The aggregates figures that are available are sporadic, and few pertain generally to the last 12 months, but snapshots from around the industry show movement in various areas: not surprisingly these are more reliably available from the local subsidiaries of key international players.

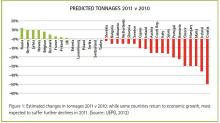

Generally speaking, the best that can be said is that the rate of decline is slowing. From the

In 2011 in Estonia, sand extraction was almost back up to 2007 figures of 3.5 million m³; gravel had been steady for two years at nearly 1.5 million m³ (from the 2008 peak of nearly 2 million m³), and carbonate rock rallied significantly in 2011 to 1.6 million m³ after dropping to 1.1 million m³ in 2010.

Latvian outputs showed appreciable growth from 2009 to 2010, too. The 21 dolomite quarries produced an increase of 300,000 m³ in that period, from 1.078 million m³ to 1.376 million m³.

Specifically, organisations around the sector are investing, working and clinging on to the global promise of better times ahead.

Throughout the construction industry, demand for materials is latched onto and developed. One Finnish marina developer,

Owner and CEO Ilkka Seppälä states that the company needed more production capacity as markets, particularly in Poland, Denmark, and Lithuania, have grown faster than estimated. He says that production in China and Romania will follow.

In Lithuania, the construction price index rose by 4.9% in January 2013 from January 2012 and by 0.1% from December 2012. The biggest increase was in the price of concrete and concrete mixes (+0.9%) and wood products (+0.7%) in January. The cost of road building rose by 0.4% year on year. The 10.9% year on year hike in payroll costs and the 3.4% hike in building materials prices had the biggest impact on construction price index growth in January.

Yeoman Latvia SIA is a part of

The granite is used in construction projects across Europe, from ready-mixed concrete to railways and motorway construction. Yeoman Latvia was founded in 2012 and its estimated turnover for 2013 is 3.5 million lats (€5 million).

Compared to other European countries, the Estonian national road network is denser, and as a result the amount of funds spent on road maintenance is also substantial. It is quite costly for a nation as small as Estonia to maintain such a dense national road network; The Estonian Road Administration invited a public tender this year for the procurement of design for concrete road surfacing and the feasibility study of building concrete roads in line with traffic loads. It also asked that the study should highlight any problems experienced in concrete road building, such as local climatic risks on building concrete surface roads. The feasibility study should involve road wear risks from the use of studded tyres with calculations based on the respective calculations made in Finland, Sweden or Norway.

Indeed, Arvo Tinn, a renowned road engineer from Australia, who will supply the expert opinion on concrete roads, says that roads passing through cities should stay under the direct control of the Road Administration as it would make control over road repairs easier.

He sees the building of concrete roads as one solution and a sustainable choice.

He claims concrete roads could be cheaper to build than asphalt surfaced roads and he also claims repairs to concrete roads could be 20 times cheaper over 20 years.

Tinn is suggesting that Baltic road builders join forces to procure the costly concrete road building machinery.

In contrast to other states, the setting up of ice roads is also part of the state road maintenance budget: a total of €278,410 has been spent on the building of ice roads. During the time they were officially opened, a total of 55,663 vehicles used the ice roads.

Among other major projects, 2012 saw completion of the Loo-Maardu road section with 3+3 lanes, new in Estonia; the entire Parnu bypass was finally finished, as was Viitna bypass on Tallinn-Narva road and Haljala separate-grade junction; on the western part of the Tartu bypass, the construction of Variku overpass and the 14.5km Voru-Rapina road section was completed.

In other company news, Lithuania-based Concretus Materials has applied for regulatory approval to acquire up to 51% of shares in Lithuanian cement plant,

Cemex in Latvia is supplying more than 80,000m³ of specialty ready-mix concrete for major improvements to Riga International Airport, which is due for completion in August 2014. Originally built in 1973, the airport is the largest in the Baltic States and serves nearly five million people every year.

“We are proud to be the partner of choice for this important project which will benefit millions of residents and visitors for many years to come,” says Cemex Latvia country director Enrique Garcia.

“We constantly strive to collaborate in the development of infrastructure in Latvia and the region by supplying the best materials and technical service for the most ambitious construction projects in all the markets where we operate.”

The airport project involves the reconstruction of de-icing areas, access roads, and aprons areas where aircrafts are parked, unloaded or loaded, refuelled, or boarded. All of these new areas will be exposed to extreme temperatures and carry high weight loads that call for specialty products;

Cemex provided a specialty ready-mix concrete mix that met all technical requirements of the project, including resistance to high frost, chemical attack from de-icing agents, and wear from surface abrasion.

Two dedicated ready-mix concrete plants, producing over 1,000m³ of concrete a day, have been placed at the job site, including one bought by the company specifically for the project. This one can produce around 1.5 million tonnes of cement a year, and was commissioned in 2010 with an investment of €292 million.

Domestic shipments of cement remained relatively stable in the Baltic States, and Estonia was able to significantly increase its cement exports, in context, revenue of the cement business line fell by 3.6 % to €1,731 million (previous year: €1,796 million).

In HeidelbergCement’s aggregates business the adverse weather of the first quarter was particularly apparent: the Baltic States were the only countries that did not record significant decreases in sales volumes.

The group area’s deliveries of aggregates contracted by 19.6% overall to 12.3 million tonnes (previous year: 15.3 million tonnes). Sales volumes in the ready-mix concrete operating line also remained below the previous year in all countries apart from the Baltic States. And in 2012, while ready-mix concrete deliveries fell by 4.6 % to 13.2 million m³ (previous year: 13.8 million m³), sales volumes increased pleasingly by a double-digit percentage in the Baltic States.

It remains to be seen if and how the imminent adoption of the euro by Latvia next year, and Lithuania in 2015, will affect the industry, but environmental and economic issues faced by the region will need to be continually managed if the green shoots are to flourish.