Exports, the backbone of the German economy, have been hit hard by the recession, and in the quarrying industry there is a mixture of pessimism and optimism Germany is the largest construction market in Europe, with over half of all investments in the country flowing into such projects.

And this had fuelled the requirement for cement and aggregates, with the country being arguably the largest producer of aggregates in Europe along with the other main producers, Spain, France, Italy and the United Kingdom.

At one point Germany contributed over 600million tonnes of aggregates to Europe's estimated 3.5billion tonnes annually, and was along with countries such as Norway and the UK one of the main net exporters of primary aggregates.

Like most other countries, the current economic difficulties have been felt in Germany. What was the world's largest exporter (it has been overtaken by China) has been hit especially hard by the global recession.

Last year, Germany's gross domestic product (GDP) fell 5%, the biggest drop in GDP since 1945. More recent figures show that exports, seen as the driving force behind the country's economic recovery, dropped by 6.3% in January, 2010, raising fresh worries about the state of the German economy.

However, it was the first drop after four months of gains, and has been blamed in part on the unusually cold weather, which in turn slowed down work done outside, such as construction.

Analysts expect the recovery to continue with order books filling up again. The January figure showed a 4.3% rise.

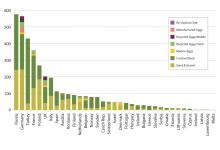

While current official figures are still awaited for Germany's aggregates industry (and they will almost certainly have changed in the last year or so) some recent figures show there were 1,800 companies involved in the industry at around 5,400 sites employing nearly 97,000 people. Total output of sand and gravel and crushed rock (about 270 million tonnes each) along with marine aggregates, recycled aggregates and manufactured aggregates at one point totalled over 625million tonnes.

Companies involved in quarrying are reacting to the recession with a blend of pessimism and optimism, and recently the country's cement industry sounded a pessimistic note for 2010.

Andreas Kern, president of the Association of the German Cement Industry, said he is expecting cement consumption in Germany to decrease by another just under 5% in 2010 after it dipped by 8.5% to 25.2million tonnes in 2009. The industry's turnover fell by just under 5.5% to just under E2.2billion in 2009.

The cement industry is currently working at just 75% of capacity and, according to Kern, the profit margin of cement producers in Germany averages 7%, which is not enough to modernise production equipment.

Kern does not rule out a further consolidation among the 22 cement producers in the country, and is expecting more cement companies to take over ready-mixed concrete companies or producers of precast concrete parts.

However, the Germany-based

In its outlook for 2010, HeidelbergCement expects the global economy to recover slowly, with differences in development between growth markets and industrialised countries. The group anticipates worldwide growth in cement, aggregates, and ready-mixed concrete in 2010, driven by continued positive developments in Asia and Africa.

For the US and Europe, HeidelbergCement expects further declines in volumes in the first half of the year, partly because of the long and hard winter. In the US, a market recovery is anticipated in the second half of the year: the extent and speed of this will strongly depend on the further development in residential construction, the spending of the US states, and decisions regarding the financing of the Federal Highway Program.

In Europe, HeidelbergCement expects a stabilisation of residential construction at a historically low level, a noticeable decline in commercial construction, and a positive development in infrastructure.

"As the world market leader in aggregates and because of our strong global market position, we are in an ideal position to benefit to a relatively strong degree from a recovery of the global economy," said Dr Bernd Scheifele, chairman of the managing board of HeidelbergCement.

Reporting its 2009 results, the Swiss-based

"Shipments were positively impacted by the start of construction work on the Nord Stream gas pipeline and the widening of the Bremen-Hamburg motorway to six lanes." The group said that while cement sales in Southern Germany were virtually stable due to road and infrastructure construction, the increase in sales of aggregates posted by Holcim Southern Germany was due to acquisitions.

"The purchase of additional ready-mix concrete facilities by the two German group companies served to counter the negative market trend."