quarrying operations in line with the government’s statement of intent on environmental taxation at the time; to cut demand for virgin aggregates; and encourage the use of alternative materials where possible.

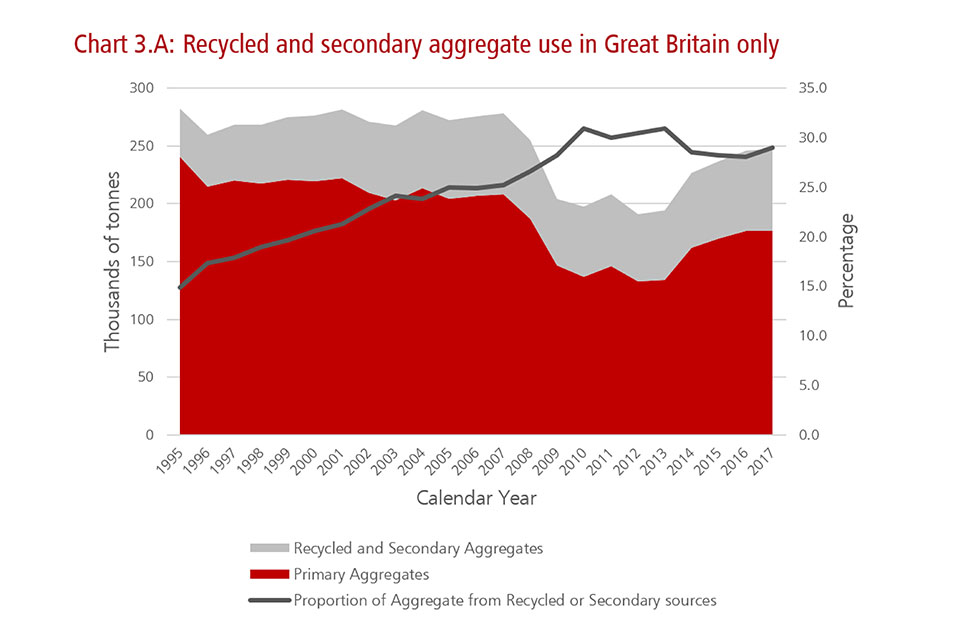

Over the years, the use of recycled aggregate has increased as a proportion of overall aggregate consumption, although this growth has recently plateaued.

In aggregates markets, recycled and secondary materials are estimated to represent nearly 30% of the market in Great Britain, compared with an average of around 10% across the rest of Europe.

The government is inviting businesses and industry organisations across the construction products, quarrying and dredging sectors to engage with the process, whether affected directly or indirectly by the levy.

Representations can be sent by email to [email protected] with the subject line ‘Aggregates Levy review representation’.

Representation by mail can be sent to:

Aggregates Levy review

Energy and Transport Tax team

HM Treasury

1 Horse Guards Road

London

SW1A 2HQ