While it is not all good news, the aggregates market in Eastern Europe is more optimistic than many. Julie-Anne Ryan reports

Eastern Europe comprises so many countries (more than 20 depending on the exact definition of their location) that individual markets are hard to quantify.

A report on such a vast region can only generalise so, generally speaking, the aggregates market in Eastern Europe is more optimistic than many of the more established markets around the world.

For definition’s sake, Eastern Europe includes Albania, Armenia, Azerbaijan, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Georgia, Hungary, Kosovo, Macedonia, Moldova, Montenegro, Poland, Romania, Russia, Serbia, Slovakia, Slovenia and Ukraine. The small part of Kazakhstan that isn’t in central Asia is also classed as Eastern Europe.

It is generally accepted that Eastern Europe, along with the Africa/Middle East region, is expected to see significant growth in construction aggregates consumption in coming years.

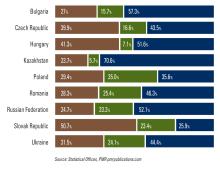

The Eastern European construction materials market had total revenues of US$34.6 billion (€25.7 billion) in 2011, representing a compound annual growth rate (CAGR) of 4% between 2007 and 2011.

The sand, gravel and other aggregates segment was the market’s most lucrative in 2011, with total revenues of $24.2 billion (€18 billion), which is equivalent to 69.8% of the market’s overall value. And predictions are that the market’s performance will accelerate further, with an expected CAGR of 11.9% for the five-year period 2011–2016. This is expected to drive the market to a value of $60.8 billion (€45 billion) by the end of 2016, says a Marketline report.

“Eastern Europe and the Africa/Mid-east region are also expected to undergo significant growth in consumption of construction aggregates, stimulated by infrastructure development projects and strong growth in general economic activity.

“While the Central and South America market will climb at a somewhat slower pace, aggregates suppliers will benefit from gains in regional construction spending,” says World Construction Aggregates, a new study from The

“Expansions in demand in developed parts of the world (the US, Canada, Japan, Western Europe, South Korea and Australia) will not be as strong as in most industrialising areas. This is primarily due to the already well-developed infrastructures found in these countries and the construction methods utilised, which tend to feature less concrete.”

Low levels of public and private investment have had an impact on the construction sector in Eastern and South-Eastern Europe.

Government spending on infrastructure projects fell in all countries, but there have been pockets of good news. For example,

Holcim also reported that sales of aggregates rose in Romania, and the group companies in Romania, Croatia and the Czech Republic increased sales of ready-mix concrete.

Bulgaria, however, was hit particularly hard by the difficult market situation and the company reported marked declines in sales volumes in all segments. Similarly, in Hungary Holcim has decided to close the Lábatlan plant in 2013 and to significantly restructure the ready-mix concrete and aggregates business.

The construction industry situation in Russia and Azerbaijan was very different, continued the Holcim report.

“Solid economic growth drove demand for cement in both markets and sales volumes rose significantly, driven by the infrastructure and residential sectors. Furthermore, price increases could be implemented in Russia. Holcim has decided to modernise the Volsk plant in the Volga region with a new kiln line which will go on stream in the third quarter of 2016. Together with the new Shurovo plant, the company is targeting market leadership in the Moscow area and Volga region, which are accounting for approximately 50% of the Russian cement consumption.”

These stronger results in Eastern Europe are set against Holcim’s general news, which is that in the fourth quarter of 2012, restructuring costs reached €82.75 million, and amortisation on infrastructure totalling €339.27 million will be included in the fourth quarter results. In the first nine months of 2012 turnover in Europe fell 5.5% to €3.64 billion.

The company plans to scale back its European activities due to this slowdown, and while it has not revealed how many jobs will be affected by the move, it hopes to make savings of at least €99.31 million a year.

Job cuts are also on the agenda for

In the Eastern Europe-Central Asia Group area, HeidelbergCement continues to expect further growth in Russia and Central Asia, driven by solid demand and additional capacities, while sales volumes are expected to decline in Eastern Europe due to weakened demand, especially in Poland and the Czech Republic.

Dr Bernd Scheifele, chairman of the managing board at Heidelberg, said: “Deleveraging remains the highest priority for us, in order to regain our investment grade rating. We will also continue our successful strategy of targeted investments to expand cement capacities in the growth markets of Asia, Africa, and Eastern Europe. More than 5 million tonnes of additional cement capacities are expected to be commissioned in emerging markets in 2013.”

A recent survey of selected German building materials machinery manufacturers reflected this feeling, and showed that demand was especially strong in the emerging markets: China, India, certain countries in Eastern Europe and some of the former Soviet republics.

The report identified strong interest in turnkey production systems where manufacturing expertise and services were also included in the package.

Building for Russia’s sporting events

Infrastructure for the 2014 winter Olympics, to be held in the Russian Black Sea resort of Sochi, has required thousands of tonnes of aggregates, sand and cement.

One company that has been producing the high quality materials required is the quarry at

The material is transported by train to Sochi where the structures for the XXII Olympic Winter Games in February, 2014 and the XI Paralympic Winter Games are being built. The Russian Formula 1 motor racing grand prix is also to be held the same year. Apart from this and Russia’s huge residential and highway programme, the country is hosting the 2018 FIFA World Cup, and this will require more materials.

Vitaly Mutko, chairman of the Local Organising Committee (LOC) for the World Cup, and Russia’s Sports Minister, held meetings in Moscow in November, 2012 with the heads of all 11 regions which will be hosting matches.

These were to draw up a list of the facilities to be included in the investment programme, which will provide funds to develop the infrastructure required for the tournament, and this is estimated at some 1,000 facilities.

Vitaly Mutko is reported as saying: “We’ve got a lot of work to do to put the infrastructure in place by the 2018 World Cup. Delivering this programme successfully will guarantee a massive legacy in the form of modern sports, transport and general infrastructure for many generations of Russians.”

Figures from

In Poland the group blamed a slowdown on the aftermath of the European Football Championship in June 2012, and in Russia a production “limitation” at a plant near Moscow caused problems.

A year ago, the

It predicted that a potential threat of public expenditure cuts would influence the infrastructure in the Czech Republic, as well as Ireland, Spain and the UK, negatively. In 2013, residential sector output would not reach the performance of 2008, it claimed, and 60% of the residential output would come from renovation activity in 2013.

“Non-residential construction is forecast to see the slowest recovery: the output in 2013 will hardly reach the level of the early 2000s. Publicly financed health, school construction and renovation might suffer from the shrinking sources. Small signs of recovery can be discovered in the commercial area,” said UEPG.

Has a year made any difference to those predictions? From the latest UEPG review (2011-2012) it seems not a great deal.

“Perhaps the good news is that the rate of decline is slowing, in that the like-for-like 2010 decline in tonnage compared to 2009 was only -1.6%. However the predictions for 2011...indicate a similar decline compared to 2010.”

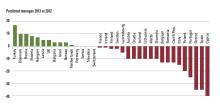

It noted that some growth is now evident in Poland and Russia among others, while many other countries were still suffering a decline in production, some declines continuing to be “extremely severe”.