Impressive economic growth rates have been seen in the Baltic states as Julie-Anne Ryan reports

In general economic terms, the Baltic States have in recent years been held up as paragons of hard-nosed recovery. As much of Europe rises slowly from the detritus of the global downturn, scarred and cautious, Estonia has been seen to be

leading its fellows, Latvia and Lithuania, with positivity and optimism. Unemployment has gone down as industry has grown and exports have increased.

In the first quarter of 2011, Estonia’s GDP growth rate was at 8.5% the highest in the

Exports grew by more than 50% over the year, and while this did reflect one or two specific successes, it was clear that it was all part of a wider industrial and commercial recovery. It was reflected in the similarly impressive growths

shown in Latvia, which took the “fastest growth in the EU” crown early in 2012, and Lithuania, both of which plan to follow Estonia into the Euro over the next couple of years.

Policymakers in all three Baltic countries made huge and apparently successful fiscal adjustments, though in Estonia at least leaders are still wary of past failures: the last boom led to reckless lending, a bust in the construction

industry and a 14% fall in GDP.

But is this positive trend-making itself felt in the construction materials industry across the Baltic States?

The UEGP (

Decline is slowing

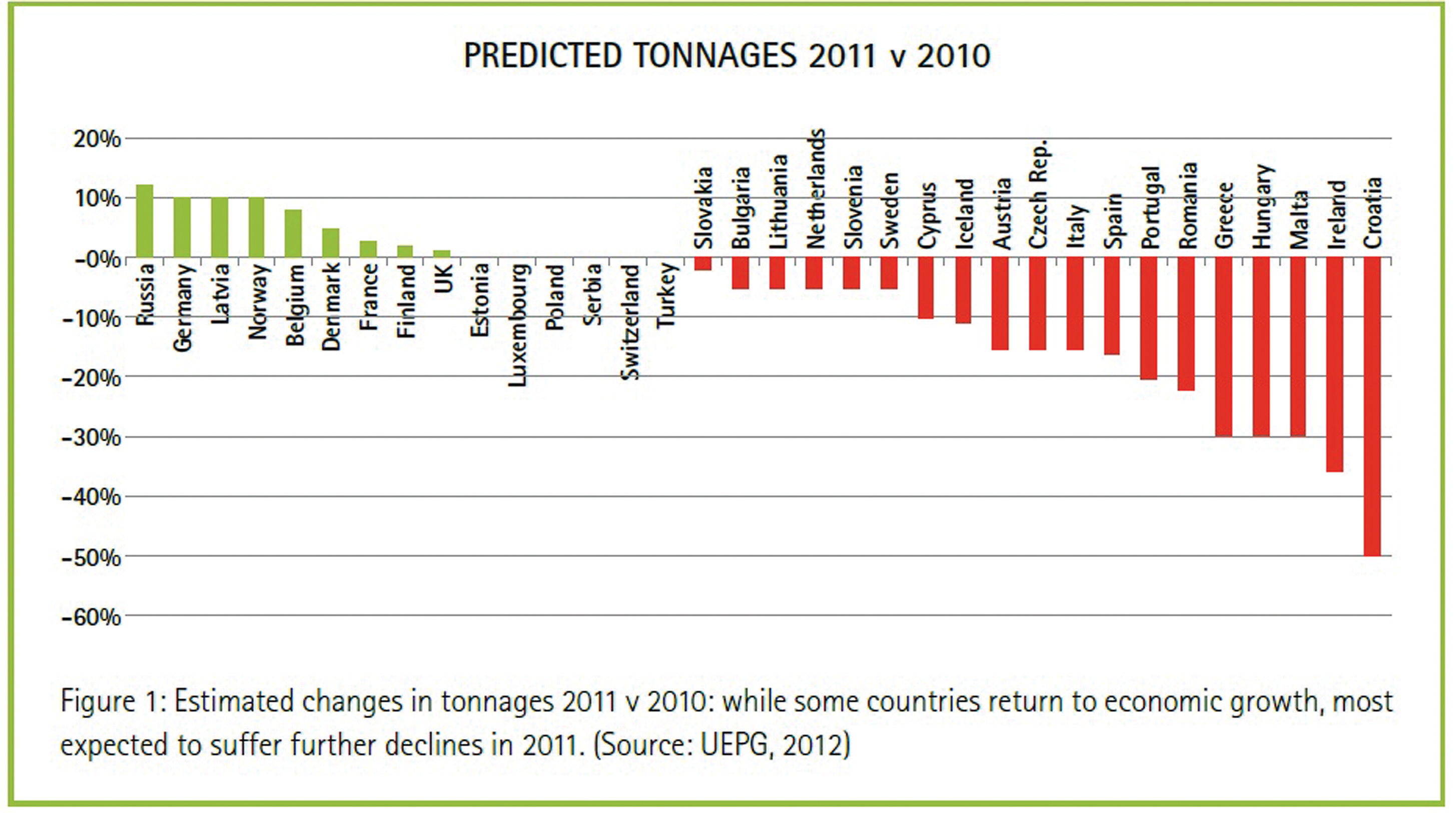

“Perhaps the good news is that the rate of decline is slowing, in that the like-for-like 2010 decline in tonnage compared to 2009 was only -1.6%. However the predictions for 2011...indicate a similar decline compared to 2010. Some growth is now evident in Austria, Belgium, France, Germany, Poland, Russia and Switzerland. However, countries such as Greece, Ireland, Lithuania, Portugal, Spain and UK are still suffering a decline in production, some declines continuing to be extremely severe. The hoped-for return to European growth is proving extremely elusive.”

Individually, figures from Estonia and Latvia don’t look too gloomy. In 2011 in Estonia, sand extraction was almost back up to 2007 figures of 3.5 million m³; gravel had been steady for two years at nearly 1.5 million m³ (from the 2008 peak of nearly 2 million m³), and carbonate rock rallied significantly in 2011 to 1.6 million m³ after dropping to 1.1 million m³ in 2010. The peak year for this was 2007, at about 2.75 million m³.

Latvian outputs showed appreciable growth from 2009 to 2010, too. The 21 dolomite quarries produced an increase of 300,000 m³ in that period, from 1.078 million m³ to 1.376 million m³.

Output from the 84 sand quarries increased from 1.763 million m³ to 2.82 million m³ (growth of more than a third) and the sand and gravel producers (262 quarries) notched up an increase of more than half a million cubic metres, from 2.202 million m³ to 2.746 million m³.

In Lithuania, the mining industry suffered one of the biggest hits in the state’s economy as a result of the financial crisis. In 2009, cutbacks in construction and road building caused extraction to drop by 44%.

Businesses producing the highest quality local mineral products had to limit their extraction even more, down 53%, according to LAPA (Lithuanian Aggregate Producers Association).

Figures for 2012 show that there are currently 445 deposits being used, with 273 businesses involved in their extraction and procession.

Gravel and sand: 351 (209 enterprises)

Peat: 59 (39)

Clay: 20 (10)

Dolomite: 6 (7)

Sapropel: 3 (3)

Limestone: 3 (2)

Chalk marl: 1 (1)

Gaize: 1 (1)

Anhydrite: 1 (1)

Since 1969, 444.4 million m³ of gravel and sand have been extracted in Lithuania. The peak year was 2008, with 4.012 million m³; this figure fell sharply in 2009 to 1.717 million m³, but there was a recovery in 2011 to 2.467 million m³.

In the same period, 36.5 million m³ of dolomite have been extracted. Again, the peak year was 2008 with 1.16 million m³, falling in 2009 to 0.355 million m³, recovering to 0.773 million m³ in 2011.

But the signs are there that infrastructure projects are on the up. The Lithuanian government is about to designate the Via Baltica motorway a project of national importance, according to the Lithuanian Minister of Transport, Eligijus Masiulis. The Minister pointed out that a 40km section between Kaunas and Marijampole needed to be widened and upgraded, and the busy Kaunas-Marijampole-Suwalki section has to be upgraded by 2020.

Via Baltica

The project is worth LTL 494 million (€143.07 million). The entire Via Baltica motorway in the territory of Lithuania should be upgraded by 2035.

The effects of recovery generally are showing themselves in the figures from individual organisations. Lithuanian cement manufacturer Akmenes Cementas has reported a 22% increase in revenues in the first half of 2012, compared to the same period of 2011. The company produced 423,000tonnes of cement in the first six months of 2012, up 7% from a year earlier, and its exports to Belarus have increased slightly.

And one recycling and resource management company,

Residual commercial waste will be processed in SITA’s new County Kent, southern England facility and used as a fossil fuel replacement at CEMEX’s cement production facility in Broceni, southern Latvia.

Enrique Garcia, CEO of CEMEX in Latvia said: “The usage of alternative fuels [AF] is an integral part of our sustainable development strategy, and in CEMEX Latvia we have been progressing very fast during the last couple of years in reducing our dependence on fossil fuels. Currently, more than half of our calorific consumption in the kiln comes from AF.”

In May 2012 the Estonian Mining Society hosted the first Baltic Aggregate Forum, Aggregate Industry – a Hidden Input to Economy, which was attended by industry leaders from around the region.

Chairman of the board of the society, Erkki Kaisla, explained at the time: “We do not think very often how important aggregate industry input to the modern society is. Forum’s objective is to acknowledge that importance and bring together specialists from all of the Baltic States to introduce and share our activities, problems and achievements.”

He added: “The economy is not the only actual problem we have to face. Every year the opening of new quarries is getting more complicated because of environmental restrictions. Due to our geological situation in many regions, we are lacking filling materials meeting high EU standards. In the situation of limited resources we have to think how we can use them more efficiently, also how to recycle and so on.”

So the revival of the aggregates industry in Estonia, Latvia and Lithuania isn’t as meteoric as the economists might hope, set against the background of their individually decisive, and clearly effective, general recovery measures across the region. But the growth is happening, even with the environmental issues that face the sector across Europe.

As managing director of the