The

Proposals for the ALCF will build on the legacy of the previous Aggregates Levy Sustainability Fund (ALSF), but at a lower cost. The MPA proposal would see 8p per tonne - or 4% - of Aggregates Levy revenue being allocated to the new ALCF to fund local community projects and biodiversity and nature conservation projects. It would mean that an aggregates quarry selling 200,000 tonnes of aggregates/year would generate aggregates levy credits of £11,200 annually for community use, equivalent to £112,000/£168,000 for a 10/15 year operating life.

Designed to support delivery of the Government’s ‘localism’ agenda and the recently announced 25-year plan for the environment, proposals set out include the introduction of ‘Local Aggregate Community Trusts’ (LACTs’) including operators, the local community and Councils to help improve stakeholder engagement and steer the funding for use in the local community.

A £3 million fund identified for Biodiversity and Nature Conservation, involving engagement from other expert environmental organisations, and including marine projects, would also be sought.

There is a very clear precedent in the Landfill Tax Communities Fund, through which landfill operators claimed tax credits of £35 million in 2016/17 compared with Landfill Tax receipts of £903 million. The Autumn Budget set out a Landfill Tax Communities Fund of £33.9 million in 2018/19 with a tax credit cap of 5.3% of Landfill Tax liability for operators.

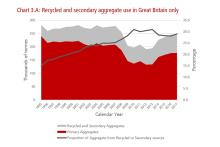

Established in 2002, and set at a rate of £2/tonne since 2009, the Aggregates Levy (AGL) was introduced by the Government to generate revenue from the sales of primary aggregate for use in construction and better reflect the environmental costs of winning primary construction aggregates. It also aimed to encourage the use of alternative, secondary and recycled construction materials. AGL receipts have typically raised between £300m to £350m pa for HM Treasury (£407m in 2016/17), totalling £5bn since inception.

MPA Chief Executive, Nigel Jackson, said: “Between 2002 and 2011, hundreds of projects benefited from the Aggregates Levy Sustainability Fund. MPA holds that the decision to end the Aggregates Levy Sustainability Fund was wrong in principle given the controversies surrounding the introduction of the Aggregates Levy in the first place, but despite best efforts, attempts to convince DEFRA Ministers of the need for its re-introduction have been fruitless.

“Undeterred, MPA has considered how the scheme could be improved, and drawn up proposals for a new funding model. Building on the substantial legacy of the Aggregates Levy Sustainability Fund, but at lower cost with a narrower and more relevant focus, I believe that the new proposals will support delivery of the Government’s ‘localism’ agenda and the new 25-year plan for the environment.

More broadly, the new Aggregates Levy Community Fund will focus on local community engagement, biodiversity and nature conservation, and could be widened out to include carbon reduction, heritage and security of supply issues at a later date. I hope that MPs, Councillors and planners in aggregate producing areas and local community and environmental organisations will get behind our proposals and encourage Government to support it.”