The

The Aggregates Levy was introduced in the UK as part of the Finance Act 2001 and came into force in April 2002. It is a tax imposed upon the commercial exploitation of rock, sand and gravel in the UK.

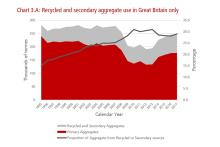

The levy was intended to improve the environmental impact of the mining industry, encouraging use of secondary or recycled aggregates and to incorporate the environmental cost into the market price. The levy has been largely unchanged since its introduction and has been frozen at a flat rate of £2 per tonne since 2009.

Following introduction of the levy in 2002 the BAA had been challenging the government both in the UK and EU through a series of ongoing legal claims. The BAA has now reached a settlement with the UK Government in respect of all aspects of the Aggregates Levy litigation in the UK and EU.

HM Treasury Exchequer Secretary Robert Jenrick MP commented in a written ministerial statement: “Longstanding litigation on the Aggregates Levy has now been concluded, with the litigation against the Government and the European Commission being withdrawn. The Government remains committed to devolving the Aggregates Levy to the Scottish Parliament following the conclusion of this litigation and is working with the Scottish Government to work out the next steps."

The government says it will now conduct a comprehensive review of the levy over the next year, working closely with the Scottish Government, and consulting the Welsh Government and Northern Ireland Executive throughout.

"The review will be comprehensive, looking at the latest evidence about the objectives of the levy, its effectiveness in meeting that objective, and the design of the levy, including the impact of devolution," Jenrick stated.

The terms of reference for the review will be published in Spring 2019 and an expert working group will be established to inform it. The review will aim to conclude by the end of 2019.

The BAA was formed in 1999 to protect the interests of the UK privately-owned SME aggregate producers and to oppose the government intentions to introduce what the association says is "a highly unpopular and unjustified stealth tax on an already highly regulated industry with internationally renowned environmental credentials".

BAA chairman Paul McManus said: “It is entirely due to the efforts of BAA and its members acting on behalf of the overall aggregate industry in Great Britain and Northern Ireland that we have now reached this point. We have finally persuaded HM Treasury of the need for a comprehensive root and branch re-visit and review of the levy, its design and objectives; and look forward to us being a principal participant in the expert working group.”